Why Is Blackstone Betting ₹10,000 Crore on a Single Chennai Data-Center Park?

Inside the logic behind a single-campus bet as India’s hyperscale market tightens

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

Blackstone’s ₹10,000 crore (~$1.2 billion) commitment is not about scale or optics. Blackstone deploys capital to secure control when markets are structurally reordering, not to make statements.

The Chennai campus is neither a broad India growth bet nor a speculative real-estate play. It is a concentrated investment in a specific corridor where connectivity density, AI-driven compute demand, and institutional capital advantages converge.

The decision reflects a shift in how hyperscale infrastructure is underwritten. Value is no longer defined by megawatts alone, but by timing, location, and the ability to lock in strategic advantage before capacity tightens.

Chennai’s Strategic Repositioning

For much of the past decade, Mumbai defined India’s data-center map, driven by early cable landings, financial services demand, and hyperscaler entry. Chennai was seen mainly as a lower-cost alternative.

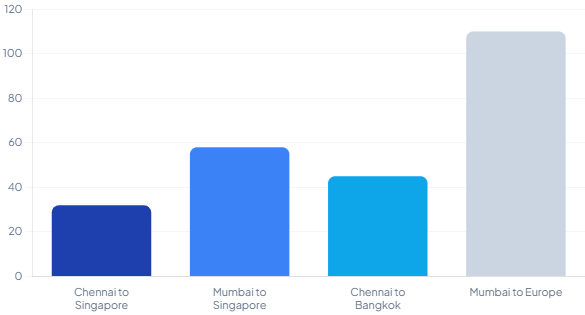

That has changed. Chennai has become a regional connectivity node linking India directly to Southeast Asia, with multiple submarine cables improving latency and redundancy to Singapore, Malaysia, and Thailand. The MIST cable tied to NTT’s Chennai campus materially expanded international bandwidth and repositioned the city within Asia-Pacific data flows.

In hyperscale economics, dense international fiber is decisive. AI and cross-regional workloads punish latency. Chennai now competes not just with Mumbai but, on some routes, with Singapore, while maintaining lower development and operating costs. Blackstone is positioning ahead of this shift.

This repositioning of Chennai from a secondary market to a regional gateway reflects a broader pattern in Asia-Pacific, where connectivity corridors increasingly determine hyperscale competitiveness, as examined in Asia-Pacific: $150B+ AI Data Center Infrastructure Enters the Industrial Phase.

Ambattur and Time Arbitrage

The reported ₹500+ crore acquisition of a 16-acre site in Ambattur looks expensive through a conventional real-estate lens. In hyperscale underwriting, land is valued less for size than for the risk it removes.

Ambattur is a proven industrial corridor with power, access, and fiber already in place, reducing uncertainty around permits, grid connection, and construction. For a 200MW+ campus, shaving even six to twelve months off delivery can outweigh a higher land cost many times over.

Blackstone is paying for schedule certainty. In hyperscale development, time determines tenant commitments, policy capture, and whether a platform establishes credibility before competing capacity arrives.

Capital Scale as a Structural Advantage

A ₹10,000 crore commitment signals the ability to absorb early-stage risk that smaller developers cannot. Large data-center campuses rarely fail on demand; they fail when power, policy, or tenant timing clashes with rigid capital structures.

Through Lumina CloudInfra, Blackstone can deploy equity early, resolve development risk, then refinance into lower-cost infrastructure capital once leases are secured, a model proven with QTS in the U.S. and AirTrunk in Asia-Pacific.

The Chennai campus is not a one-off asset. It is a capital absorption platform designed to scale as development risk converts into contracted cash flow.

This equity-first, refinance-later model is increasingly central to hyperscale investing, where capital sequencing matters as much as site selection a dynamic explored in The Rise of Compute REITs: Why Power, Not Property, Now Defines the Digital Estate.

Execution as a Differentiator

At hyperscale, execution risk dominates outcomes. Delays in commissioning, power handover, or cooling infrastructure cascade directly into lost leasing momentum and weakened returns. This is why the choice of development partner is central to the thesis.

Blackstone’s partnership with Beary Group reflects a focus on delivery certainty rather than branding. Beary Group’s experience delivering hyperscale facilities in the same Chennai corridor reduces execution risk materially. Familiarity with local utilities, permitting authorities, and supply chains matters at this scale.

A design-build-deliver approach consolidates accountability across design, procurement, construction, and commissioning. For institutional capital, this structure is less about speed at any cost and more about protecting downside through disciplined execution.

AI Changes the Demand Curve

The Chennai campus is being built for AI-ready workloads, which significantly raises infrastructure requirements. AI clusters require higher power densities, advanced cooling, and grid stability beyond legacy data centers.

India’s AI compute demand is no longer speculative. Government action, enterprise adoption, and hyperscaler expansion are converging as compute becomes core infrastructure, with hyperscalers leasing capacity while focusing capital on GPUs and models.

This favors platforms that can deliver large blocks of power-dense capacity on schedule. Chennai’s connectivity supports AI inference for both India and Southeast Asia, reinforcing the case for a single, large campus over fragmented builds.

Policy as an Enabler, Not the Thesis

Tamil Nadu’s data-center policy provides incentives around power access, duties, and renewable sourcing. These incentives improve economics, but they do not explain a ₹10,000 crore commitment on their own.

The critical variable is execution against policy timelines. Incentives are only valuable if land control, power planning, and initial leasing milestones are achieved in time. Blackstone’s scale and partner selection suggest confidence that these conditions can be met.

For institutional investors, this is the correct posture. Policy should be treated as upside earned through execution, not as a base-case assumption.

The Takeaway

Blackstone is investing ₹10,000 crore in a single Chennai data-center park as AI demand accelerates, hyperscalers shift to leasing infrastructure, and connectivity repositions the city as a regional gateway. At this scale, institutional advantages compound best in a single, expandable control point.

This is not a speculative real-estate play or a generic India growth bet. It is a calculated move to secure a long-duration position in the physical backbone of India’s AI economy, anchored in a corridor with power access, fiber density, and execution certainty.

The implication is clear. India’s next data-center leaders will not be those chasing headline megawatts, but those who control corridors, timelines, and capital sequencing.

Chennai has crossed that threshold, and Blackstone is positioning accordingly.