Google’s Nuclear Playbook: Why a 1.8GW Bet Could Reshape AI Infrastructure

Google just partnered with Elementl Power to fund 3 nuclear energy sites in the U.S. It’s not just clean energy. It’s a blueprint for controlling the backbone of the AI economy.

Welcome to Global Data Center Hub. Join 1000+ investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

The Quiet Shift with Massive Implications

On May 7, 2025, Google made one of the boldest moves in AI energy infrastructure to date.

It signed a strategic agreement with Elementl Power, an advanced nuclear project developer, to co-develop three nuclear energy sites in the U.S., each expected to produce 600MW of baseload power. That’s 1.8 gigawatts total.

This isn't about sustainability branding.

It’s about survival in an AI-powered world.

Power is no longer a commodity, it's a competitive advantage.

Google’s New Role: Energy Builder, Not Buyer

Most companies buy energy.

Google is starting to build it.

This deal isn't a PPA (power purchase agreement).

It’s early-stage development capital.

Google is funding the unglamorous but essential first steps:

Site selection

Permitting

Grid interconnection

Environmental studies

Community engagement

Then, if the project becomes operational, Google has rights to buy the power.

This structure gives Google something far more valuable than a clean energy badge:

Optionality + Priority Access

To 24/7, carbon-free power—right where its AI infrastructure is growing.

Inside the Elementl Power Model

Founded in 2022, Elementl Power is a new kind of nuclear developer.

Rather than committing upfront to a specific technology, they’re technology agnostic. Their focus is a “site-first” approach:

Lock down land and interconnection

Work with communities early

THEN pick the right advanced nuclear technology

Why is this smart?

Because most nuclear projects fail before construction ever begins, not because of the technology, but because of permitting, local opposition, and grid constraints.

Elementl de-risks the front end.

And Google gives them capital to move faster.

The goal? 10GW of nuclear capacity by 2035.

The Energy Behind AI

Google’s AI ambitions aren’t theoretical.

CEO Sundar Pichai recently said new data centers could consume over 1 gigawatt EACH.

That’s equivalent to powering a major city.

As AI models scale, so do compute demands. But current grids aren’t built for this.

Wind and solar are critical, but intermittent.

What AI needs is dense, reliable, 24/7 power.

That’s what nuclear delivers.

The scale of AI-driven energy demand isn’t just a technical challenge, it’s a looming infrastructure crisis.

This companion piece breaks down why the grid itself has become the bottleneck and what happens if Big Tech can’t solve it in time.

Google’s Other Nuclear Deal, Upgraded

This isn’t Google’s first nuclear move.

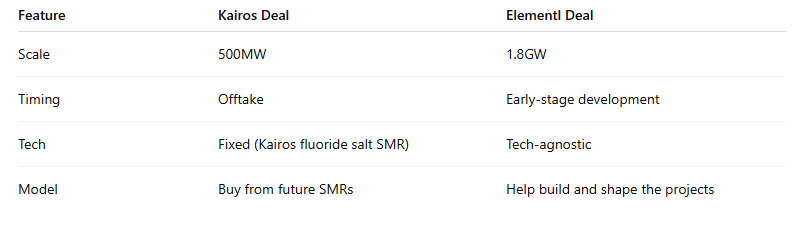

In October 2024, it signed a groundbreaking agreement with Kairos Power to purchase 500MW from small modular reactors (SMRs).

But this Elementl deal is different:

With Elementl, Google is shaping the grid, not just buying from it.

The Bigger Pattern: Tech as Energy Sovereigns

Google isn’t alone.

Microsoft is exploring restarting the iconic Three Mile Island plant.

Amazon owns a data center campus at a nuclear site in Pennsylvania.

Larry Ellison is planning a 1GW SMR-powered Oracle campus.

What’s happening?

Tech giants have stopped waiting on utilities.

They’re creating energy infrastructure to match their AI ambitions.

This is about energy sovereignty—securing the electrons they need to dominate compute at planetary scale.

Why Nuclear? Why Now?

Let’s be clear. Nuclear has problems:

High upfront costs

Long development timelines

Regulatory hurdles

Limited U.S. deployment track record for SMRs

But nuclear also offers four things no other clean source can match:

Baseload Reliability – 24/7 power, rain or shine

Energy Density – Small footprint, massive output

Longevity – Reactors last 40+ years

Cost Predictability – Stable long-term pricing

In an AI-driven world where reliability, scale, and predictability are king, nuclear is suddenly the best-kept strategic secret.

Risks Still Remain

Let’s not oversell.

This isn’t turnkey infrastructure. It's a long game.

Elementl has no completed nuclear projects to date

The technology is not yet selected

U.S. nuclear still faces cost overruns and delays (e.g., NuScale’s Idaho project was canceled)

But here's what makes this different:

Google isn’t funding one plant. It’s investing in a platform.

A playbook that can scale across markets.

A blueprint that other tech giants, and governments, can follow.

If you’re tracking how the nuclear energy shift is playing out across Microsoft, Amazon, Oracle, and others read this:

It breaks down the full wave of corporate nuclear bets and what they signal for the future of AI infrastructure.

Why This Changes the Game

What this partnership signals is bigger than Google or Elementl.

It’s a shift in who gets to decide how the future is powered.

And make no mistake: the AI economy is a power economy.

Data centers don’t run on hope.

They run on megawatts.

And whoever controls the energy behind AI, controls AI itself.

This is what infrastructure domination looks like in the 21st century.

One More Thing

I publish daily on data center investing, AI infrastructure, and the trends reshaping global data center markets.

Join 1000+ investors, operators, and innovators getting fresh insights every day and upgrade anytime to unlock premium research trusted by leading investors and developers.