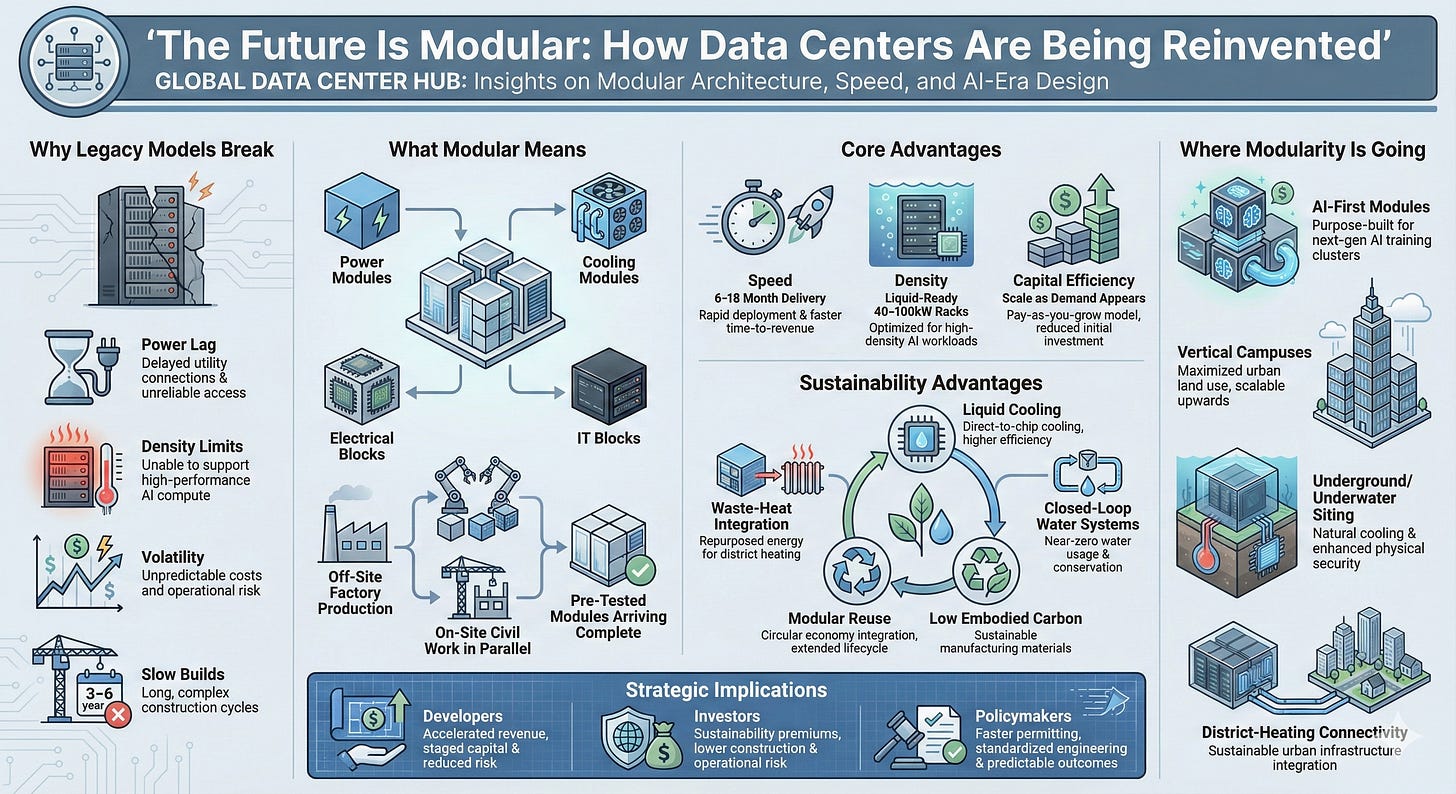

The Future Is Modular: How Data Centers Are Being Reinvented

Modular Design as the New Industrial Baseline for AI-Scale Buildouts

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

This article is the 15th article in the series: From Servers to Sovereign AI: A Free 18-Lesson Guide to Mastering the Data Center Industry

Traditional data centers were built as custom, slow, one-off projects. That worked when workloads were predictable and power needs were modest, but it collapses under AI-scale demand and the speed at which hyperscalers now need capacity.

Inconsistent power availability, labor shortages, and extreme GPU densities make legacy designs unworkable. The sector is shifting to modular, prefabricated, liquid-ready architectures because modern compute economics leave no room for inflexible or multi-year builds.

The data center is becoming an industrial product rather than a bespoke construction job, reshaping capital deployment, operating models, and long-term competitiveness across the AI cycle.

The Breakdown of Traditional Design

Power exposed the first break. Hyperscalers wanted 50–200MW energized blocks delivered at once, while conventional builds still took three to six years from land to load. Modular development cuts that to six to eighteen months, and the time gap now drives adoption.

Density applied the next pressure. Air-cooled plants cannot handle 40–100kW GPU racks at scale, and retrofitting liquid systems into legacy sites is slow and expensive. Modular blocks ship liquid-ready, enabling immediate high-density AI support.

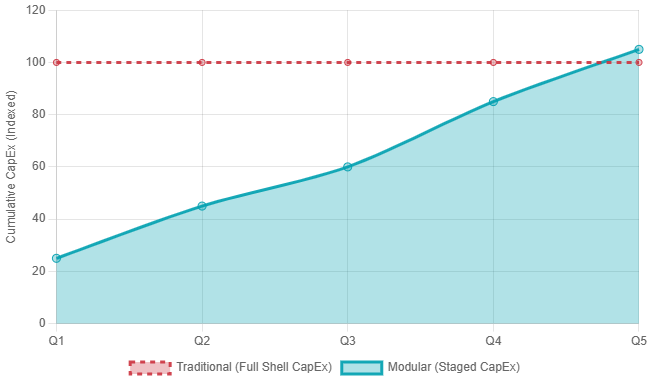

Volatility added the final strain. AI demand comes in bursts, while traditional campuses require full-shell investment long before demand is clear. Modular blocks let operators scale in controlled steps so capital follows real commitments rather than forecasts.

These forces push the legacy model past its limits. Modular architecture aligns with the requirements of AI-era development.

What Modular Data Center Design Means

A modular data center uses pre-engineered power, cooling, electrical, and IT blocks built off-site and delivered to a site prepared in parallel. It replaces bespoke construction with controlled factory production.

Its core advantages come from standardization and parallelization. Modules are built to fixed specs, tested before shipment, and installed while civil and utility work advance, eliminating many delays in traditional builds.

The model shortens schedules, improves quality control, reduces labor exposure, and enables precise, incremental scaling. Operators replicate a proven system rather than finishing large shells on-site.

Edge deployments adopted it first because speed mattered most. AI is now extending the same approach to hyperscale with 1–5MW GPU-ready blocks added as demand appears.

Modularity decouples digital growth from the slow cadence of conventional construction.

Sustainability Advantages

Modular architecture is more sustainable because efficiency is designed in upfront rather than added during construction.

Liquid cooling lowers energy use on dense AI campuses, and closed modular systems avoid the airflow losses of legacy buildings.

Water scarcity now drives design choices. Modular sites use closed-loop cooling with minimal evaporation, air-first or hybrid systems in arid regions, and waste-heat capture, with some European deployments operating near zero-water.

Factory production cuts material waste and embodied carbon. Standardized frames allow accurate carbon tracking, and modules can be reused across sites, reducing redevelopment impact as scrutiny on embodied carbon rises.

These pressures now shape permitting and financing, and modular design provides a cleaner, faster path through both.

How Modular Design Is Evolving

Modularity is no longer a construction tactic. It is changing how data centers are conceived.

AI-First Architecture: These modules integrate liquid loops, dense rack layouts, and GPU-oriented network fabrics. They function as industrial production units rather than general-purpose halls, with electrical systems sized for concentrated loads and rising densities.

Vertical Builds: Land scarcity in Europe and parts of Asia is pushing operators upward. Multi-story prefabricated blocks bring 10–50MW campuses onto tight parcels, and their controlled geometry makes vertical stacking more predictable than traditional construction.

Underground and Underwater Siting: Standardized envelopes make nontraditional placements viable. Natick proved prefabricated units can operate underwater; similar designs now enable underground vaults and hillside installations where temperature stability or land limits constrain surface builds.

District Heating Integration: Waste-heat recovery is scaling. Modular campuses route thermal output into district heating networks or nearby industrial users through closed-loop systems, aligning compute growth with local energy-resilience goals and gaining regulatory support in Europe and Asia.

Modularity expands where and how advanced facilities can be built.

Strategic Implications

For developers, modular timelines bring revenue forward. Shorter builds cut interest carry and let capital be staged against real demand rather than funding full shells upfront. Return profiles improve, risk drops, and GPU-driven design changes can be absorbed without major rework.

For investors, sustainability now influences capital costs. Modular sites benefit from lower embodied carbon, higher cooling efficiency, and tighter water control. These attributes shape valuation premiums and discounts, and modular designs meet sustainability thresholds with fewer unknowns. The focus shifts from total megawatts to megawatts delivered quickly and responsibly.

For policymakers, permitting increasingly centers on efficiency, water use, and carbon reporting. Modular projects arrive with predefined engineering and documented performance, reducing regulatory uncertainty and speeding approvals. In markets where community scrutiny is high, their predictability makes them easier to support.

Across all three groups, modular design reduces friction and aligns with the sector’s structural pressures.

Examples in Practice

The shift is already underway. Aligned uses prefabricated cooling platforms that let them increase density without rebuilding mechanical plants, treating cooling as a swappable component rather than a fixed system.

STACK scales with modular electrical rooms and cooling blocks, allowing construction to advance even when power delivery timelines differ across regions.

Digital Realty now delivers campuses that are liquid-ready from day one, with mechanical plants built to absorb density changes without redesigning distribution.

Meta has redesigned its campus architecture around GPU loads, using modular electrical topologies, standardized liquid systems, and fast iteration across markets.

These moves mark the transition from one-off engineering to repeatable, industrialized infrastructure.

The Core Point

The sector’s trajectory is now defined by speed, density, and sustainability. Modular architecture aligns these forces by replacing bespoke construction with standardized production. This reflects a structural shift driven by AI-scale compute, not a passing trend.

Organizations that master modular deployment will set the pace. They will build faster, scale denser, and meet sustainability requirements with fewer constraints.

Those anchored to slow, rigid designs will fall behind as AI timelines compress and infrastructure cycles shorten.