The Hidden Cost Inside Every Fiber Project

Sustainability and permitting have shifted from background noise to the main brake on digital infrastructure expansion.

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

The New Bottleneck: Sustainability as a Capital Risk

Fiber-to-data center projects once seen as the connective tissue of digital transformation now sit at the intersection of two opposing forces: exponential digital demand and tightening environmental governance.

What began as a regulatory hurdle has evolved into a financial drag capable of reshaping returns, valuations, and capital allocation across the sector.

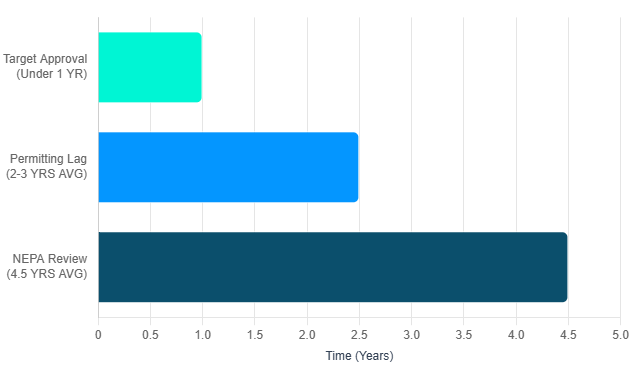

The convergence of extended permitting timelines (now averaging two to three years in major markets), resource scarcity, and aggressive community opposition has transformed sustainability from a “reputation topic” into a binding investment constraint.

The problem is systemic: global digital infrastructure investment needs are expected to exceed $19 trillion by 2040, yet much of that capital is now gated by environmental compliance, resource access, and ESG disclosure capacity.

Root Causes: Regulation, Community, and Resource Exposure

Three structural forces explain why sustainability and permitting pressures are escalating.

1. Fragmented and protracted regulation

Fiber deployments crossing federal, state, or tribal lands are trapped in multi-jurisdictional approval systems. Environmental Impact Statements under NEPA still take an average of 4.5 years, with 61% exceeding statutory deadlines despite reform attempts. Each agency Army Corps, EPA, BLM maintains distinct review procedures, creating overlapping friction.

Even when projects qualify for “categorical exclusions,” local authorities can stall progress through environmental justice reviews or zoning appeals. For fiber investors, this bureaucratic asymmetry translates directly into carrying cost escalation and delayed revenue generation.

2. Rising community resistance

Public opposition has become a measurable investment risk. Across the U.S., 142 organized advocacy groups are contesting or delaying data center-linked infrastructure worth $64 billion. Their objections noise, diesel emissions, water drawdowns have forced outright cancellations of projects in Michigan, Virginia, and Oregon.

In Loudoun County, the U.S.’s densest data center hub, citizen activism has triggered election reversals and zoning moratoriums. The political cost of water and power intensity has become the new barrier to entry.

3. Resource intensity and ESG scrutiny

AI workloads amplify physical resource stress. Data centers already account for up to 60% of projected U.S. load growth by 2030 and require millions of gallons of water per site annually.

Google’s reported 51% emissions increase since 2019, despite net-zero pledges, highlights the paradox: even efficient operators are losing ground as compute demand scales faster than renewables.

For investors, ESG shortfalls now carry valuation penalties 75% of data center providers report losing business or financing due to weak sustainability programs.

The Financial Translation: Delays, Inflation, and Stranded Assets

Permitting delays have moved from operational inconvenience to capital erosion.

1. Extended timelines inflate CapEx

Approval cycles that once took under a year now span multiple fiscal periods. In Virginia, site fees are rising 5% annually, while construction and holding costs accumulate with each quarter of delay. For fiber, rights-of-way and environmental assessments can consume 15–20% of total deployment budgets.

Traditional trenching compounds the issue. Digging 12-inch-wide trenches across urban corridors triggers road closures, restoration mandates, and costly inspections. By contrast, microtrenching narrow 1-inch cuts reduces excavation volume by up to 80% and costs by 60%, while minimizing local disruption. Here, sustainability is not moral virtue it’s financial optimization.

2. Litigation risk compounds exposure

Communities now weaponize environmental statutes. Developers in Saline Township (Michigan) and Warrenton (Virginia) have faced legal injunctions, political backlash, and outright bans following zoning disputes. Each challenge freezes capital, drains legal budgets, and undermines IRR assumptions.

3. Stranded asset risk emerges from technological churn

Investors face a second-order sustainability risk: obsolescence. GPU cycles now move on 18-month upgrade timelines, meaning the hardware driving today’s hyperscale data centers could be outdated within five years.

This compresses the economic life of assets financed on 20-year models and exposes long-duration investors pension funds, insurers to depreciation mismatches. “Green obsolescence” joins carbon exposure as a new category of stranded risk.

Policy Response: Two Diverging Paths

The policy landscape is bifurcating between acceleration and accountability.

United States: Acceleration for national security

The July 2025 Executive Order, “Accelerating Federal Permitting of Data Center Infrastructure,” designates projects above $500 million or 100 MW as “qualifying,” enabling fast-track approvals through categorical exclusions under NEPA, the Clean Air Act, and the Clean Water Act.

This shift shortens timelines by up to 18 months, especially when combined with the Federal Permitting Improvement Steering Council’s FAST-41 coordination model. But the tradeoff is reputational: by waiving deep environmental review, the political burden of proof shifts to the developer.

The NTIA’s 36 new categorical exclusions for broadband aim to reduce fiber review time from years to weeks. Yet states retain veto authority illustrating that federal speed does not neutralize local resistance.

European Union: Accountability through transparency

Europe has taken the opposite tack. The Corporate Sustainability Reporting Directive (CSRD) and Corporate Sustainability Due Diligence Directive (CSDDD) make sustainability disclosure and transition planning legally binding. Power Usage Effectiveness (PUE) targets are ratcheting down to 1.2 for new builds by 2030, and carbon intensity metrics must be reported under double materiality principles.

The outcome is predictable: U.S. policy favors velocity and scale, while Europe demands proof and permanence. Global investors must navigate both through portfolio staging deploying speed capital in the U.S., long-duration ESG capital in Europe.

Strategic Adaptation: How Leading Investors Are Responding