Europe's $114 Billion Data Center Realignment: Why the Future of AI Infrastructure in Europe Is Expanding in Every Direction

Europe’s data center future isn’t shifting, it’s expanding. From FLAP-D to Poland and Portugal, here’s how $114B is redrawing the AI infrastructure map.

Welcome to Global Data Center Hub. Join 1400+ investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

Executive Summary

The European data center market is projected to reach $114 billion by 2030, doubling from $47 billion in 2024.

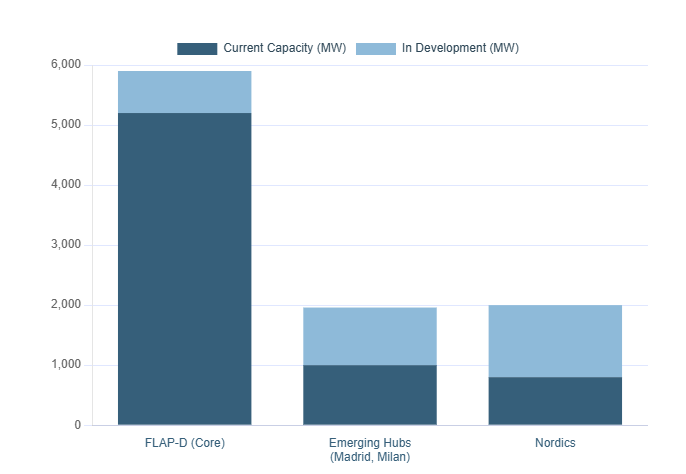

Traditional FLAP-D markets (Frankfurt, London, Amsterdam, Paris, Dublin) remain central to Europe’s infrastructure ecosystem, but are now complemented by rapid growth in the Nordics, Southern Europe, and Central and Eastern Europe.

The surge in demand is fueled by AI, 5G, and sovereign cloud strategies, which require low-latency, high-density, and sustainable infrastructure across a wider range of locations.

Power availability, permitting speed, and sustainability requirements are reshaping how and where new facilities are developed.

The winners in this new landscape will be those who can bridge maturity with innovation—leveraging proven hubs while unlocking new regions of opportunity.

What Happened

Europe’s data center market is undergoing a strategic expansion rather than a pure shift. According to EUDCA's March 2025 report, traditional FLAP-D hubs remain vital but face structural challenges, chiefly around power and land, that are redirecting some growth to alternative sites.

In 2024, Amsterdam added no new capacity due to local moratoriums. Dublin extended its development pause through 2028. Meanwhile, power availability has emerged as the top challenge across the continent, cited by 76% of operators.

In parallel, Europe’s infrastructure map is diversifying:

Microsoft is investing $4.8 billion in Northern Italy.

Brookfield is allocating €20 billion to AI infrastructure in France.

Nordic developers are scaling renewable-powered campuses with nearly $1 billion in capital.

Poland, Romania, and Bulgaria are welcoming hyperscaler pilots and regional AI workloads.

Rather than displacing legacy hubs, this new investment wave is expanding the edge of what’s possible.

Why It Matters

This market evolution is not about abandonment, it’s about addition.

Europe’s infrastructure strategy is becoming more regional, more specialized, and more responsive to both regulatory pressure and technological needs.

1. Power Constraints Are Reshaping Build Patterns

Electricity demand from European data centers is projected to rise 160% by 2030, reaching 287 TWh, more than Spain’s 2022 consumption. Grid congestion in core markets has prompted some hyperscalers to explore greenfield opportunities elsewhere.

But cities like Frankfurt and Paris are responding with upgrades: investing in substation capacity, grid balancing, and advanced energy reuse systems.

2. AI and 5G Require Infrastructure Diversity

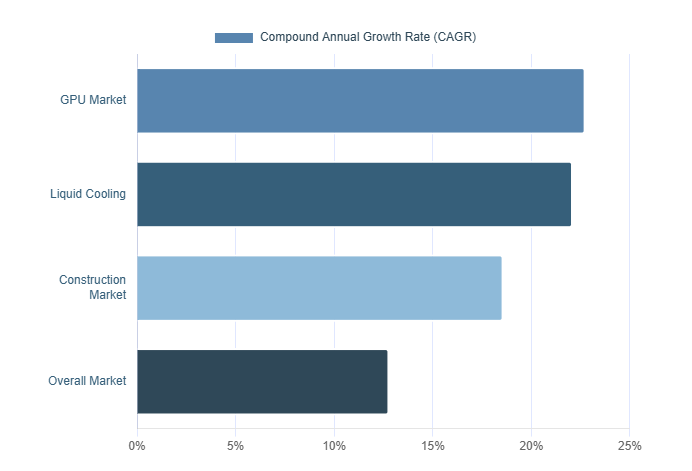

Legacy enterprise and early cloud data centers can’t meet the demands of high-density AI clusters. Facilities must now support 30–100 kW per rack, liquid cooling, and inference-ready latency.

This favors new builds in the Nordics and Southern Europe, but also retrofits in London and Amsterdam, where innovation is focused on densification and sustainability.

3. Sovereign Cloud Is Driving Multi-Market Deployment

As governments push for localized data control, hyperscalers are expanding across more geographies. France, Italy, Spain, and Poland are all advancing national cloud strategies.

This isn’t decentralization for its own sake, it’s strategic redundancy and political alignment.

4. Sustainability Mandates Are Raising the Bar

EU legislation is enforcing minimum thresholds for renewable energy and heat reuse. By 2027, all German data centers must run on 100% renewable energy. By 2028, many must reuse 20% of waste heat.

FLAP-D cities are leading with district heating pilots and liquid cooling adoption. Elsewhere, regions with natural renewable resources and cooler climates are becoming ESG-advantaged zones.

What This Means

For Investors

The European data center market is no longer concentrated, it’s compounding.

Three strategic themes to watch:

1. Maturity + Frontier Pairing

FLAP-D cities remain essential for financial, enterprise, and latency-critical workloads. But forward-looking investors are pairing core-market assets with expansion into Tier-2 cities like Kraków, Milan, Lisbon, and Bucharest.

2. ESG and Sovereign Filters Are New Capital Screens

Funds with sustainability mandates will favor regions that meet environmental thresholds by default. Likewise, sovereign cloud strategies are creating new investment zones tied to national policy.

3. Platform-Driven Returns

Returns will concentrate around those who can scale a common design and permitting playbook across both established and emerging regions, offering tenants consistency with geographic flexibility.

For Operators

Success is no longer about size. It’s about system thinking:

Can your sites support liquid cooling and meet heat reuse benchmarks?

Are you able to navigate permitting and procurement in both Paris and Poland?

Are you aligned with local cloud, fiber, and government objectives?

Operators who embrace a portfolio approach, combining stable core markets with expansionary bets, will win the next wave of long-term anchor clients.

For Policymakers

Europe’s infrastructure opportunity is continent-wide. Policymakers must ensure their regions are prepared to host AI and cloud at scale.

That means:

Expanding grid capacity

Streamlining permitting

Offering clear ESG incentives

Investing in local workforce training

Regions that do this well, whether mature or emerging, can unlock FDI, job creation, and digital sovereignty.

The Bottom Line

Europe’s $114 billion data center buildout is not a story of displacement. It’s a story of diversification.

Legacy hubs are adapting. New markets are emerging. And infrastructure is evolving to meet a radically new AI and cloud demand profile.

The edge of European digital infrastructure is no longer defined by geography alone. It’s defined by readiness:

To deliver clean power

To support dense AI workloads

To align with regulatory and sovereign mandates

If your infrastructure strategy isn’t built for both the depth of Frankfurt and the optionality of Sofia—

You’re missing the bigger move.

The center is holding. But the map is expanding.

And those who build across both will lead.