Who Will Fund the $6.7T Global Data Center Boom?

AI demand is soaring. Capital access is tightening. And the gap between those who can scale and those who can’t is only widening.

Welcome to Global Data Center Hub. Join 1200+ investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

The global data center sector is undergoing the most capital-intensive transformation in its history.

Behind every new AI cluster, every hyperscale expansion, and every sovereign compute strategy lies a simple, but looming question:

Who will pay for it all?

By 2030, global data center capital expenditures are expected to exceed $6.7 trillion, more than the entire GDP of Japan.

This isn’t just a headline figure. It’s a new economic reality that’s beginning to reshape how infrastructure is financed, where it’s built, and who ultimately survives in this era of compute-driven growth.

Across both developed and emerging markets, the traditional financing model is under severe strain.

What worked for cloud expansion in the 2010s is faltering in the face of AI workloads that are doubling build costs, grid delays that are adding years to timelines, and interest rates that have erased the margin for error.

Capital isn’t just a resource anymore. It’s the gating constraint. And in this next wave of growth, it may be the single most important strategic advantage.

The Perfect Storm: Demand Is Surging While Capital Tightens

The data doesn’t lie.

Dell’Oro projects annual data center capex will hit $1 trillion by 2029.

McKinsey estimates that $5.2 trillion of that spend will be required to support AI workloads alone.

Hyperscale AI facilities now cost over $20 million per megawatt, twice the price of conventional builds.

At the same time, interest rates across major economies remain at decade highs, and lending conditions in emerging markets are tightening.

Access to long-tenor, affordable capital is increasingly difficult in regions like Southeast Asia, Latin America, and Sub-Saharan Africa. Even in mature markets like the U.S. and Europe, rising costs and constrained power availability are creating bottlenecks that money alone can’t solve quickly.

The result is a global infrastructure paradox: demand is accelerating exponentially, but capital is becoming both more expensive and less available.

The Financing Model Is Breaking

For much of the past decade, the playbook was simple: build at scale, secure an anchor tenant, and refinance at lower cost post-stabilization. That model relied on cheap capital and relatively predictable development cycles.

Today, it’s harder.

Debt costs have increased 15–20% globally since 2022. Loan durations are shortening. Lenders are enforcing stricter covenants, and only hyperscalers and sovereign-backed sponsors are accessing preferred rates and terms.

Mid-market developers, responsible for much of the sector’s edge capacity, are being squeezed, forced to either accept expensive, inflexible debt or dilute heavily through equity.

Meanwhile, AI is forcing changes to the physical asset itself.

Power densities have doubled or tripled. Cooling systems now require immersion or liquid technologies. Timelines are compressing, grid upgrades are becoming mandatory, and permitting complexity is growing across nearly every region.

What was once a real estate-driven investment is now a hybrid of high-tech engineering, utility coordination, and capital markets innovation.

The Five Capital Risks Reshaping Global Strategy

Power infrastructure now sits at the top of the risk stack.

Across PJM in the U.S., Eskom in South Africa, and India’s state utilities, grid upgrades are not only necessary—they’re increasingly funded by developers themselves. In the U.S. alone, data center-driven transmission projects are expected to add $9.4 billion in costs.

Land scarcity is also intensifying.

Suitable parcels near grid and fiber connections are limited in Ashburn, Amsterdam, Nairobi, and São Paulo. In Tier 1 cities, land acquisition and site prep now represent over 25% of total development costs. Delays, community resistance, and utility permitting issues regularly push costs up by 50–80%.

On the operational side, the cost of maintaining next-gen data centers is rising.

AI hardware has shorter refresh cycles, and cooling and electrical systems are under more stress than ever before. In some regions, annual opex for AI builds is now consuming more than 40% of net operating income, threatening long-term IRRs.

Underwriting risk has fundamentally changed.

Lenders today are not just looking at location and power, they expect signed leases, confirmed grid interconnections, and reserve accounts in place before closing. In frontier and secondary markets, this level of pre-certainty is often unattainable, further deepening the capital access divide.

And finally, the market is splitting in two.

The top four hyperscalers (AWS, Microsoft, Google, Meta) will collectively account for nearly half of global data center spend in 2025. Their balance sheets give them strategic pricing power and lower cost of capital. Everyone else must either partner, syndicate, or innovate just to compete.

How the Smartest Capital Is Evolving

Across the global landscape, investors are adapting in five ways.

Portfolio-level financing is replacing single-asset deals. By bundling assets across regions or stages, sponsors are improving their credit profiles and gaining access to securitization. This strategy is increasingly common in Spain, India, and the United States.

Asset-backed securities are becoming the go-to solution for unlocking yield-hungry institutional capital. ABS issuance in the data center sector is expected to double to $50 billion by 2027, fueled by the need for flexible refinancing and long-term capital.

Co-investment with utilities is becoming a necessity. In places like Malaysia, Brazil, and Kenya, developers are sharing the cost of substations and interconnection upgrades through take-or-pay contracts, revenue splits, or build-transfer-operate models.

Sale-leaseback structures are unlocking value in markets like South Korea and Germany, where developers sell stabilized assets to REITs while retaining management contracts and expansion options. This allows them to recycle capital and scale without overleveraging.

And in Europe and select parts of Asia, sustainability-linked financing is providing a cost advantage. Green bonds and ESG-linked loans are reducing interest rates by up to 100 basis points for developers who meet environmental performance benchmarks, especially in high-efficiency AI-ready builds.

Where the Capital Gap Hits Hardest

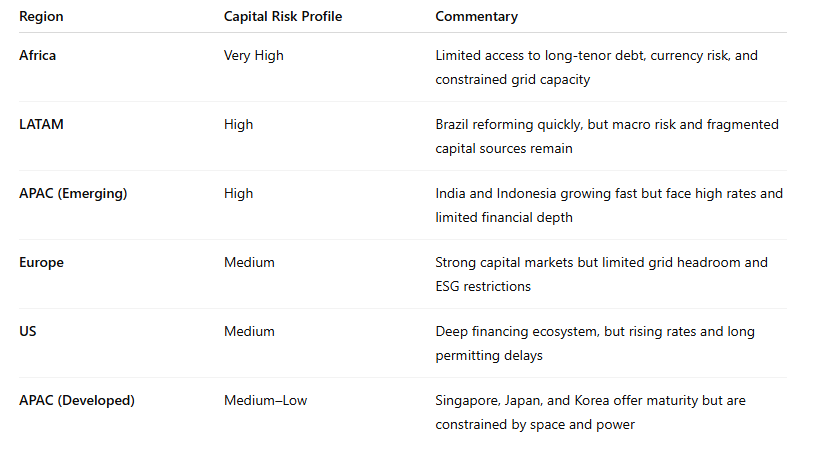

Not all markets face the same challenges or the same solutions.

Emerging markets often offer lower land costs and faster demand growth. But they also come with less predictable regulatory frameworks, thinner financial markets, and slower permitting regimes.

For investors and operators alike, geography is no longer just a market decision, it’s a capital allocation strategy.

Final Insight: Capital Is the New Strategic Edge

In the last cycle, the best-positioned developers had land, power, and speed.

In this one, they’ll need something more sophisticated: the ability to structure, syndicate, and recycle capital across jurisdictions and asset types.

Winning the next wave of global data center growth won’t be about who builds first.

It will be about who finances best.

Because in the AI-driven decade ahead:

Capital is the moat.

It determines who builds.

It determines who scales.

And it will ultimately determine who survives.