Why Green Power, Not Capital, Is Stalling LATAM Data Centers

Clean power was supposed to be LATAM’s advantage. Instead, hyperscale growth has turned it into gated infrastructure reshaping ESG, financing, and site selection.

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

Event: When Clean Power Became a Development Gate

The inflection point in Latin America’s data center market did not arrive through rolling outages or grid failures. It arrived quietly, through balance sheets and contracts.

When leading operators began raising billion-dollar green-labeled financings and when others committed to renewable agreements measured not in tens but hundreds of millions of dollars, sometimes paired with equity exposure to generation the signal was unmistakable. Clean power had stopped behaving like an operating input and started behaving like gated infrastructure.

This shift matters because it reorders development logic. For much of the last decade, the limiting factors in LATAM data center growth were familiar: site control, fiber access, political risk, and capital availability. Power mattered, but it was assumed to be solvable late in the process. That assumption no longer holds.

Today, the ability to secure verifiable, deliverable, and auditable green power at the right voltage, in the right location, on the right timeline has become the real interconnection queue.

Core Cause: Renewable Abundance Meets Grid Reality

Latin America’s challenge is not renewable scarcity. It is the mismatch between renewable geography and data center geography.

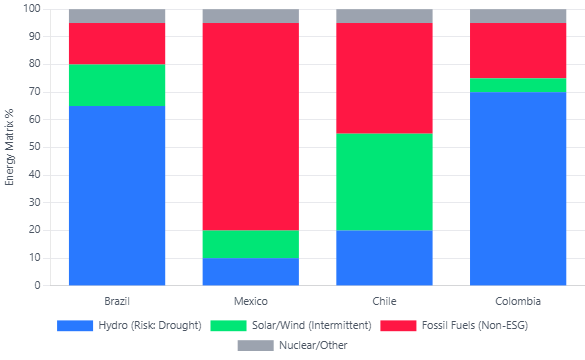

At a regional level, LATAM has some of the cleanest power systems globally, with renewables dominating several markets. But the headline masks the real investor constraint: nodal deliverability.

Data centers are immobile, continuous loads needing firm capacity at specific grid points. Renewables are often built where resources are strongest, not where demand concentrates. Transmission, interconnection, and congestion turn theoretical abundance into practical shortage.

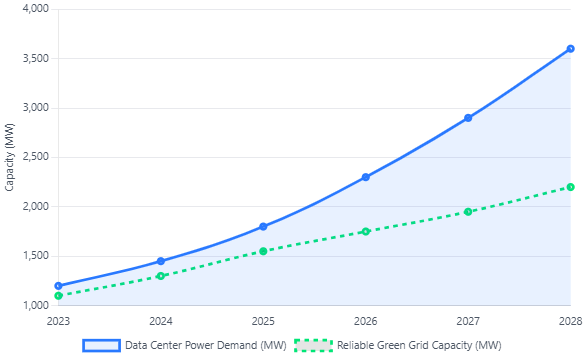

Load concentration amplifies the tension. Forecasts show roughly 3.1 GW of installed data center IT capacity by decade’s end clustered, round-the-clock demand stressing grids designed for industrial and residential peaks. Mexico faces compressed reserve margins, signaling little buffer, while Chile has curtailment despite abundant generation. Clean power exists, but it can’t always reach demand centers, making sustainability claims a credibility test.

Layered on top of these physical constraints is tightening ESG scrutiny. As Scope 2 accounting standards mature, stakeholders increasingly care about additionality, location, and timing not just annual renewable coverage. The acceptable universe of “green power” contracts contracts sharply once these dimensions are priced.

This disconnect between theoretical renewable abundance and usable capacity is increasingly defining which LATAM markets can scale AI infrastructure, a pattern examined in South America: $60B+ AI Buildout from Sovereign Zones to Cross-Border Lanes.

Financial Impact: Power Risk Rewrites Underwriting

The consequences of this squeeze appear first in underwriting.

Schedule risk has become power-driven. Projects that secure land, permits, and capital can still stall if interconnection timelines or renewable contracting slip. In hyperscale leasing markets, where demand windows are narrow and competitive, time-to-power is often more valuable than incremental pricing upside.

Capital expenditure profiles are also shifting. Leading platforms increasingly finance grid-adjacent infrastructure themselves substations, switching capacity, and dedicated tie-ins to bypass utility bottlenecks. While rational, this approach reclassifies part of a data center investment into energy infrastructure, with different permitting risk, construction complexity, and return profiles. Investors who underwrite LATAM data centers as pure real estate plus MEP builds misprice this reality.

Financing outcomes now diverge based on sustainability credibility. Sustainability-linked and green-labeled capital has proven available at scale for operators that can demonstrate measurable performance. At the same time, baseline financing costs have risen materially since 2022, widening the gap between platforms with credible green-power strategies and those relying on cosmetic compliance. ESG has moved from narrative to spread.

There is also an operating cost dimension. When reliability gaps are bridged with fossil-based backup generation, uptime may be protected but ESG alignment erodes. The tension between operational resilience and sustainability is no longer theoretical; it is being priced into tenant decisions and lender diligence.

Policy Response: Conditional Welcome, Not Capacity Creation

Governments across Latin America are not hostile to data center investment. They are, however, increasingly explicit about the conditions under which that investment is welcome.

Brazil’s approach exemplifies the new policy stance. Fiscal incentives are tied directly to sustainability performance: renewable sourcing requirements, aggressive water-efficiency thresholds, and mandated reinvestment into domestic innovation. This is not aspirational ESG language. It is industrial policy designed to force capital to internalize energy transition costs rather than externalize them to the grid.

Chile’s response emphasizes planning reform and grid modernization, seeking to accelerate transmission development and integrate storage more effectively. Mexico has signaled investment in renewables, storage, and grid expansion, even as system margins remain tight.

The common thread is clear. Policy can reduce friction, but it cannot compress physics. Transmission projects, equipment manufacturing, and interconnection reform operate on multi-year timelines. Hyperscale demand does not.

For investors, this means regulatory alignment is necessary but insufficient. Power strategy must stand on its own merits even in the absence of perfect policy execution.

Investor Response: From Procurement to Power Control

The most sophisticated investors are responding by reorganizing development around power-first logic.

The clearest shift is upstream integration. Rather than relying solely on arms-length PPAs, leading platforms are aligning directly with generation developers sometimes through equity participation to secure additionality, delivery certainty, and long-term cost visibility. These structures convert renewable power from a variable expense into a semi-controlled asset.

Long-tenor PPAs tied to new build have become table stakes, but they are no longer sufficient on their own. Investors are increasingly pairing renewables with storage or hybrid configurations to manage intermittency and defend ESG claims under tighter temporal scrutiny. Annual matching is giving way to hourly credibility.

Another response is private investment in deliverability. By funding substations, dedicated interconnections, and enabling infrastructure, developers reduce dependence on congested queues and gain control over timelines. This capital intensity can deter smaller players, effectively turning grid friction into a barrier to entry.

Portfolio construction is also evolving. Power strategy is now evaluated at the platform level rather than project by project, allowing investors to balance geographic exposure, grid risk, and regulatory regimes across markets.

Finally, sophisticated sponsors are pricing social license directly into their models. As public scrutiny over electricity prices and cross-subsidization intensifies, higher demand charges, collateral requirements, and long-term commitments are becoming normalized for large loads. Platforms that assume these obligations upfront face less regulatory friction over time.

As grid friction intensifies, these power-first strategies increasingly function as defensive moats, converting regulatory and physical constraints into competitive advantage, as outlined in Regulation As Alpha: How Smart Fiber-to-DC Capital Turns Friction Into Moats.

Investor Lesson: Deliverable Green Power Is the Real Moat

The competition for green power in Latin America is not a temporary bottleneck. It is a structural outcome of AI-scale demand colliding with grids that expand incrementally.

In this environment, access to capital is no longer the decisive advantage. Control over deliverable power is.

LATAM’s renewable advantage doesn’t make ESG compliance easier it makes it clearer and more enforceable. In cleaner grids with visible curtailment, stakeholders ask sharper questions: Did this project add supply? Can the power reach the campus? Is it proven hour by hour?

Investors who succeed will internalize this shift. Renewable PPAs matter, but only as part of a broader strategy integrating generation, grid access, storage, and regulatory alignment. In Latin America, green power is no longer optional it is the platform.