The $400B AI Bet: Boom, Bubble, or Global Reset?

As $400B Flows Into AI, Power Bottlenecks and Overbuilding Threaten to Redefine the Global Data Center Landscape.

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

A Historic Buildout Redefining The Global Infrastructure Cycle

The world is experiencing an infrastructure surge unlike anything in modern history.

In 2025 alone, global AI-related capital spending will surpass $400 billion, nearly 1 percent of U.S. GDP and approaching the annual output of countries like Austria or the UAE.

From Northern Virginia to Frankfurt, from Singapore to Mumbai, new data center campuses are breaking ground faster than power grids can catch up.

Every great technological revolution produces a similar pattern euphoria, overbuilding, and eventual correction.

The critical question is whether this AI wave will resemble the railways of the 19th century, which bankrupted investors but built lasting infrastructure, or the housing bubble of the 2000s, which left only debt and empty subdivisions.

The next two years will determine who profits from the boom and who pays for it.

The Shape Of The Boom

AI has become the gravitational center of global capital.

Venture funding for AI startups hit $100 billion in 2024 and exceeded 50 percent of all global venture capital in early 2025 the highest concentration for a single sector ever recorded.

The United States still dominates the flow, capturing roughly three-quarters of global AI funding, but the phenomenon is unmistakably global: sovereign funds in the Middle East, telecom operators in Southeast Asia, and private-equity groups in Europe are all racing to secure capacity.

The four major hyperscalers Microsoft, Amazon, Google, and Meta will invest a combined $315–364 billion this year in AI-related infrastructure, while Asian giants like Alibaba, Tencent, and ByteDance will spend another $60–70 billion.

NVIDIA, the principal beneficiary, expects fiscal-year revenue above $130 billion, up more than 110 percent year-on-year, as its GPUs sell out months in advance.

Capital is abundant. What is scarce and now decisive is power. Across every continent, utilities face multi-year backlogs for transmission upgrades and interconnection approvals.

The race to electrify AI has replaced the old race to connect fiber.

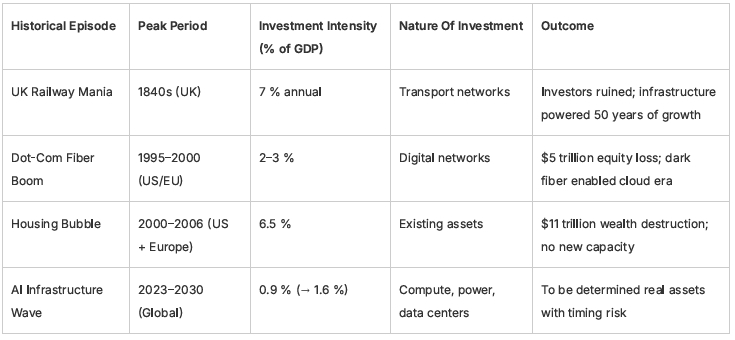

Lessons From History

Every infrastructure bubble starts with legitimate innovation. What differentiates the enduring ones from the disastrous ones is whether they leave productive assets behind.

By scale, today’s AI investment is smaller than the manias of the past. But in nominal terms, the dollar amount dwarfs them all. The AI buildout is deploying more capital per year than the entire dot-com cycle did over its lifetime.

That scale brings both opportunity and danger: opportunity because it is creating the backbone of the digital economy; danger because even productive bubbles can overshoot.

Where Data-Center Fundamentals Still Shine

Global data center markets are hitting extraordinary levels. Vacancy rates are record-low: 1.6% in the U.S., under 2% in Singapore, and 3% in Frankfurt.

Absorption is at new highs 2.2 GW leased in H1 2025, nine times the pace of 2020. Average wholesale rents top $184 per kW per month, rising faster than inflation in nearly every major market.

Power is the choke point. Traditional racks draw 10–15 kW; AI clusters demand 40–250 kW. Interconnection queues are swelling, with 1,500+ GW of projects awaiting approval in North America alone. Transformer lead times exceed three years, and moratoriums in Dublin, Amsterdam, and Tokyo are slowing development.

Yet developers are building at unprecedented speed. Over 6,350 MW is under construction globally roughly 3½ years of current absorption and announced projects exceed 30 GW. If hyperscaler demand softens or efficiency gains accelerate, the market could swing from scarcity to surplus within two years.

The risk is not collapse but compression: rents stabilizing, yields normalizing, and valuations resetting.

The Fault Lines Ahead

Four fault lines define the next stage of this cycle.

Demand Fragility. Enterprise adoption is expanding but monetization lags. Analysts estimate that more than $560 billion has been invested in AI infrastructure against only $35 billion in realized AI revenue. A ratio of sixteen to one cannot persist indefinitely. Efficiency breakthroughs like DeepSeek’s 18× reduction in training costs could slow hyperscaler expansion by 25–30 percent through 2026.

Supply Momentum. Construction pipelines are self-propelling. Once a site is financed and power secured, it will be delivered regardless of market conditions. The resulting overlap of deliveries in 2026–2027 could lift vacancy above 5 percent globally for the first time in a decade.

Power Constraints. Grid congestion is now a global phenomenon. In Asia, nations like Thailand, Malaysia, and India are accelerating renewable buildouts; in Europe, transmission bottlenecks are slowing rollouts in London and Dublin; in North America, PJM capacity prices have surged 11× since 2023. The most valuable commodity in digital infrastructure is no longer land but electrons.

Regulatory Pressure. Governments are tightening efficiency and sustainability requirements. The EU’s CSRD and California’s SB 253 mandate Scope 1–3 emissions disclosures, while Singapore and the Nordics are introducing stricter PUE thresholds. Facilities that fail to meet 1.3 PUE or renewable-energy targets could see 15–20 percent valuation discounts.

These crosscurrents mark year three of a typical five-to-seven-year cycle: growth still strong, but risk premiums quietly rising.

What Top Investors Are Doing

The smartest capital is repositioning. Sovereign wealth funds, infrastructure specialists, and global REITs aren’t chasing the boom they’re preparing for the correction.

Top investors focus where power and policy stability converge: Northern Virginia, Dallas, Frankfurt, Singapore, and Mumbai. Power adjacency owning substations, renewable PPAs, and grid rights is now core to investment strategy.

Speculative exposure is shrinking. Projects without firm power or 60% pre-leasing are deferred or sold. Funds that entered in 2023–2024 are shifting from growth to defensive yield strategies, recapitalizing stabilized assets and buying operating portfolios over greenfield risk.

Private-equity and pension funds are holding 20–30% dry powder, betting on opportunities between 2027–2028. History shows patient capital wins: cheap fiber in 2002 became the backbone of trillion-dollar platforms; today’s disciplined buyers could define the next data center era.

Geographic diversification is rising European capital into North America, U.S. funds into Asia, and Middle Eastern sovereigns building vertically integrated ecosystems linking power, compute, and connectivity.

Across the board, the rule is clear: build only where you can power. Those combining infrastructure patience with energy foresight will lead the post-2027 landscape.

The Verdict: A Good Bubble With Bad Timing Risk

The global AI and data-center boom marks a real technological transformation one building lasting capacity across industries and governments. Yet, like every infrastructure cycle, it will overshoot before stabilizing.

With over 30 GW of projects underway and power constraints mounting, timing risk is inevitable. The next three years will create fortunes and the correction that follows will redistribute them.

The winners will be those who stay liquid, global, and focused on the one variable that defines the future of AI infrastructure: power.

Power, not capital, will decide who survives the shakeout.