DayOne’s $3.54B Bet on Johor: A New AI Infrastructure Blueprint for Asia

DayOne just raised one of Asia’s largest green data center financings to build sustainable AI infrastructure in Malaysia’s Johor state. But this isn’t just about capacity, it’s about strategy.

Welcome to Global Data Center Hub. Join 1300+ investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

Executive Summary

DayOne secured $3.54B in dual-currency green financing to expand its AI-ready digital infrastructure in Johor, Malaysia.

The deal combined RM7.5B in Islamic Murabahah financing and a $1.7B offshore term loan, creating a “double green” structure aligned with both ESG and Islamic principles.

The financing was oversubscribed 2x, with major commitments from Maybank (RM2.5B) and OCBC.

Facilities are being built in Nusajaya and Kempas Tech Parks, within the Johor-Singapore SEZ, targeting LEED Gold or higher.

DayOne signed a 21-year agreement for up to 500MW of solar power with Malaysia’s national utility under the new Corporate Renewable Energy Supply Scheme (CRESS).

This marks a major turning point in Southeast Asia’s digital infrastructure narrative and a signal of how the region will build AI compute at scale.

What Happened

On June 11, 2025, DayOne announced it had secured RM15 billion (~$3.54 billion) in green infrastructure financing.

But the number tells only part of the story.

This wasn’t standard project finance.

It was structured in two complementary tranches:

RM7.5B Murabahah Islamic financing facility

$1.7B offshore conventional green loan facility

This structure allowed DayOne to:

Access local Islamic banks and regional liquidity pools

Satisfy global green finance standards and ESG mandates

Create a unique hybrid financing vehicle that appealed across jurisdictions

Maybank, Southeast Asia’s largest Islamic bank, committed RM2.5B to the deal, one-third of the Islamic tranche, while OCBC Bank (Malaysia and Singapore) acted as joint coordinators, green finance advisors, and Shariah advisors.

The result?

A financing oversubscribed by 2x, drawing strong demand from both domestic and international banks.

Why Johor, Why Now?

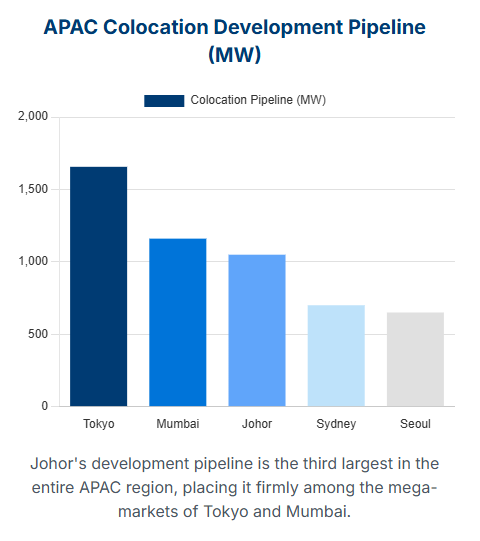

Singapore’s moratorium on new data center approvals (introduced in 2019 and only selectively lifted in 2022) created a capacity squeeze.

That squeeze created a vacuum.

Johor filled it with:

Abundant land

30% lower energy and operating costs

1–2 millisecond latency to Singapore

Access to both Malaysian and cross-border fiber

DayOne’s campuses in Nusajaya and Kempas are strategically placed in the Johor-Singapore Special Economic Zone (JS-SEZ), which offers regulatory advantages and direct pipelines to Singapore’s digital ecosystem.

Green Power at AI Scale

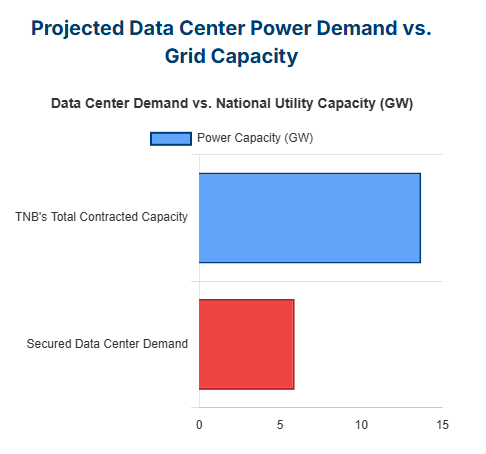

In parallel with the financing, DayOne signed a 21-year bilateral solar energy agreement with Tenaga Nasional Berhad (TNB), Malaysia’s national utility.

This was the first-ever corporate bilateral energy deal under Malaysia’s CRESS program (Corporate Renewable Energy Supply Scheme), which was launched to help corporates access large-scale renewable power directly.

Key elements:

Up to 500MW of solar capacity

21-year term, locked in pricing

Supplies DayOne’s current 120MW and future expansion sites

Guarantees carbon-aligned power for AI workloads

This isn’t just good optics.

It’s strategic.

The next 1,000 hyperscale megawatts in Asia will be judged not just by uptime and connectivity, but by carbon intensity and energy resilience.

Strategic Implications

1. A New Financing Playbook

DayOne’s “double green” structure (Islamic + ESG) is a breakthrough for emerging markets where local capital is often underutilized in digital infrastructure.

It unlocks deep regional liquidity without sacrificing access to global ESG investors.

Expect to see this template replicated in Indonesia, UAE, and even West Africa.

2. The Rise of Sovereign-Adjacent AI Infrastructure

Johor isn’t just Singapore’s overflow market.

It’s becoming Asia’s sovereign AI zone.

With Chinese hyperscalers like Alibaba, TikTok (ByteDance), and Tencent increasing their Malaysian footprints, and Microsoft investing in AI capacity, Johor is now where compute, compliance, and cost converge.

3. A Model for Sustainable Hyperscale Growth

By combining:

Clean energy (via CRESS)

Shariah-compliant capital

AI-optimized facilities

…DayOne is demonstrating how financial engineering can unlock physical infrastructure.

This isn’t a startup anymore.

It’s a sovereign-scale infrastructure developer.

What This Means

For Investors

This is a proof point for thematic capital deployment in digital infrastructure. Islamic + green = scalable in Muslim-majority growth markets. Watch for more structured financing plays tied to sustainability and sovereignty.

For Operators

Johor is no longer optional, it’s foundational. But the lesson here isn’t “build in Malaysia.” It’s: structure creatively, align early, secure energy first.

For Policymakers

CRESS, JS-SEZ, and DayOne’s playbook offer a masterclass in regulatory design. Want hyperscalers? Build a fast, bankable, sovereign-aligned path to 500MW+ clean power. Malaysia just showed it can be done.

The Bottom Line

DayOne just did more than close a $3.54B financing deal.

It built a new blueprint for how AI infrastructure can be capitalized, localized, and decarbonized in emerging Asia.

The future of digital infrastructure won’t be decided in Silicon Valley or Beijing.

It’ll be decided in places like Johor, by those bold enough to build with capital discipline, sovereign alignment, and climate foresight.

If your data center strategy isn’t solving for power, policy, and capital structure.

You’re not playing the real game.