Why the UAE-NVIDIA Alliance Redefines Global AI Infrastructure

The UAE is executing a bold AI infrastructure strategy with NVIDIA transforming energy, compute, and sovereignty into national competitive advantage.

Welcome to Global Data Center Hub. Join 1400+ investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

Executive Summary

Khazna and NVIDIA will build next-generation AI data centers certified for the Blackwell GPU architecture, supporting 250MW-scale clusters

The majority of these clusters will anchor the planned 5GW UAE-US AI Campus in Abu Dhabi

This effort marks a shift from cloud-region expansions to sovereign-aligned AI infrastructure

Blackwell-optimized blueprints standardize design, accelerate deployment, and lock in compatibility with future trillion-parameter models

The deal reflects a broader regional strategy: not just to host AI, but to control its infrastructure, energy inputs, and regulatory posture

What Happened

Khazna, one of the Middle East’s largest digital infrastructure firms, has entered into a deep technical collaboration with NVIDIA to develop Blackwell-ready data centers across multiple emerging markets.

These data centers will be purpose-built for large-scale AI workloads and will serve as the foundation for the UAE’s bid to become a global AI superhub.

The facilities will use standard architectural templates validated by NVIDIA, enabling rapid scaling while ensuring compatibility with high-density GPU deployments.

Each campus is designed to support up to 50 megawatts per hall and 250 megawatts per cluster. These clusters will house the infrastructure required to train and serve sovereign models that match the scale of GPT-4 and beyond.

While much of this capacity will be located in the UAE, anchoring the massive 5GW UAE-US AI campus, the plan includes new sites in Türkiye, Egypt, Saudi Arabia, and Kenya, with future expansions into Europe.

This initiative is not a standalone announcement.

It aligns with the UAE’s broader industrial strategy, which includes multi-billion-dollar investments in clean energy, sovereign AI firms like G42 and MGX, and a deliberate pivot away from Chinese technology infrastructure to gain unfettered access to U.S. silicon.

Why It Matters

1. Power Is Now the First Constraint

In past infrastructure cycles, data centers followed fiber and land. The new constraint is megawatts.

Khazna is solving this upstream by anchoring sites around clean energy commitments, including nuclear, solar, and gas, rather than retrofitting AI into conventional facilities.

The sites selected for Blackwell-ready builds are being planned in direct coordination with energy strategy. Sovereign AI capacity is only as good as its power envelope.

2. Standardization Accelerates Sovereign AI

By adopting NVIDIA’s reference blueprints, Khazna gains deployment velocity and ecosystem lock-in. But this isn’t just about speed. It’s about nation-level alignment.

These facilities are being designed to host sovereign language models, sensitive government AI applications, and inference infrastructure that cannot be outsourced.

For countries that want to run large models on their own soil, these are not optional features. They are minimum requirements.

3. A Middle East Infrastructure Race Has Begun

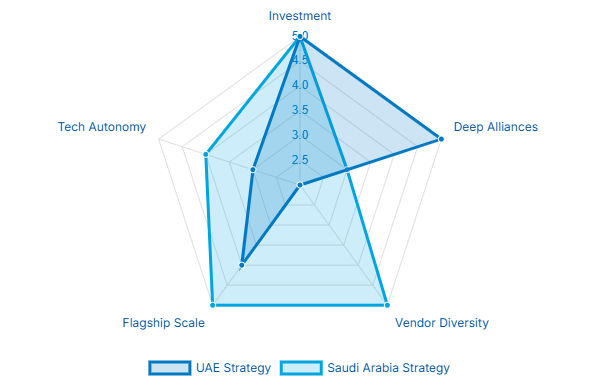

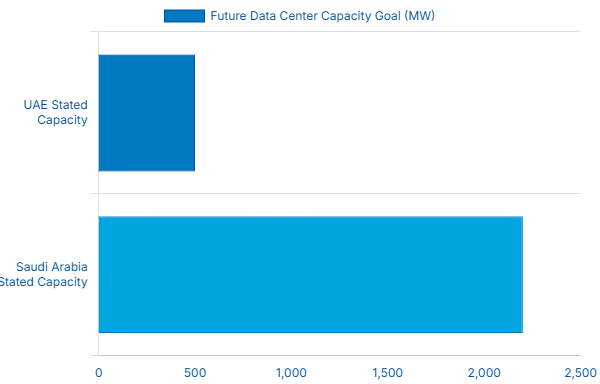

The UAE and Saudi Arabia are now engaged in a capital-intensive contest to dominate the compute landscape of the Global South.

The UAE has opted for deep partnerships with U.S. hyperscalers and vendors. Saudi Arabia is pursuing a diversified strategy, engaging a broader set of hardware and software providers.

This rivalry is driving capacity expansions across the region that far exceed traditional cloud builds. AI is no longer a subcomponent of IT strategy. It is now the primary justification for billion-dollar energy and infrastructure investments.

4. The New AI Stack Is Vertical

This partnership is not a chip deal. It’s a vertically integrated supply chain play.

NVIDIA provides the silicon, the design patterns, the software frameworks, and the network fabrics. Khazna provides the land, the energy, and the sovereign context.

This structure allows both parties to avoid the delays, fragmentation, and cost overruns that often plague hyperscale deployments in emerging markets. It also creates an execution loop where each new site improves the deployment time of the next.

5. From National Strategy to Export Model

Once these clusters are operational, the UAE will possess a rare export asset:

Excess compute.

With global demand for AI compute outstripping supply, countries that can offer sovereign-grade, GPU-rich infrastructure will be able to license access, attract foreign model training, and generate recurring revenues not from oil, but from inference.

This may represent one of the most durable economic pivots in the region’s history.

What This Means

For Investors

Sovereign AI infrastructure is an emergent asset class. The play is no longer just GPUs. It’s bundled compute, energy, and regulation. Backers like Silver Lake and MGX are underwriting long-term returns on the bet that the next cloud is sovereign and the next hyperscale region is Abu Dhabi.

For Operators

The market is moving past generic colocation. If your facilities aren’t certified for high-density GPU clusters with liquid cooling, you won’t meet demand from sovereigns or hyperscalers. Operators in Africa, Southeast Asia, and Latin America should take note: power-first, AI-native design is the new standard.

For Policymakers

AI infrastructure is no longer a commercial project. It’s a geopolitical instrument. Governments that streamline land acquisition, energy permitting, and data sovereignty frameworks will be in position to attract long-term digital tenants. Those that don’t will be left out of the emerging compute map.

The Bottom Line

This isn’t a story about Khazna or NVIDIA.

It’s about a new playbook.

In this next cycle, compute is a national asset. Energy is the gatekeeper. And whoever controls infrastructure controls the slope of innovation.

The UAE has made its bet.

The rest of the world is on the clock.