The Renewable PPA Bottleneck in Asia’s Tier 1 Data Centers

As AI-driven demand accelerates from 12.2 GW to 26.1 GW of capacity, clean power contracts not capital are becoming the gating asset in Singapore, Tokyo, Seoul, Sydney, and Mumbai.

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

Event: Clean Power Became a Scarce Asset

The inflection point is numerical. Asia-Pacific data center capacity is projected to grow from 12.2 GW in 2024 to 26.1 GW by 2028, a ~21% CAGR.

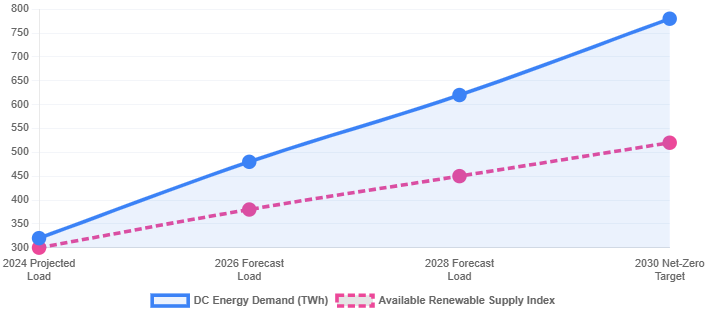

Electricity consumption is expected to rise from roughly 320 TWh in 2024 to 780 TWh by 2030, driven by AI workloads, higher rack densities, and hyperscaler expansion across major metros.

Renewable generation is expanding, but at an estimated ~13% annually insufficient relative to data center load growth. The gap is structural.

In Tier 1 markets, constraints are geographic and regulatory. Singapore has limited land and domestic renewables. Tokyo operates on a mature, tightly balanced grid. Seoul remains utility dominated. Sydney faces transmission bottlenecks. These are the same markets where hyperscale demand concentrates.

Renewable PPAs have shifted from ESG preference to competitive necessity.

Cause: Structural Demand–Supply Mismatch and Market Design

At its core, renewable procurement in Asia’s Tier 1 markets is constrained by a structural misalignment between accelerating digital load and the design of regional power systems.

The first cause is arithmetic. AI infrastructure is expanding faster than clean generation in constrained markets. Digital load scales nonlinearly; higher compute density means each additional megawatt drives disproportionate electricity demand.

The second is market design. Many Asian grids remain partially centralized, limiting direct corporate access. Even where PPAs are permitted, wheeling rules, settlement complexity, and congestion restrict practical execution. Renewable capacity does not automatically translate into accessible supply.

The third is deliverability. A bankable renewable contract must satisfy regulators, customers, and financiers at once. In congested Tier 1 grids, only a narrow set of projects meets compliance, decarbonization, and financing requirements. That pool is limited.

The fourth is buyer concentration. A small group of hyperscalers dominates procurement. In thinner markets, their scale absorbs available supply, clearing through price and credit strength rather than rapid volume expansion.

This is not a cyclical tightening. It is structural.

Impact: Opex Pressure, Capex Pull-Forward, and Time Risk

The financial consequences are direct. Global PPA prices have rebounded, with solar around $56.58/MWh and wind near $65.63/MWh as of Q3 2024. In constrained Asian hubs, competitive tension and supply-chain pressures have pushed energy costs higher, contributing to estimated 10–15% opex increases for power-intensive facilities.

At the project level, higher renewable pricing compounds construction inflation. Average data center build costs have risen from roughly $7.7 million per MW in 2020 to about $10.7 million per MW in 2025. Energy volatility now sits on top of an already capital-intensive model.

Time is the second-order risk. In markets such as Johor, power bottlenecks have delayed new capacity by 24–36 months. For developers with hyperscale pre-leases, delays raise interest during construction, compress lease-up windows, and increase tenant migration risk. Time-to-power has become a core underwriting variable.

The final impact is strategic divergence: operators with early renewable supply gain financing and tenant advantages, while others face higher costs and fewer options. Recent platform deals above 20x forward earnings show capital favoring energy certainty over speculative growth.

Policy responses across Asia reinforce this dynamic.

Singapore has adopted selective allocation mechanisms tied to strict efficiency thresholds, including PUE caps around 1.25 and defined green energy pathways.

Thailand has introduced frameworks for direct renewable PPAs with pilot allocations up to 2,000 MW. Malaysia’s Corporate Green Power Programme supports virtual PPAs while tightening sustainability screening in Johor. Japan has advanced large-scale transition financing, including ¥120 trillion in GX funding, and encourages load redistribution from congested metros.

South Korea’s K-RE100 framework has expanded compliance pathways through green premiums, RECs, and PPA options. Policy is simultaneously opening channels and narrowing approvals.

Investor Response: Power as a Core Capability

Top investors are not reacting defensively. They are redesigning strategy around energy origination.

Leading operators are securing long-tenor contracts that enable new renewable generation. For example, a 21-year solar PPA in Malaysia delivers roughly 1 TWh, creating bankable supply that expands capacity rather than competing with legacy projects.

They are also diversifying procurement formats. Virtual PPAs, green tariffs, utility-backed schemes, and certificate-based structures are combined to navigate jurisdictional complexity. Across Asia, portfolio capability provides a clear advantage over reliance on a single channel.

Co-investment and vertical integration further align supply with demand. Platforms are taking minority stakes in renewable projects or forming structured partnerships, reducing dependence on third-party contracts and smoothing the match between generation and data center load curves.

Investments behind the meter including battery storage, hybrid microgrids, and dedicated substations turn grid volatility into engineered solutions. Though capital intensive, these measures improve schedule reliability and strengthen resilience narratives, while efficiency gains (PUE <1.2) reduce overall renewable requirements.

Finally, operators are leveraging geography and exploring firm clean power options. Scale deployments migrate to adjacent markets with greater renewable potential, and emerging solutions such as nuclear or small modular reactors are considered for long-term baseload demand.

Energy procurement is thus shifting from operational cost management to strategic asset design.

Investor Lesson: Energy Certainty Is the New Moat

Tier 1 Asia is not power-constrained in aggregate it is contract- and deliverability-constrained. Bottlenecks arise at the intersection of regulation, grid physics, and credit quality.

The central lesson: renewable PPAs in leading Asian markets are infrastructure assets, shaping timelines, tenant mix, costs, and valuations. Capital alone isn’t enough; platforms that industrialize energy origination via contracts, policy navigation, co-investment, efficiency, and portfolio design gain a lasting advantage.

The next phase of Asia’s data center expansion will be defined not by funding, but by who can secure credible, deliverable clean megawatt-hours at scale. In Tier 1 markets, renewable PPAs have become the new interconnection queue, far beyond a mere sustainability narrative.