Will Vodacom’s $1B Google Cloud Bet Rewire Africa’s AI Market?

The structural bet behind Vodacom’s partnership with Google Cloud and what it means for investors.

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

When I heard about this deal, I was not in the least bit surprised…

Vodacom’s Google Cloud partnership is less about AI and more about capital formation.

On November 25, 2025, it announced plans to migrate key data platforms and deploy generative AI models like Gemini, Veo, and Imagen to serve 223 million customers and nearly 100 million financial-services users.

For investors, the structural shift matters more than the headline.

Vodacom is moving beyond a connectivity utility, evolving into an AI-enabled platform that monetizes data and transforms services across Africa.

The question isn’t cloud migration. It’s whether Vodacom can turn a telco balance sheet into a scalable, continent-spanning AI platform.

The Shift from Connectivity Utility to AI Platform

Vodacom has long sought to escape low-margin voice-and-data economics, and this partnership formalizes the pivot. It unifies fragmented data network, billing, support, and mobile money into a single BigQuery backbone, enabling real-time analytics.

With this foundation, generative AI and machine learning scale across operations: customer care becomes personalized, network operations predictive, fraud detection real-time, and fintech and enterprise products intelligence-driven.

The change appears technological but is fundamentally economic. Efficiency, churn reduction, deeper monetization, and faster product innovation are the true levers, hinging on whether the unified platform improves margins, ARPU, and economic defensibility.

Why margin expansion, churn reduction, and monetization not model performance determine success aligns with lessons discussed in this assessment of how AI infrastructure economics are being recalibrated.

The Capital Stack Behind the Platform

Most see the Vodacom–Google Cloud deal as a telco cloud migration. I see it as a layered capital stack reshaping value across Vodacom, African data centers, subsea and terrestrial connectivity, mobile money, enterprise cloud, and emerging sovereign clouds.

At the center is Vodacom, supported by hyperscale data centers and resilient networks like 2Africa. Its financial ecosystem M-Pesa and VodaPay could use AI to reprice risk and expand lending, while Vodacom Business distributes cloud transformation to SMEs and public institutions.

Investors are choosing their exposure: core telco equity, data centers, connectivity, or fintech rails. The deal is not a single investment it’s an ecosystem where different capital pools monetize different layers.

Underwriting the Data Ocean

The most important part of the deal is Vodacom’s unified data ocean. BigQuery centralizes customer, network, and financial data in real time, turning fragmented data into actionable insights.

Investors should ask if this consolidation moves the P&L: lower churn, higher ARPU, reduced costs, and improved credit and fraud outcomes signal success; flat metrics mean limited payoff.

Governance and sovereignty matter. Operating across multiple African markets with different regulations requires a balance between cross-market AI and compliance, or monetization slows.

Resilience is key. A single data source boosts efficiency but also risks a single point of failure, making reliability, redundancy, and sovereign-ready hosting central to the thesis.

Why reliability, redundancy, and local hosting have become underwriting variables is consistent with risks outlined in this guide to the operational and infrastructure risks that actually matter to investors.

Generative AI as Differentiator or Commodity

AI can cut customer care costs, optimize networks, enhance credit scoring and fraud detection, and differentiate enterprise and SME services.

Investors must ask if these capabilities create defensible advantages. If competitors can replicate them easily, the moat disappears.

Success depends on whether Vodacom’s data, financial rails, and distribution let it fine-tune AI models others can’t, turning the partnership into a structurally advantaged platform.

Africa Is Not a Single Risk Line

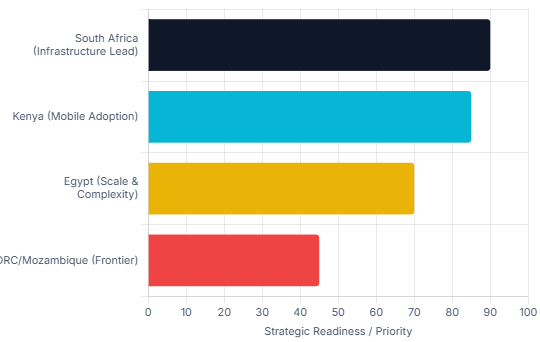

The rollout will vary: South Africa leads in infrastructure and enterprise base; Kenya excels in mobile adoption; Egypt offers scale and regulatory complexity. DRC, Mozambique, Lesotho, and Tanzania present diverse ARPU, power, and political risks.

I’ve seen investors make this mistake time and time again.

Investors who treat “Africa” as a monolithic exposure will misread the sequencing. Vodacom will validate the model in more stable, higher-value markets before expanding into regions with lower ARPU or higher volatility.

Capital should sequence in the same way: corridor by corridor, not continent by continent.

The Risk Architecture

Execution risk is unavoidable. Migrating mission-critical workloads while serving more than 200 million customers is a high-stakes act.

Regulatory risk is equally material; data sovereignty is tightening across the continent. Infrastructure fragility from power shortages to grid instability may bottleneck AI deployment.

Concentration risk emerges as Vodacom embeds more of its operating logic into a single hyperscaler’s stack. And talent gaps across cloud engineering, data science, and AI operations could slow or derail implementation.

Underwriting the partnership means mapping these risks precisely. Some are short-term integration risks. Others are structural fragilities inherent to African markets. All are manageable, but none are trivial.

Strategic Takeaways

Underwriting Vodacom–Google Cloud requires a disciplined lens, not AI hype. Benchmark against MTN–Microsoft, AWS, and other telco-cloud alliances, and focus on measurable outcomes like churn, ARPU, fintech adoption, and enterprise revenue.

Decide which layer of the stack to target telco equity, data centers, subsea routes, or fintech rails and stress-test risks around infrastructure, regulation, vendor concentration, and execution. Capital should follow Vodacom’s market rollout strategically.

Treat the partnership as a live test case of AI, cloud, mobile money, and digital infrastructure in Africa. Success comes from disciplined observation and sequencing, not press releases or headlines.