Can Meta’s $29 Billion AI Infrastructure Play Redefine How Data Centers Are Financed in the US?

Inside the most ambitious private credit deal in tech history and what it means for the future of capital, compute, and control

Welcome to Global Data Center Hub. Join 1500+ investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

Meta is not short on capital.

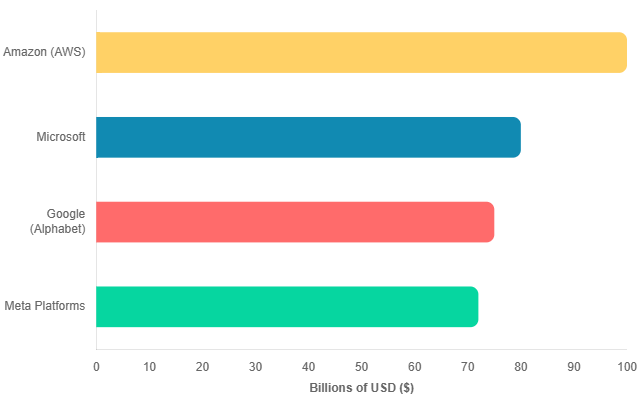

With nearly $70 billion in cash and a manageable debt load, it has the balance sheet to fund its entire $64 to $72 billion capital expenditure plan for 2025. But that is not what it is doing.

Instead, Meta is seeking $29 billion in external capital through private credit markets. The structure under discussion includes:

$26 billion in debt

$3 billion in equity

The raise is backed by some of the world’s largest alternative asset managers: Apollo, KKR, Brookfield, Carlyle, and PIMCO.

This is not a distressed raise. It is a strategic shift.

Meta is signaling something fundamental: data center infrastructure is no longer just a corporate cost center. It is becoming a capital market product. One that can be financed, leased, packaged, and sold much like energy or transportation infrastructure.

And that signal is already reverberating across the market.

From Advertising Giant to Infrastructure Orchestrator

Meta’s strategy is clear: it wants to compete for AI dominance without absorbing the financial drag of large-scale infrastructure expansion. It is doing that by moving hyperscale assets off its balance sheet.

The $29 billion initiative is expected to use a leaseback model. Investors fund and own the data centers. Meta signs long-term leases to operate them. Morgan Stanley is advising on the structure and exploring ways to make the resulting debt tradable.

This approach allows Meta to:

Preserve capital for R&D, acquisitions, and product development

Gain immediate access to infrastructure without upfront ownership

Avoid balance sheet pressure while scaling rapidly

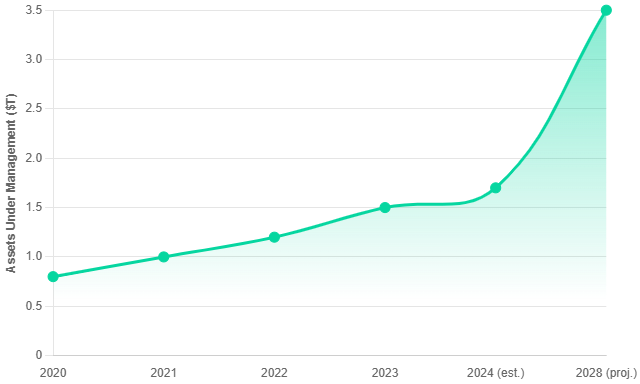

And the capital powering this model is not from traditional banks. It is flowing from the $3 trillion private credit market.

It wants to compete for AI dominance without absorbing the balance sheet drag of large-scale infrastructure expansion an approach we unpacked further in Meta’s $72B AI Power Play Is a Data Center War Plan in Disguise, where Meta’s physical footprint becomes a strategic lever.

Why Private Credit Is the New Hyperscaler Ally

Private credit offers what public markets cannot: speed, discretion, and structuring flexibility. These features are now essential for hyperscalers facing tight build timelines, regulatory uncertainty, and CapEx scrutiny.

According to reports, the Meta deal is expected to include:

SOFR plus 375 to 425 basis points pricing

7 to 10 year tenors

Delayed-draw tranches for phased deployment

These terms suggest a level of sophistication more commonly found in project finance than corporate debt.

For Meta, the benefit is clear. It avoids visible leverage, preserves rating strength, and defers cash outflows. For investors, the opportunity is compelling. They gain exposure to a new class of long-duration, yield-bearing digital infrastructure backed by one of the most creditworthy companies in the world.

This is no longer a workaround. It is the model.

For investors, the opportunity is compelling. They gain exposure to a new class of long-duration, yield-bearing digital infrastructure backed by one of the most creditworthy companies in the world a trend accelerating globally, as explored in Who Will Fund the $6.7T Global Data Center Boom?.

Redefining Infrastructure as a Competitive Advantage

Meta’s AI ambitions go far beyond software.

It is building a vertically integrated AI stack that includes:

Open-source models like Llama

Training data infrastructure via Scale AI

Custom accelerators

A national-scale compute footprint for AI workloads

These are not just server rooms. Meta is building AI factories assets with multi-decade life spans, sovereign-scale power needs, and the physical complexity of modern utilities.

By financing this infrastructure externally, Meta creates flexibility. It can redirect internal capital toward higher-margin layers like AI models, developer tools, and user-facing products while still scaling compute at the pace the AI race demands.

This is not simply vertical integration. It is a form of capital innovation used as a competitive edge.

What It Means for the Market

This deal sets a new precedent.

It tells us three things:

AI infrastructure is now investable at institutional scale

Private credit is no longer adjacent to hyperscale growth it is becoming central

CapEx flexibility is emerging as a new axis of competitive advantage

The message to other hyperscalers is unmistakable.

You do not need to own every megawatt on your balance sheet. You need to control the infrastructure while freeing up capital to win on software, data, and AI services.

Meta is moving first.

Others will follow.

Capital Stack Innovation Is the New Moat

The hyperscale era has entered a new phase.

It is no longer just about who can build fastest. It is about who can finance most intelligently. Meta is using private markets to expand its physical footprint without sacrificing financial agility.

This is not just a new way to build data centers.

It is a new way to compete in the AI economy.

And in this game, capital structure may be just as important as chip count.