How Top Investors Arbitrage Renewable Energy Disparity (Instead of Being Crushed by It)

As AI Demand Surges, Grid Constraints Threaten Both Costs and Capacity.

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

AI Hits the Grid Wall

I believe the U.S. grid will be the ultimate cap on AI growth. Not capital, land, or GPUs.

AI workloads aren’t just raising power demand, they’re exposing the fact that the U.S. grid is geographically misaligned with where AI is actually being built.

The warning didn’t come from a climate report or earnings call it came from a capacity auction.

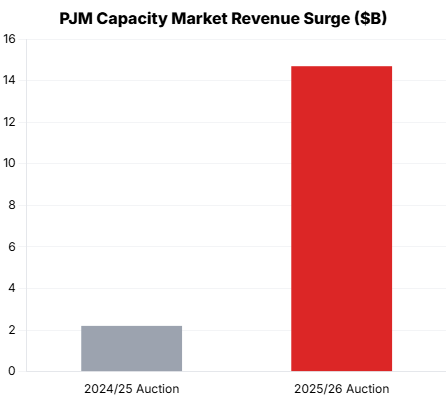

For the 2025/26 delivery year, PJM cleared roughly $14.7 billion of capacity payments, up from $2.2 billion in the prior auction, as prices in key zones surged nearly tenfold.

Analysts immediately pointed to data center load: hyperscale demand in Northern Virginia and surrounding states had outpaced the region’s ability to supply firm power.

On paper, PJM had gigawatts of capacity. In practice, the grid could not deliver enough power to the pockets where data centers clustered, nor replace retiring fossil plants with clean generation fast enough.

The auction repriced scarcity and reframed the investor question: the risk is no longer “Will AI demand show up?” but “Can the grid deliver clean, firm megawatts to the right nodes without exploding costs or political backlash?”

Cause: A Geography Problem Masquerading as a Market Problem

The structural truth is simple: AI demand is forming where renewable generation is not, and the grid doesn’t have the connective tissue to reconcile the two.

The issue is simple.

The best renewable resources and the largest AI clusters occupy different geographies.

High-quality wind sits across the Great Plains and upper Midwest; competitive utility-scale solar across the desert Southwest and Sun Belt; hydro remains in the Pacific Northwest.

Meanwhile, roughly 4% of U.S. electricity in 2023 came from data centers, projected to rise to 6.7–12% by 2030 under aggressive AI growth. Around 80% of this demand is concentrated in 15 states, with Northern Virginia alone consuming a quarter of the state’s power for data centers in 2023.

The grid itself compounds the problem: aging lines, congested interfaces, and interconnection queues stuffed with over a terawatt of proposed generation and storage. Transmission projects linking wind in SPP or MISO to East Coast load pockets routinely take 10–15 years far longer than the 3–5 year hyperscale build cycle.

The result: regions rich in renewables but thin on load see curtailment and stranded projects; regions dense with data centers but limited on local renewables face soaring capacity prices and congestion. PJM’s auction made this mismatch undeniably public.

My lens is simple: Data centers and investors don’t fail because demand disappears, they fail because when it comes to power, they anchor on generation charts instead of transmission reality.

Impact: Rising Bills, Rising Capex, Rising Political Temperature

Financially, the consequences appear in three areas: capacity markets, retail bills, and required capex.

Capacity: PJM’s auction effectively transferred billions from consumers to capacity owners. Data center demand accounted for an estimated $7.3–9.3 billion of incremental costs roughly half of total capacity revenues.

Retail bills: These costs show up in consumers’ mailboxes. In Maryland, electricity rates spiked 20% in months linked to Northern Virginia’s data center boom.

Capex: Meeting projected demand could require $19 billion in incremental transmission investment in the U.S. by 2030, plus tens of billions more for generation, substation, and distribution upgrades for AI campuses.

Political consequences are immediate. Residential voters care about bills, not hyperscalers, turning cost causation into a campaign issue. The “AI dividend” narrative quickly morphs into an “AI tax” narrative.

Response: Regulators Rewrite the Rules While Capital Rewrites the Playbook

Policy is shifting on three fronts: interconnection, transmission planning, and cost allocation.

Federal: FERC’s Order 2023 enforces clustered, deadline-bound interconnection studies; Order 1920 requires long-term transmission planning accounting for clean energy targets and large expected loads. DOE encourages integrated plans where large loads, like 100 MW campuses, pay the full cost of network upgrades.

RTO and utility: PJM re-anchors load forecasting around data centers and tightens interconnection criteria. Dominion and other utilities are introducing new rate classes and contract structures for ≥25 MW customers to align payments with incremental investments.

State: Commissions and consumer advocates are scrutinizing new proposals and demanding traceable local low-carbon supply rather than distant RECs.

Sophisticated capital, meanwhile, is building durable advantages.

If an investor can’t map how scalable, low-carbon MW will reach a specific node (under realistic timelines) they don’t understand the deal.

Strategy: How Top Investors Arbitrage the Disparity Instead of Being Crushed by It