How the Best Teams Are Treating Power as a Competitive Advantage

The most important shift in data center infrastructure isn’t what you’re building. It’s how you power it.

Welcome to Global Data Center Hub. Join 1600+ investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

In the past, infrastructure builders treated power like plumbing:

You found a site

Called the utility

Waited a few quarters

Got connected

That playbook is dead.

In markets like Northern Virginia, Silicon Valley, and Phoenix, the delays to power delivery now outlast entire build cycles.

Case in point:

Northern Virginia (2024):

60 data centers dropped offline in one event. Dominion has 40GW under contract and can’t guarantee new connections until after 2027 .

Phoenix:

Power demand must grow 553% to meet 2030 needs—but interconnection requests already exceed capacity by 10GW .

Silicon Valley:

Developers are waiting longer for electrons than for permits .

This is now a structural shift in how infrastructure gets done.

Power Is A Strategic System

Let’s define the new reality:

Power isn’t a utility, it’s a system to design for.

AI workloads now require 5–10x more energy than traditional compute.

Peak demand doesn’t just rise, it spikes.

And interconnection queues are backing up by years, not months.

In this environment, power strategy drives:

Site selection

Deal structure

IRR predictability

Policy risk exposure

It’s now about having the right kind of power.

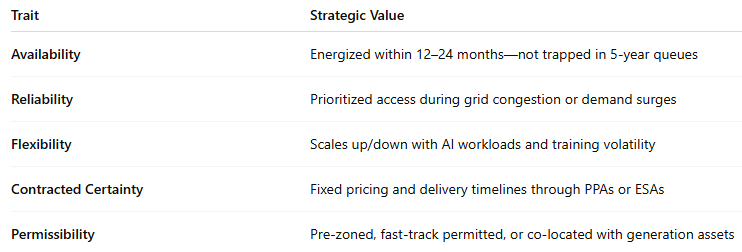

What Makes a Megawatt “Strategic”?

The best operators now evaluate megawatts like real estate.

What used to be a binary (“Do we have power?”) is now a multidimensional assessment:

A secured megawatt with all five traits is now as valuable as the tenant lease.

The next section unpacks how top investors and operators are navigating grid constraints, not by avoiding them, but by turning them into strategic leverage.

Plus: The practical implications of this shift for operators, investors, technologists, and policymakers.

What Forward-Looking Builders Are Doing Now

While much of the industry waits for regulators and utilities to clear the bottlenecks, the most forward-looking builders are engineering around them.

They’re not just adapting to scarcity, they’re converting it into strategic advantage.

Here’s how:

Behind-the-Meter as Timeline Insurance

Behind-the-meter (BTM) power, once seen as backup, is now a primary tool to de-risk interconnection delays.

Think solar arrays paired with battery storage, solid-oxide fuel cells, and modular natural gas gensets.

Why it matters:

Securing grid power in a top-tier market can take 3–7 years. Deploying a BTM system can shrink that to 18–24 months, often the difference between market relevance and irrelevance.

Case in point:

Amazon’s $650M acquisition of Talen Energy’s nuclear-powered data center campus wasn’t about real estate.

It was about energy sovereignty: guaranteed, dispatchable, scalable power—no grid required.

Joint Ventures with Power Generators

Blackstone and PPL’s multi-billion-dollar JV to develop dedicated natural gas plants for data centers marks a new playbook:

Build the power first, then bring the compute.

These JVs are a hedge against queue delays, curtailment risk, and price volatility. They also unlock structured, long-term Energy Service Agreements (ESAs), enabling predictability at scale.

Expect more infrastructure investors to move into “digital energy” hybrids in the next 12–24 months.

Migration to Power-Abundant Secondary Markets

Some of the most overlooked geographies are now seeing deal flow accelerate, not because of tax breaks, but because the megawatts are available.

Reno, NV

Des Moines, IA

Columbus, OH

Culpeper, VA

These secondary markets offer:

Proximity to Tier 1 hubs

Favorable grid headroom

Faster permitting cycles

20–40% cost advantages over constrained metros

Hyperscalers are already shifting deployment here. Smart developers are following suit, with land strategies, modular builds, and edge market energy JVs.

Energy Procurement as an Operating Discipline

Power is no longer a utility cost, it’s a dynamic, volatile input that must be actively managed.

That’s why leading developers are building energy procurement teams with capabilities similar to capital markets desks:

Long-term PPAs and hedges

BESS arbitrage

Demand response and VPP participation

Spot market exposure management

In volatile energy markets like ERCOT (Texas), failure to hedge power pricing can erode margin by 20–30% annually.

In short: Energy is now a balance sheet risk, not just an ops line item.

How Roles Are Shifting Across the Ecosystem

This structural shift to power-aware infrastructure is transforming roles at every level.

Here’s what it looks like:

Operators

Design for modularity, both in capacity and energy inputs

Pre-integrate battery systems, fuel cells, or dual-feed redundancy

Make site selection contingent on power delivery timelines, not just available load

Investors

Underwrite interconnection timelines like a second development cycle

Prioritize platforms with utility relationships, energy partners, and policy fluency

Recast megawatt access as a strategic moat, not a commodity input

Technologists

Build for high-density, high-variability AI workloads

Design cooling systems optimized for load ramping and frequency response

Align workload scheduling with energy markets and demand response incentives

Policymakers

Streamline environmental and energy permitting for AI infrastructure zones

Modernize incentives for transmission and behind-the-meter capacity

Rebalance clean energy mandates with baseload reliability strategies to protect AI and cloud deployment pipelines

Final Word

The future of digital infrastructure isn’t just being shaped by hyperscaler budgets or sovereign AI ambitions.

It’s being shaped, megawatt by megawatt, by those who understand how to design around constraint, build with foresight, and treat energy as a strategic pillar.

In this new reality, the best builders won’t be the ones who find land first.

They’ll be the ones who power it first, and power it smart.