The Hidden Risk Inside U.S. Fiber Networks

Why outages, AI uptime demands, and corridor risk are forcing investors to reprice legacy fiber

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

Event: When Fiber Stopped Behaving Like Passive Infrastructure

Positions the moment legacy fiber transitions from “stable utility” to operational risk surfaced by outages, AI reliance, and SLA sensitivity.

In 2024, a utilities-led survey put numbers behind what many investment committees still treated as anecdote: excavation caused 40% of fiber failures, human error 22%, rodent damage 20%, right-of-way clearing 14%, and other factors 4%.

For investors treating U.S. fiber as “low-touch infrastructure,” these figures are sobering. Failures rarely unfold gradually; they strike suddenly, often externally, turning ordinary routes into emergency projects. Outages can cascade across corridors, affecting multiple customers and requiring multi-crew restorations.

Two capital cycles now amplify these risks. Federal subsidies ($42.45B) are accelerating broadband expansion through state-administered programs, while AI-driven data center growth raises the economic value of route diversity, restoration performance, and SLA reliability.

Legacy fiber sits at the intersection of both: it is indispensable for digital infrastructure but increasingly exposed to operational surprises that traditional underwriting may overlook.

This shift from assumed stability to operational exposure reflects the hidden cost structure inside many legacy networks, explored in The Hidden Cost Inside Every Fiber Project.

Core Cause: Physical Entropy Meets Corridor Concentration

Frames aging fiber as a compound problem of excavation risk, shared rights-of-way, documentation decay, and historical design assumptions.

“Aging legacy fiber” is a misleading label because it evokes the wrong mental model: glass quietly decaying until it fails. In reality, the core problem is operational entropy across three interdependent layers: physical plant, network design, and information quality.

Physical plant: Many legacy routes were built under standards suited to lower traffic and simpler services. Over time, they accumulate splices, field fixes, and undocumented changes. Each splice is an operational dependency, not just optical loss. High splice density raises repair complexity and cost, particularly during emergency restorations where speed and access are critical.

Network design: Historical routing decisions create modern fragilities. Paths that appear “diverse” on paper often share physical corridors, exposing multiple customers to the same excavation, flood, or rail work. A single event can impact several enterprise clients simultaneously, turning assumed redundancy into concentrated risk.

Information quality: Platforms built through M&A or incremental expansion often inherit inconsistent GIS, incomplete as-builts, and undocumented field modifications. Poor records extend repair times, raise permitting and make-ready costs, and limit proactive replacement. The information layer amplifies physical and design weaknesses, making minor incidents disproportionately expensive.

In short, legacy fiber ages like a city not only by material wear but through layers of operational complexity stacked over decades. Each patch, splice, and undocumented adjustment compounds the difficulty of managing the network under stress.

This form of corridor concentration is increasingly shaping where resilient compute infrastructure can scale, as detailed in Fiber Scarcity Is Redrawing America’s Data Center Map.

Financial Impact: From Predictable Cash Flow to Mandatory Capex

Signals the shift from yield underwriting to execution underwriting, with repair costs, replacement economics, and valuation discounts.

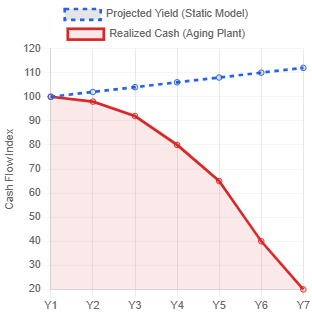

The financial implications of aging fiber are deceptively subtle. The impact rarely arrives as a single, dramatic headline. Instead, cash flow steadily converts into unplanned remediation.

At the incident level, repairs range from minor fixes to multi-crew restorations, with costs spanning hundreds to tens of thousands of dollars depending on access and complexity. Across a portfolio, this translates into elevated opex, unstable service availability, and measurable churn and SLA penalty risk for enterprise-heavy books.

At the system level, the risk is replacement capex that is unbooked in underwriting models. Full-route refreshes can cost $60,000–$80,000 per mile in some contexts. This mismatch means a platform can be “right” about demand and revenue yet “wrong” on cash conversion if the plant requires more reconstruction than anticipated.

Treating modernization as discretionary is a mistake. Rising outage frequency or increasing customer demand for route diversity transforms emergency rebuilds into mandatory investment. Sponsors ignoring these dynamics risk both contract retention and long-term operational viability.

There is also a hidden valuation effect. Legacy-heavy networks often trade at a discount not due to weak cash flows but due to execution risk: unknown remediation, inconsistent records, and uncertainty over when the next corridor event will force a rebuild. Buyers implicitly price these risks into their offers, lowering valuation multiples compared to newer, fully documented fiber platforms.

Policy Response: Modernization Incentives Without a Bailout

Clarifies how BEAD, RDOF, and state programs intersect with legacy assets helpful but conditional, not a rescue.

Public policy is not designed to “refresh America’s aging fiber.” Its focus is expanding access and modernizing broadband. Programs like BEAD and RDOF offer grants, but they are not recapitalization tools for legacy networks, providing balance sheet relief only where aging assets overlap with rural or last-mile modernization needs.

State-level initiatives, such as California’s SB 156, provide additional funding for middle-mile capacity and broadband acceleration in complex corridors. These programs illustrate that the economic benefit of subsidies depends on alignment with infrastructure modernization needs rather than blanket support for legacy networks.

The takeaway: policy does not remove aging risk; it only shifts where modernization pencils. Ignoring subsidies leaves value untapped, while relying on them creates political and timing risk. Effective investors integrate policy into capital planning but underwrite modernization to stand on its own.

Investor Response: From Route Miles to Network Resilience

Shows how top platforms change diligence, capex sequencing, commercial strategy, and subsidy integration.

1. Industrial diligence: Leading investors go beyond route miles. They evaluate route condition, splice density, failure history, corridor exposure, and record quality. Claimed diversity is reconciled with physical geography because corridor correlation is the simplest source of hidden fragility.

2. Staged modernization capex: Rather than waiting for the next catastrophic cut, sponsors plan proactive replacements where failure probability intersects restoration impact flood-prone sections, heavily spliced corridors, and single-corridor dependencies affecting high-value enterprise routes. The goal is to convert emergency capex into scheduled capex, enhancing both operational predictability and customer confidence.

3. Commercial monetization: Legacy fiber is often sold as a commodity. Top operators shift the narrative to resilience: restoration performance, true physical diversity, and predictable delivery timelines become premium products for clients with high downtime costs. This approach transforms operational risk into a monetizable asset.

4. Policy integration: Platforms qualify sections of their build for BEAD, RDOF, or state grants, effectively blending private and public economics. The winning behavior is selective: subsidies are leveraged where they naturally fit, without creating reliance on external funding for core modernization plans.

By combining diligence, staged capex, commercial positioning, and selective subsidy use, investors convert a legacy liability into a structured, monetizable advantage.

Investor Lesson: Fiber Is No Longer “Set and Forget” Infrastructure

Ends with a binding constraint insight: operational control and modernization discipline, not demand, define outcomes.

U.S. fiber behaves like true infrastructure only when managed with condition assessment, planned replacement, corridor risk oversight, and disciplined capex. Aging legacy fiber is now a core underwriting test models ignoring sustainability capex, physical diversity, or excavation risk misstate cash flow and SLA reliability.

Fiber failures are rarely tied to traffic growth; operational fragility drives most risk. Successful investors treat modernization and resilience as the asset, with route miles secondary. Platforms that adopt this approach protect cash flow, maintain SLA performance, and can monetize the operational risks of legacy networks.

In short, legacy fiber demands operational rigor, proactive modernization, and selective subsidy integration. Only by controlling the physical, design, and information layers rather than relying on passive operation can investors convert aging infrastructure into predictable, profitable assets.