When 1.5 Gigawatts Vanished: What the Virginia Near-Blackout Revealed About the Future of AI Infrastructure

A real 1.5-GW near-blackout in Virginia exposed the biggest hidden risk in AI infrastructure grid fragility. Here’s how leading investors are redesigning for reliability and yield.

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

The Moment the Grid Blinked

Just before midnight on a humid July evening, a lightning arrestor failed along a 230-kV transmission line feeding Dominion Energy’s Northern Virginia corridor

The densest concentration of data centers on Earth.

The disturbance lasted only milliseconds, but the automated protections inside dozens of hyperscale facilities interpreted it as an existential threat.

To safeguard their servers, the facilities instantly disconnected from the grid and switched to backup diesel and battery systems.

In that single moment, 1.5 gigawatts of load evaporated, roughly equivalent to turning off an entire mid-sized city (or all the data centers in either India, Singapore or South America).

Grid operator PJM Interconnection scrambled to stabilize voltage.

Power plants across Virginia and Maryland were ordered to throttle output to prevent a cascading frequency spike.

It worked, barely. But it took hours before engineers could manually reconnect each data center to the network.

The North American Electric Reliability Corporation (NERC) later called it a “five-alarm fire for reliability.” As NERC’s Jim Robb warned, “The grid is not designed to withstand the loss of 1,500 MW of load at once.”

Why It Happened

At its core, the event was not a one-off failure. It was the visible symptom of a structural mismatch between the modern data-center load profile and the physics of an aging grid.

Load Density: Individual campuses in Loudoun and Prince William counties now draw 30–60 MW each, orders of magnitude higher than the industrial facilities the region’s substations were designed for.

Simultaneity: Many of these facilities sit on the same transmission backbone. Their protection systems are programmed nearly identically. When one senses a fault, they all react together.

Infrastructure Age: Much of PJM’s high-voltage equipment dates from the 1970s–80s. Components like lightning arrestors and transformers operate far beyond their intended lifespan.

Automation Cascades: Modern Uninterruptible Power Supply (UPS) systems react in milliseconds. The human operator has no window to intervene, so a micro-fault can trigger mass disconnection faster than grid software can respond.

The takeaway: hyperscale resilience protocols, while protecting servers, can unintentionally endanger the wider grid.

The Financial Fallout

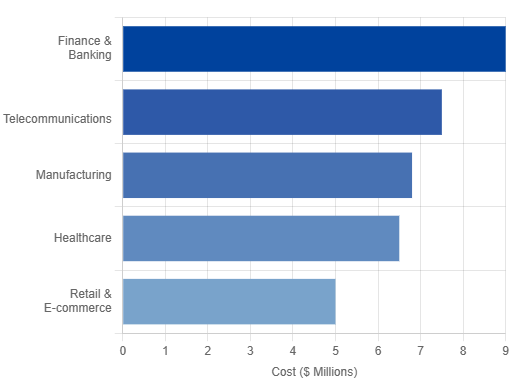

For operators, the July 2024 near-blackout wasn’t free. Each facility burned through thousands of gallons of diesel while running in “island mode.” Several reported synchronization damage to switchgear and UPS components. One operator quietly disclosed that its fuel and testing costs that quarter rose 28%.

For investors, the incident reframed risk modeling across the sector. Analysts now treat grid-induced outages not as rare “Acts of God,” but as foreseeable operational events.

Direct costs: The industry average outage cost $9,000 per minute multiplied by even brief generator runtime implies multi-million-dollar exposure per incident.

CapEx inflation: Facilities are accelerating investments in dual-feed substations, voltage stabilizers, and on-site generation, pushing total build cost above $20 million per MW for AI-optimized campuses.

Insurance reaction: Underwriters began adding exclusions for utility-origin outages, arguing that simultaneous 1.5 GW trips constitute a systemic risk, not an insurable event. Premiums for business-interruption coverage rose 12–18% in the second half of 2024 in the Mid-Atlantic market.

Perhaps most telling: PJM’s board approved $5.9 billion in new transmission projects immediately after the event, financed largely through ratepayer surcharges across 13 states. That means higher operating expenses for every colocation tenant in the region.

Regulatory Repercussions

The Virginia incident triggered a chain reaction in policy circles. Within months, PJM proposed its Non-Coincident Peak Load (NCBL) classification, allowing the grid operator to curtail large data-center loads before residential customers during emergencies. ERCOT in Texas soon explored similar measures.

In practice, this redefines the relationship between data centers and utilities:

Power reliability is no longer guaranteed service it’s earned compliance.

Facilities must prove they can self-stabilize or face prioritized curtailment.

On-site generation and storage are shifting from “optional redundancy” to regulatory necessity.

For investors, the NCBL framework adds a new layer to due diligence. A project’s value now depends not only on land, fiber, and tax incentives, but on regulatory flexibility whether local RTOs view it as a stabilizing partner or a risky load.

What Smart Operators Did Next

The hyperscale community responded quickly. The incident effectively ended the era of blind dependence on public-grid reliability.

Private Substations and Looped Feeds

Dominion and several hyperscalers co-funded redundant 230-kV interconnects, allowing campuses to reroute power internally during faults.

Some facilities are now connected to two separate transmission corridors—a level of redundancy once considered excessive.

Behind-the-Meter Generation

Developers began deploying gas-fired microturbines and reciprocating engines capable of covering full site load for extended periods.

Microsoft and Vantage Data Centers expanded pilot projects that combine natural-gas microgrids with battery storage, effectively forming “private grids within the grid.”

Grid-Interactive UPS (GI-UPS)

Operators are retrofitting existing UPS systems with bi-directional inverters. During normal operation, these batteries can provide Fast Frequency Response (FFR) to the grid, earning revenue while stabilizing voltage.

When disturbances occur, the same systems isolate and protect IT load. What was once dead capital for emergencies becomes a monetizable asset.

Load Flexibility and Demand Response

PJM now gives interconnection priority to facilities capable of reducing load or supplying power during stress events.

Leading colocation providers are developing AI-driven workload orchestration, shifting non-critical compute to other regions during peak hours.

The pattern is clear: resilience has become a profit center.

The Broader Market Signal

The July 2024 event re-anchored how investors interpret time-to-power.

Before, projects were judged by how fast they could secure a PPA or break ground. Now, investors ask three questions:

Can it energize without grid delays?

Is the supply firm under stress scenarios?

Does the asset contribute to, or destabilize, its grid region?

Projects answering “yes” to all three command premium valuations. In contrast, those dependent on a single congested substation (especially in Virginia or California) are being discounted by lenders anticipating multi-year interconnection risk.

Meanwhile, utilities are adopting cost-sharing tariffs like Georgia’s 2025 rule requiring large-load customers to co-fund grid upgrades.

In effect, the capital structure of a data-center build now includes an energy-infrastructure line item, a reality investors can no longer ignore.

Lessons for Capital and Strategy

The Virginia near-blackout distilled three enduring lessons for global infrastructure capital.

1. Power Reliability Is Now a Board-Level Variable

The assumption that “the grid will catch up” no longer holds. Investors must model reliability risk alongside debt cost and market rent. Facilities lacking on-site generation or dual feeds should be priced with a reliability discount.

2. Energy Flexibility Equals Speed-to-Revenue

Projects able to energize via hybrid interconnections, pairing load with nearby generation, reach commercial operation years earlier. FERC’s forthcoming rule allowing joint load-and-generation filings validates this strategy. Expect investors to favor developers who integrate energy planning from day one.

3. Resilience Assets Can Produce Yield

Battery banks, generators, and UPS systems can all participate in ancillary-service markets. Early movers are already earning six-figure annual revenue per MW by providing frequency control. For institutional investors, this transforms mandatory CapEx into a yield component, a structural hedge against downtime.

The Human Factor: Operators Under Pressure

Behind every engineering schematic is a human stress story. When those 60 facilities dropped off the grid, operations teams spent hours re-synchronizing generator fleets and ensuring power quality met the hyperscale thresholds of 60 Hz ± 0.036.

Several technicians later described the sound of hundreds of generators roaring to life simultaneously “like an airport taking off underground.” The anecdote underscores a subtle truth: resilience culture matters as much as hardware.

The facilities that recovered fastest were those with drilled incident-response teams and automated resynchronization software. The weakest were over-engineered but under-trained, proof that reliability is as much about process as technology.

What Comes Next

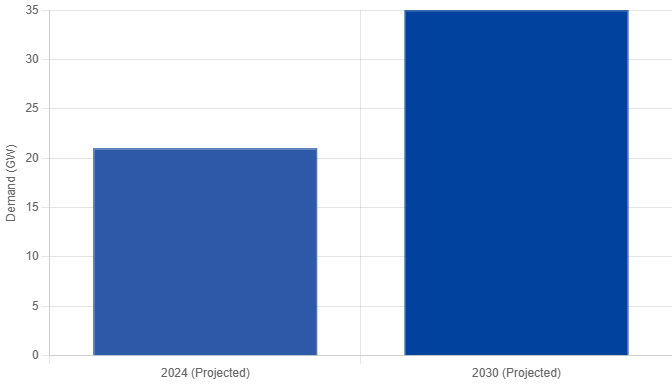

Since the event, Dominion Energy has advanced two major projects:

A $4.6 billion transmission backbone spanning Virginia, West Virginia, and Maryland to distribute future data-center load.

The Chesterfield Energy Reliability Center, a 1.47-billion-dollar natural-gas plant built specifically to support data-center reliability.

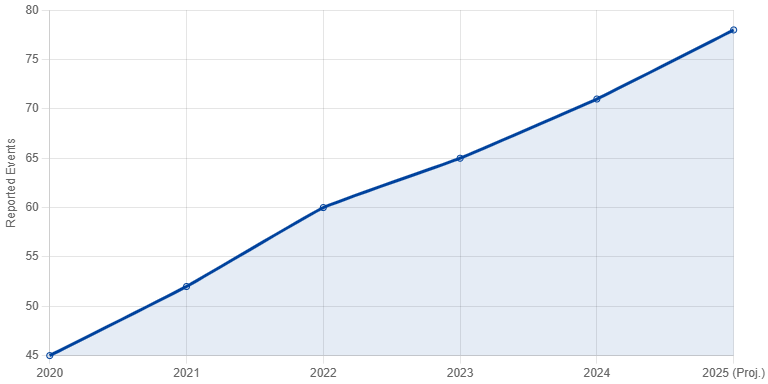

Yet even these are stopgaps. Lead times for transformers now exceed 200 weeks, and half the region’s substations are nearing end-of-life. As AI clusters scale toward 500-MW campuses, the probability of another mass trip event rises.

Nationally, regulators expect rolling constraints: ERCOT projects peak demand could jump from 85 GW to 218 GW by 2031, with nearly 78 GW from data centers alone. Without proactive redesign, the next Virginia-style disturbance could trigger not a near-miss, but a multi-state blackout.

The Investor’s Bottom Line

The July 2024 incident was a $150-billion-market-signal disguised as a flicker of light. It proved that the digital economy’s physical foundation (electricity) has become its greatest bottleneck.

For data-center investors, the path forward is clear:

Treat power like real estate. Location and reliability define value.

Favor regions with grid-modernization roadmaps or proximity to generation assets.

Integrate energy planning into underwriting on-site generation, BESS, GI-UPS, and dual feeds are no longer optional.

Engage regulators early to shape curtailment and cost-sharing frameworks.

The Virginia near-blackout will be remembered not for what went wrong, but for what it revealed: that the next wave of AI infrastructure won’t be decided by compute capacity, it will be decided by who controls the electrons.

And in the market that powers intelligence, reliability isn’t just resilience, it’s alpha.