The Renewable PPA Squeeze Inside America’s AI Buildout

Why AI-scale demand is turning clean power from a sustainability input into a binding infrastructure constraint

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

The Event: When Clean Power Became Scarce Infrastructure

The turning point did not arrive through a single regulatory act or a high-profile project breakdown.

It emerged as markets began to price clean power not as a voluntary sustainability choice, but as constrained infrastructure whose availability, location, and timing now determine which AI-scale projects can proceed.

By late 2025, the U.S. renewable PPA market had stopped operating as a discretionary sustainability instrument and began functioning as a constrained infrastructure allocation mechanism. The transition was not driven by a single regulatory decision or project failure, but by a convergence of market signals that made scarcity visible across multiple fronts.

PPA clearing prices for financeable renewable projects rose materially, capacity markets delivered unusually high outcomes, and political attention intensified around who ultimately bears the cost of grid expansion. Taken together, these signals indicated that clean power was no longer clearing on voluntary demand, but on deliverability and system limits.

The underlying driver was the acceleration of AI-driven data center development outpacing the ability of the U.S. power system to respond. Data center construction timelines began running ahead of interconnection queues, transmission approvals, and equipment manufacturing, turning renewable PPAs from an optional procurement tool into a binding constraint on development.

The Core Cause: Concentrated Demand Meets Deliverability Constraints

The first structural driver is buyer concentration. In 2025, tech companies made up roughly 75% of U.S. renewable PPA purchases. Developers prioritize counterparties that can sign large, repeatable contracts quickly, meaning projects increasingly clear the market only when paired with hyperscale or AI-linked demand.

The second driver is data centers’ pull on clean procurement. BloombergNEF estimates they accounted for 43% of global clean PPAs in 2024. A large share of marginal renewable capacity is now effectively pre-allocated to AI-adjacent load, shaping both who signs contracts and where projects are built.

The third driver is deliverability. Unlike traditional virtual PPAs, AI-scale data centers need energy delivered to specific, often congested regions and during tight system hours. Pricing for locational congestion, curtailment, and basis risk sharply limits the universe of acceptable projects.

As a result, the market for “any renewable MWh” is giving way to “credible, locationally aligned supply.” Buyer concentration, AI-linked demand, and deliverability requirements are now reshaping the economics and geography of renewable procurement.

This shift toward deliverable, location-specific power is already reshaping capital flows across U.S. markets, as outlined in North America: $600B Redefines the Scale of AI & Data Center Infrastructure, where grid positioning not headline demand emerges as the decisive variable.

The Financial Impact: Repricing Across Energy and Capacity Markets

The PPA squeeze is evident in pricing. LevelTen’s Q3 2025 index shows solar at $59.77/MWh and wind at $74.69/MWh, reflecting not just inflation or rates but a premium for projects that can secure interconnection, manage congestion, and meet data center schedules.

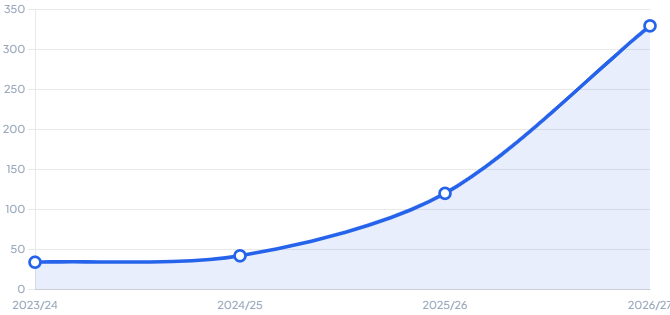

More consequential, however, is the spillover into reliability markets. PJM’s capacity auction for the 2026/2027 delivery year cleared at $329.17 per MW-day, one of the highest outcomes in the market’s history. Utility Dive reported that across PJM’s last three base auctions, approximately $21.3 billion of cleared capacity costs around 45 percent of the total were attributable to incremental data center load forecasts beyond existing demand.

This reflects the system monetizing uncertainty. Capacity markets are effectively charging for insurance against rapid, concentrated load growth, turning what was once a predictable planning mechanism into a risk premium for emerging AI-scale demand.

The political salience of these costs is also rising. Bloomberg reported wholesale electricity prices in regions near large data center clusters running as much as 267 percent higher than five years earlier. Regardless of precise attribution in any single market, such figures fuel a narrative that households are subsidizing global AI infrastructure, making regulatory responses increasingly likely.

This repricing dynamic is not uniform across markets and is increasingly creating exploitable dislocations for sophisticated capital, as examined in How Top Investors Arbitrage Renewable Energy Disparity (Instead of Being Crushed by It).

The Policy Response: Cost Causation Moves to the Foreground

Regulators across the U.S. are increasingly focused on tying cost responsibility to large-load growth. In PJM, debates over interconnection and capacity pricing now hinge on who should underwrite reliability as data centers drive marginal demand.

Virginia offers a concrete example. The State Corporation Commission approved the creation of a GS-5 customer class for users with demand of 25 MW or greater, effective January 1, 2027. This signals that AI-scale customers will be treated distinctly in rate design and oversight, with the implicit goal of reducing cross-subsidization from residential and small commercial customers.

Texas has taken a different but philosophically aligned path. Senate Bill 6 tightened requirements around large-load interconnection planning and grid reliability, reflecting a policy stance that new mega-loads should not impose stranded costs or reliability risks on the broader system.

Across jurisdictions, the trend is clear: large data center loads are no longer treated as neutral additions to demand. Instead, they are recognized as system-shaping forces that must carry explicit obligations for cost and reliability.

The Investor Response: From Procurement to Power Control

These dynamics are driving a strategic shift. Developers and investors who treat renewable PPAs as a procurement exercise face rising price, schedule, and regulatory risks, while leading platforms treat power as a controlled, strategic input.

One visible manifestation of this shift is upstream integration. Blackstone’s announced plan to invest more than $25 billion in digital and energy infrastructure in Pennsylvania reflects a co-location logic that ties data centers directly to generation assets. The strategic rationale is not ideological decarbonization but risk compression: controlling generation and interconnection reduces dependence on congested queues and volatile contract markets.

Another response is portfolio construction rather than single-contract procurement. Investors are increasingly underwriting combinations of renewables, storage, and firming arrangements to manage hourly mismatch and deliverability risk. This approach internalizes costs that were previously externalized to the grid, but it produces a power profile that aligns more closely with AI operational requirements and emerging regulatory expectations.

Geographic selectivity is also evolving. Markets are now evaluated not only on tax incentives and fiber availability, but on the probability-weighted timeline to energized capacity and the likelihood of future cost-allocation tightening. Jurisdictions with faster interconnection processes or clearer large-load frameworks attract disproportionate capital, even if headline power prices appear higher.

Finally, sophisticated investors are pricing social license directly into their models. As public scrutiny over rate impacts intensifies, higher minimum demand charges, collateral requirements, and long-term commitments are becoming normalized for large loads. Platforms that assume these costs upfront are structurally advantaged over those that treat them as negotiable anomalies.

The Investor Lesson: Power, Not Capital, Is the Binding Constraint

The competition for renewable PPAs is not a transient artifact of the energy transition. It is a structural outcome of AI-scale demand colliding with a grid that expands incrementally.

In this environment, capital availability is no longer the primary differentiator. The decisive advantage lies in control over deliverable power that can be secured on credible timelines and integrated into constrained grids.

Investors most likely to outperform are those who internalize this shift and reorganize development strategies around power-first logic. Renewable PPAs remain relevant, but only as one element within a broader infrastructure approach that integrates generation ownership or access, grid positioning, and regulatory alignment.

In the AI era, clean power is no longer abundant enough to function as a peripheral input. It has become the platform on which scalable digital infrastructure is built.

Great article and insights! My one quibble is with the characterization of capacity markets as having previously been a reliable planning tool. These constructs were never functional; the scale of data center growth just exposed their inadequacy in ways no one could ignore.

The PPA squeeze feels real, it’s less a sudden shock and more the result of demand finally running into physical limits. Data centre growth has simply moved faster than grid upgrades, new generation, and planning approvals can keep up with. What’s changing is the assumption that clean power can always be locked in early, cheaply, and at scale. In reality, feels like PPAs are becoming more conditional, more location-dependent, and more exposed to grid constraints and timing gaps. From a delivery point of view, this pulls projects back to basics where the power actually is, how fast it can arrive, and what interim steps are needed along the way. It’s more about reconciling them with how infrastructure really gets built.