Meta’s $600B Build Cycle; Anthropic’s $50B Deal; Europe’s €23B Platform; India and Australia Announce 1GW Sites

Inside the capital, power, and policy shifts redefining global AI infrastructure.

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

If you’re not a subscriber, here’s what you’ve missed so far:

From Servers to Sovereign AI: A Free 18-Lesson Guide to Mastering the Data Center Industry [An 18-part series that breaks down the fundamentals, economics, geopolitics, and future of the world’s most important infrastructure]

Site Selection: How Billion-Dollar Data Centers Pick Their Land [Billion-dollar data centers aren’t just built they’re placed where power, fiber, and policy align.]

The Interconnection Bottleneck: How Renewable Delays Are Rewriting the AI Power Map [The real risk in AI infrastructure isn’t power cost—it’s time. Renewable backlogs are stranding capital and reshaping investment. Winners act without waiting for the grid.]

10 Reports Defining Global Data Center Strategy (Q3 2025) [A quarterly field guide to the AI supercycle: power, capital, and sustainability as the new strategy stack.]

Interested in sponsorship? info@globaldatacenterhub.com

In This Issue

Global Buildout at a Glance — From Meta’s $600B US expansion and Anthropic’s $50B Fluidstack commitment to AirTrunk’s 1GW Sydney site and Reliance’s 1GW Indian AI campus, every region accelerated toward sovereign-scale compute.

Power + Policy = Advantage — North American utilities confront multi-GW project queues, Europe tightens interconnect rules, APAC markets activate expedited AI-capacity pathways, and Brazil’s Amazon corridor shows how DFIs now shape regional digital policy.

Sovereign Capital Meets AI — Saudi Arabia, India, and Australia continue deploying state-aligned capital to secure land, megawatts, and national compute capacity, redefining who owns the next generation of AI infrastructure.

Notable Transactions — From BlackRock–ACS’s €23bn platform and Anthropic’s multi-year Fluidstack deal to Amazon-Basin subsea corridors, the capital stack behind AI data centers continues to consolidate into larger, more coordinated programs.

Dear Friends,

A new stage of the AI buildout has arrived. One defined by gigawatts of power and multi-billion-dollar capital, not incremental data-center growth.

This week alone, Meta activated a $600B U.S. expansion, Anthropic signed a $50B long-term deal with Fluidstack, and New Era advanced a 7GW AI campus in New Mexico. Abroad, Europe consolidated around a €23B platform, and both AirTrunk and Reliance moved forward with 1GW sites in Australia and India.

The pattern is unmistakable: competitiveness now hinges on power access, policy alignment, and sovereign-scale capital. Those who treat digital infrastructure as a strategic, energy-linked asset class will define the next decade.

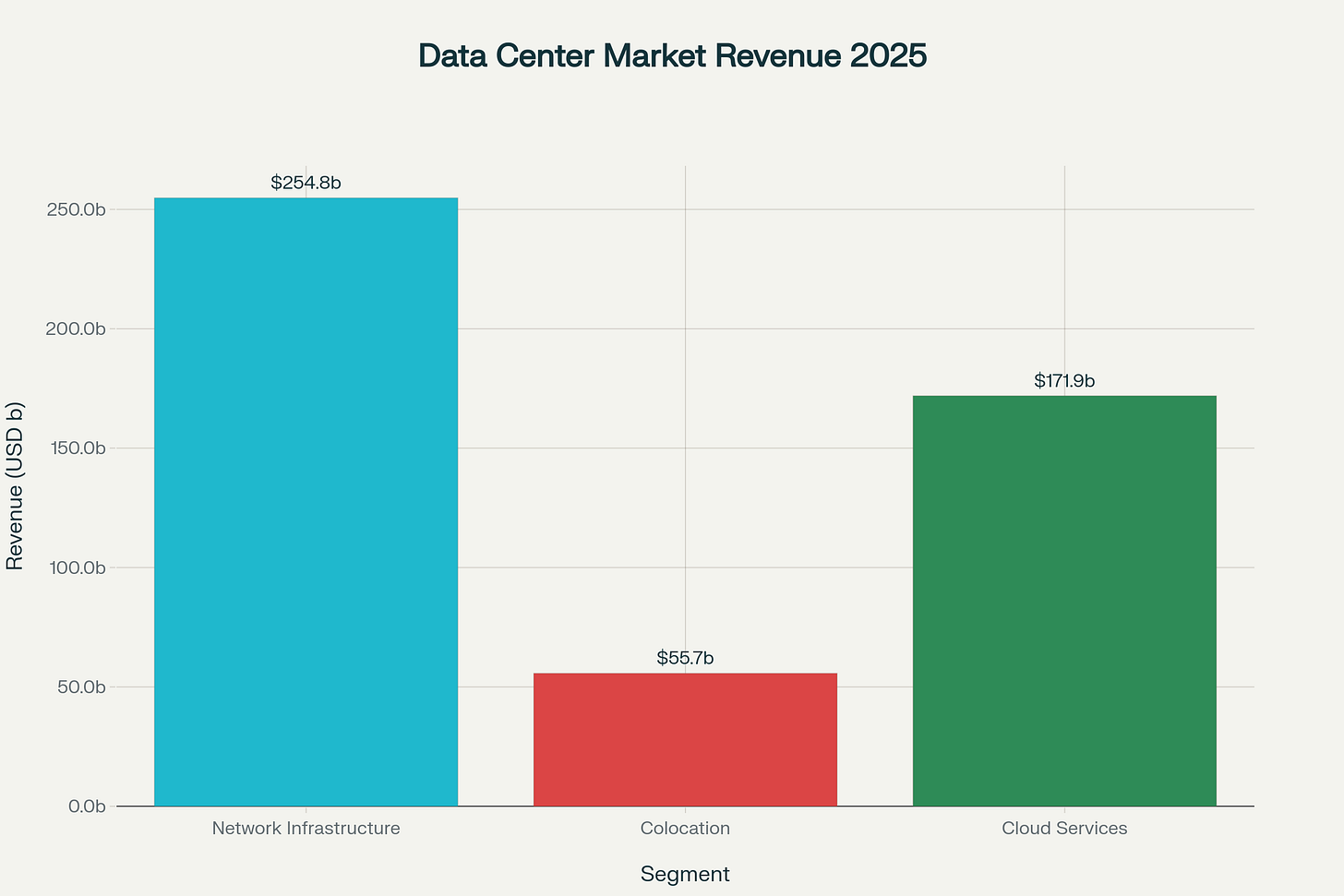

Chart of the Week — Global Data Center Market Revenue by Segment, 2025

In 2025, the global data center market is projected to generate revenue across multiple segments: network infrastructure ($254.8B), colocation ($55.7B), and cloud services ($171.9B). Network infrastructure takes the lead, highlighting its critical role in powering the next generation of digital services.

Source: Brightlio – Data Center Stats

Global Buildout at a Glance

A 1-minute scan of the week’s biggest moves — by region.