Who Really Owns the AI Future: Demand or Infrastructure?

Q1 2025 earnings revealed two diverging strategies, both betting billions. But only one group is building the foundation everyone else must run on.

Welcome to Global Data Center Hub. Join 1000+ investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

Executive Summary

The four largest U.S. tech firms (Alphabet, Amazon, Microsoft, and Meta) are on track to collectively invest over $300 billion in capital expenditures in 2025, with AI infrastructure as the defining priority.

But their endgames are not the same.

Alphabet and Meta are focused on capturing and monetizing global AI demand through consumer products, engagement, and ads.

Microsoft and Amazon are focused on controlling AI infrastructure (land, power, data centers, and cloud platforms) for enterprise and national-scale AI delivery.

This isn’t just an AI race.

It’s a structural divergence in margin, leverage, and long-term platform control.

The headline results only tell part of the story.

The real divergence comes in how these companies are deploying AI: one group builds demand, the other controls delivery.

The full breakdown starts below (available to premium subscribers only).

The Two Playbooks

Alphabet + Meta: Own the Demand Layer

Alphabet and Meta now serve over 2.5 billion AI users through Gemini, YouTube, WhatsApp, Meta AI, and Threads.

Their approach integrates AI directly into platforms where users already spend time: search, social, messaging, and content creation.

In Q1 2025:

Meta AI reached nearly 1 billion monthly users across apps.

WhatsApp surpassed 3B MAUs, with growing traction in India, Brazil, and Africa for AI-assisted business messaging.

YouTube’s AI features improved discovery and ad targeting.

Meta raised its 2025 CapEx guidance to $64–72B, with expanded investment in AI-ready data centers and custom infrastructure.

Alphabet projected ~$75B in 2025 CapEx, with Google Cloud posting 28% YoY revenue growth and improving margins.

Despite these massive investments, both firms remain partially dependent on leased infrastructure and third-party cloud providers:

Meta’s Llama models still run on Azure and AWS.

Google builds and operates its own infrastructure, but focuses on internal workloads and doesn’t yet match Microsoft or Amazon in enterprise AI delivery.

Their core business model remains tied to advertising and engagement, with AI enhancing, but not yet redefining, monetization.

Microsoft + Amazon: Own the Infrastructure Stack

Microsoft and Amazon are building the AI economy’s utility layer, from chips to power to cloud-scale deployment.

In Q1 2025:

Azure revenue grew 35%, with 16 points attributed to AI services.

AWS posted $29.3B in revenue and $11.5B in operating income, with its cloud backlog rising 20% YoY to $189B.

Microsoft is on track to invest $80B in CapEx this fiscal year, largely for AI data center buildouts.

Amazon’s projected 2025 CapEx (across AWS, logistics, and devices) is expected to exceed $80B, with a significant share allocated to AWS AI infrastructure.

Both firms are also executing aggressive global expansion strategies, particularly in emerging markets:

Microsoft added capacity in Malaysia, Chile, and India.

Amazon continues expanding in Brazil, South Africa, and Southeast Asia.

Critically, they are securing sovereign partnerships to gain long-term control of land, power, and zoning rights—conditions Alphabet and Meta rarely control at the same depth.

Their monetization strategy is centered on long-term enterprise contracts, compute delivery, and AI services—not attention.

Strategic Comparison

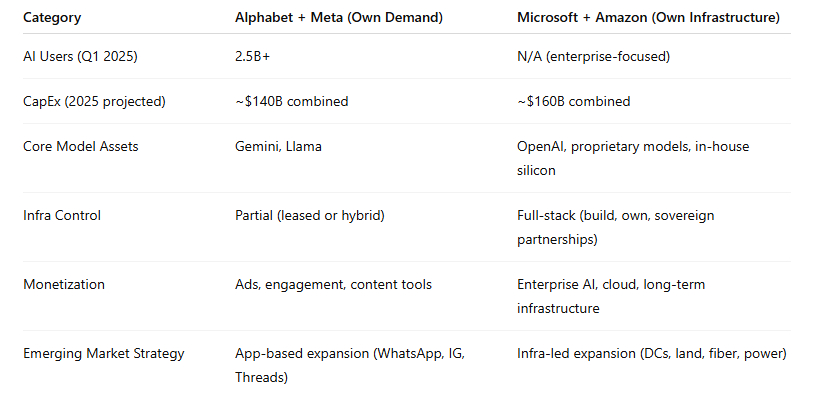

The strategic divergence becomes even clearer when you line them up side by side.

Key Insight:

One group owns demand. The other owns delivery.

Alphabet and Meta are growing AI engagement at massive scale—but their infrastructure is still partly leased.

Microsoft and Amazon are securing the full delivery stack—from power to silicon to global reach.

This divergence matters because infrastructure owners shape cost, performance, policy—and the very limits of what AI can scale to.

What to Watch Next

Will Meta shift away from Azure and AWS or double down on partnerships?

Can Alphabet turn Gemini into a revenue engine inside Google Cloud?

Will Microsoft's infrastructure advantage hit capacity ceilings due to power grid constraints?

Can Amazon balance AI CapEx and margin as global demand accelerates?

Bottom Line

If you're investing in AI's next decade, the question isn’t just who’s growing fastest.

It’s who controls the conditions of growth.

Demand drives scale. Infrastructure controls value capture.