Is Google’s $75B Data Center Bet the Smartest Move in the AI Arms Race?

Inside the vertical integration strategy that could reshape the future of compute

Welcome to Global Data Center Hub. Join 1500+ investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

The Future of AI Isn’t Just Algorithms It’s Infrastructure

In 2025, Google committed $75 billion to AI data centers and infrastructure.

That’s nearly $1.5 billion a week an eye-popping figure, even in hyperscaler terms.

But this isn’t just aggressive spending. It’s a shift in strategy.

Google is making one of the boldest bets in tech history.

That the long-term advantage in AI won’t come from the models themselves but from owning everything they run on.

Chips. Cloud. Clean power. All of it.

Why Google Is Spending So Fast

By late 2024, Google Cloud hit a wall.

Demand for AI compute outpaced supply. Cloud growth slowed to 28%. Customers wanted more than Google could deliver.

So Google responded like only a hyperscaler can: massive capital deployment at global scale.

But this isn’t just reactive.

The $75B plan is a commitment to a new model of digital competition where infrastructure is the moat and hyperscalers become industrial AI platforms.

Owning the Stack: Google’s Vertical Edge

Unlike most AI players, Google doesn’t rent infrastructure. It builds it.

From custom TPUs to purpose-built data centers to in-house software like JAX and XLA Google has gone full-stack.

This vertical integration delivers:

Better cost control

Faster performance optimization

Long-term independence from Nvidia and other suppliers

The newest chip, Trillium (TPU v6), is the clearest example.

It’s 4.7x faster than its predecessor, 67% more efficient, and tuned specifically for Gemini.

This isn’t about joining the AI chip race. It’s about controlling the rails of intelligence.

This vertical integration delivers: better cost control, faster performance optimization, and long-term independence from Nvidia and other suppliers especially as Google’s 1.8GW nuclear strategy aims to future-proof its AI infrastructure with clean, self-owned power.

Not Just Spending Strategizing

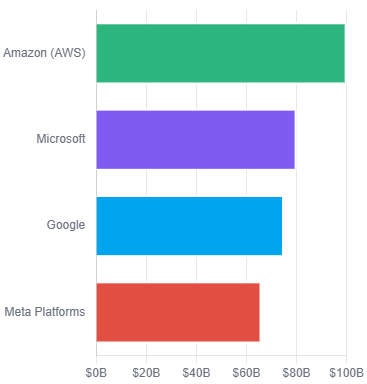

Yes, Microsoft, Amazon, and Meta are spending too. Combined, the big four will pour over $320 billion into AI infrastructure this year.

But each is playing a different game:

Microsoft is enterprise-first, closely tied to OpenAI.

Amazon is model-agnostic, focused on AWS as a platform.

Meta is going open-source to win ecosystem dominance.

Google’s approach? Vertical control.

It wants to be the most efficient, self-contained AI infrastructure machine in the world.

Yes, Microsoft, Amazon, and Meta are spending too. Combined, the big four will pour over $320 billion into AI infrastructure this year as Meta’s $72B CapEx blitz signals a shift from cloud scale to war-time infrastructure posture.

The Risks Are Real-But So Is the Threat of Doing Nothing

Google’s strategy is not without danger.

Overcapacity is a real risk, especially if AI model efficiency leaps ahead of infrastructure demand.

Its energy and water use are skyrocketing up 27% and 28% year-over-year, respectively.

And regulators are watching. Vertical integration this deep raises antitrust flags.

But here’s the bigger risk: under-investment.

In this new era, falling behind on compute capacity could be fatal. There are no second chances in an arms race.

What the $75B Really Buys

This isn’t just about Gemini or keeping up with ChatGPT.

Google’s investment is a defensive shield and an offensive weapon.

It’s designed to:

Defend search

Grow Google Cloud

Dominate the infrastructure layer of AI

In a world moving from software-defined intelligence to infrastructure-dominated compute, Google is betting everything that whoever controls the stack, controls the future.

Final Thought

$75 billion is a bold bet.

But in a market where models come and go and infrastructure stays Google may be playing the smartest long game of all.

The question isn’t whether the bet is big enough.

It’s whether anyone else can afford not to match it.