The Interconnection Bottleneck: How Renewable Delays Are Rewriting the AI Power Map

The real risk in AI infrastructure isn’t power cost it’s time. Mounting renewable backlogs are stranding capital and rewriting investment playbooks. The winners are those who stop waiting for the grid

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

The Quiet Crisis Beneath the AI Boom

The global AI buildout has created a new class of infrastructure investor: the energy-to-data center (E2DC) investor. These are the funds, developers, and institutions financing both electrons and servers in a single integrated model. But the bridge between clean power and compute (the interconnection and permitting process) has become a choke point.

As of late 2023, roughly 2.6 GW of renewable and storage capacity was waiting for grid connection in the U.S., a volume more than twice the existing power plant fleet. Nearly 95% of this backlog is solar, wind, or storage, the exact resources on which hyperscalers and institutional investors are banking to decarbonize their data centers.

The average queue time has ballooned from less than two years in 2008 to nearly five years today, with some California projects stretching beyond nine years. Only 20% of projects requesting interconnection between 2000 and 2018 ever reached commercial operation. For solar and batteries, completion rates are closer to 10–15%.

The queue, once a formality, is now the fulcrum of risk in digital infrastructure investing.

Causes: Bureaucracy Meets the AI Energy Shock

The backlog isn’t one problem, it’s a stack of failures.

Serial Process Failure. Legacy “first-come, first-served” interconnection studies incentivized speculation. Developers could reserve queue positions without full site control or financing, crowding out viable projects. When one project dropped out, the entire queue had to be re-studied, cascading years of delay.

Transmission Underinvestment. U.S. transmission investment hasn’t kept pace with renewable demand. Network upgrade costs have climbed above $240/kW in constrained regions up nearly tenfold from 2018 levels making many projects financially unviable.

Policy Reversals and Permitting Overload. Federal land approvals slowed under new Department of the Interior directives, while environmental reviews under NEPA can add 2–4 years to solar or wind projects. Agencies like FERC and DOE face a mismatch between record application volume and limited analytical staff.

AI-Driven Load Growth. Data centers alone could add 100 GW of new electricity demand by 2035, roughly equivalent to the generation of Japan. This surge has turned what was once a grid-planning challenge into a national economic risk.

The combined result: a system built for a slow, predictable grid now faces exponential, concentrated demand from AI-era loads.

Financial Impacts: How Delays Reprice Everything

The financial fallout is no longer hypothetical, it’s measured in billions.

In the first half of 2025 alone, over $22 billion in renewable projects were canceled, erasing 16,500 jobs and stranding billions in tax-equity capital. The sunk cost per abandoned megawatt now averages $200,000, and attrition rates above 70% are common in certain interconnection zones.

For investors linked to data centers, these delays mean:

Lost tax credits. Projects missing 2026–2028 start dates for the 45Y and 48E clean-energy credits face cost increases of 30–50%.

Escalating energy prices. PJM’s latest capacity auction ballooned from $2.2 billion to $14.7 billion in a single year, driven largely by slow interconnections. Consumers will pay up to $7 billion more in higher rates.

Regulatory exposure. In 2024, $4.3 billion of transmission costs to connect data centers in PJM were passed directly to ratepayers, with Virginia bearing $1.98 billion, a political flashpoint now embedded in future regulation.

Every month of delay erodes investment returns and compresses the arbitrage between power and compute. In practice, the queue has become the most expensive line item on the P&L.

Policy Response: Reforming the Queue, Not the Clock

Regulators have begun to react, but the structural fix will take years.

FERC Order 2023, issued in mid-2023 and affirmed in 2024, replaced the serial queue with a “first-ready, first-served” cluster model. Projects now require stricter site control, higher deposits, and withdrawal penalties, while transmission providers face firm study deadlines. Early adopters like NYISO, CAISO, and MISO are clustering studies regionally and prioritizing mature projects.

But FERC’s reform doesn’t solve the load-side crisis. Recognizing this, the DOE’s Large Load Interconnection Directive (Oct 2025) proposes federal jurisdiction over any new load above 20MW. The goal: standardize large-load procedures and link interconnection speed to operational flexibility allowing, for instance, a 0.25% annual curtailment in exchange for faster approval.

At the state level, Virginia’s permit digitization platform cut approval times by 70%, while Colorado and Maine have issued executive orders to fast-track renewable projects ahead of tax credit expirations.

Yet these efforts remain tactical: they speed up the paperwork, not the physics. Transmission planning remains decades behind the AI economy.

Investor Response: Bypassing the Queue

Leading investors are not waiting for the bureaucracy to catch up. They are rewriting the power-sourcing model around speed, control, and resilience.

1. Behind-the-Meter (BTM) Generation.

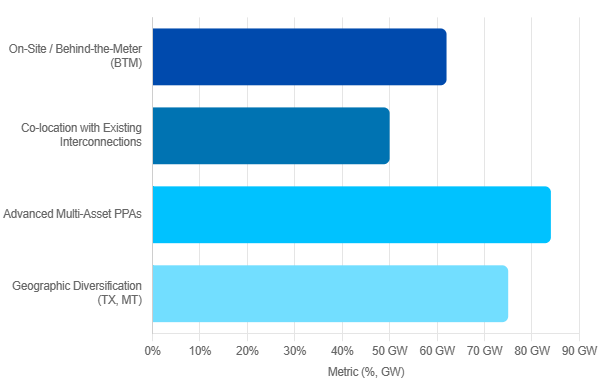

The most aggressive data center operators are building their own power plants. 25–33% of new data center demand through 2030 is expected to come from on-site generation. The advantage is time solar-plus-storage systems can be operational in months once permitted, compared to years for grid-tied projects.

By the end of 2024, 62% of data centers were evaluating on-site power, with 19% already implementing BTM solutions. IBM’s U.K. partnership with Clean Energy Capital exemplifies this shift: the company built a dedicated solar farm directly wired to its Hursley facility no queue, no delay.

2. Advanced Power Purchase Agreements.

Hyperscalers have secured 84 GW of clean energy across 29 markets, primarily through long-horizon and diversified PPAs. Meta’s 600 MW deal with ENGIE and Microsoft’s 12 GW partnership with Qcells reflect a move toward multi-year, multi-asset contracts designed to hedge regulatory and timing risk.

3. Co-Location with Existing Interconnections.

RMI estimates that pairing new data centers with existing generator interconnection points could unlock 50 GW of capacity quickly. Co-locating near retired coal plants or curtailed renewables cuts queue times by years while using stranded infrastructure.

4. Geographic Diversification.

Investors are shifting to states with faster permitting and stronger transmission capacity. Texas, Montana, and South Dakota score highest for renewable potential and water resilience, while ERCOT’s streamlined process makes it the U.S. benchmark for “speed-to-power” markets.

5. Firm, Zero-Carbon Hedging.

Next-generation strategies include nuclear restarts with 3–4-year timelines and fuel-cell hybrid systems. Equinix and Bloom Energy’s $5 billion fuel-cell partnership provides a blueprint for scalable on-site baseload power.

6. Policy Engagement and Cost Repricing.

Some states, like Oregon under its POWER Act, now require large loads to bear direct interconnection costs. Sophisticated investors are modeling this shift early, pricing future tariff exposure into underwriting rather than treating it as regulatory tail risk.

The Investor Playbook

The backlog is no longer a temporary distortion it’s the new cost of doing business. For E2DC investors, the lesson is structural:

Treat interconnection as financial risk, not engineering risk. Queue exposure directly drives IRR variance.

Prioritize control over purity. A hybrid stack (gas + solar + battery) with speed-to-power beats a 100% renewable PPA that never connects.

Model policy volatility. Tax credit cliffs and cost reallocation are now deterministic factors in project finance.

Design for flexibility. Facilities that can curtail, shift load, or participate in demand response will secure faster approvals under DOE’s forthcoming rules.

Diversify geographies and technologies. Transmission-constrained regions and single-source PPAs are concentration risk in disguise.

The Strategic Repricing of Power

The $100 billion economic upside from fixing interconnection is real but waiting for policy reform is not an investment thesis. In the near term, the backlog is creating a new class of winners: those who design around it.

The future of AI infrastructure belongs to investors who understand that queue risk is power risk. The advantage no longer lies in who pays less per kilowatt-hour, but who reaches it first.