Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

In 2025 and into 2026, the global hyperscale infrastructure race is no longer defined by how much companies spend, but by how fast they turn capital into energized compute.

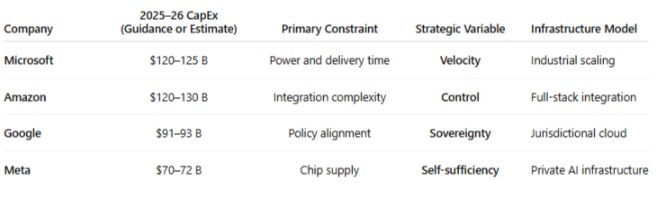

Microsoft, Amazon, Google, and Meta have committed over $300 billion in combined annual capital expenditures more than Japan or India’s national infrastructure budgets. Yet each is optimizing a different strategic variable: velocity for Microsoft, integration for Amazon, sovereignty for Google, and reinvention for Meta.

The shared metric is infrastructure velocity, how quickly a dollar of CapEx becomes usable compute. The fastest builders now hold the most valuable economic advantage in the AI era.

Microsoft: velocity as a moat

Microsoft’s Q1 FY2026 results reframed the scale of its AI infrastructure ambitions. The company reported $77.7 billion in revenue (+18% YoY), $38 billion in operating income (+24%), and EPS of $4.13, exceeding expectations. But the real signal was on the capital line: $34.9 billion in quarterly CapEx, up 64% sequentially, with roughly half devoted to GPUs and CPUs for Azure AI.

CFO Amy Hood confirmed that “about half of our spend was on short-lived assets GPUs, CPUs, and networking and the rest long-lived infrastructure that will support monetization over the next 15 years and beyond.” Management also raised its full-year FY2025 CapEx outlook to $120–125 billion, up sharply from earlier guidance, reflecting surging AI infrastructure demand and accelerated data center buildouts.

Microsoft’s goal: double its data center footprint by 2027, adding roughly 4 GW of new capacity across 70+ global regions. The company is compressing traditional 24-month build cycles down to 12–15 months through modularized campus templates, long-term grid partnerships, and GPU pipeline coordination with NVIDIA and AMD.

This is no longer a software company expanding cloud margins it’s a manufacturing enterprise scaling industrial throughput. Each megawatt energized translates directly into new Azure and Copilot compute capacity, while the balance sheet has evolved into a velocity engine for monetizing constrained AI supply.

→ Read the full Microsoft Q1 FY2026 analysis: Microsoft’s $35 Billion Quarter and the Rise of Infrastructure Velocity

Amazon: integration at scale

Amazon’s Q3 2025 report showed $180.2 billion in revenue (+13 % YoY) and earnings per share of $1.95, both above expectations. Its CapEx trajectory is even more striking: an expected $125 billion in AI infrastructure investment through 2026.

Management tied this surge to AWS’s re-acceleration to 20 % year-over-year growth, its fastest since 2022, powered by new chips (Trainium v2 and Inferentia 3), region expansions, and hyperscale modular campuses.

Where Microsoft compresses time, Amazon deepens control. The company’s vertical integration (designing chips, financing power contracts, and building regionally distributed campuses) prioritizes end-to-end ownership over speed. It trades delivery velocity for structural dominance and lifetime margin capture.

AWS’s infrastructure spend now exceeds its combined total from 2019–2021. By building each layer of the AI stack internally, Amazon positions itself to reprice cloud services from silicon upward.

→ Read the detailed AWS Q3 2025 breakdown: Amazon’s $125 Billion AI Infrastructure Pivot

Google / Alphabet: sovereignty as architecture

Alphabet’s Q3 2025 results marked a 16 % year-over-year revenue increase to $102.35 billion, with Google Cloud up 34 % to $15.16 billion. Capital expenditures reached $24.3 billion for the quarter, and full-year guidance rose to $91–93 billion, up sharply from 2024’s $68 billion.

About 60% of Q3 CapEx went to servers and the remainder to new data centers, networking, and regional expansion. The company is establishing sovereign cloud regions in France, Japan, India, and Saudi Arabia, pairing TPU v6 clusters with local compliance frameworks. CEO Sundar Pichai described these investments as “building the infrastructure for the next decade of AI and regional innovation.”

Google’s capital strategy optimizes for durability and jurisdictional trust, not raw speed. It builds slower but under stronger geopolitical logic, aligning compute regions with national digital-sovereignty policies and energy efficiency mandates. The payoff: predictable, regulation-proof capacity in critical markets.

→ Read the full Alphabet Q3 2025 coverage: Alphabet’s $75 Billion CapEx and the Architecture of Sovereign Compute

Meta: reinvention through compute

Meta’s Q3 2025 numbers underscored its metamorphosis from advertising platform to AI infrastructure builder. The company reported $51.2 billion in revenue (+ 26 % YoY) and CapEx of $19.37 billion for the quarter, guiding $70–72 billion for full-year 2025, its highest ever.

This reallocation of capital finances the construction of multi-region AI campuses and a fleet of 1.3 million GPUs slated for deployment by 2026. Meta’s facilities are engineered for high-density liquid cooling and model-training workloads across Llama, its generative-AI family.

Unlike Microsoft, Amazon, and Google, Meta builds almost exclusively for internal consumption. Its constraint is the GPU supply chain rather than grid capacity or land acquisition. Each CapEx dollar buys self-sufficiency transforming ad cash into compute equity.

Meta’s CapEx-to-revenue ratio now exceeds 35 %, rivaling early hyperscale buildouts of AWS circa 2015. This internalization of infrastructure signals a company betting its next growth wave on ownership of physical compute.

→ Read the full Meta Q3 2025 review: Meta’s $70 Billion CapEx Pivot and the AI Factory Within

The new competition curve

All four hyperscalers are in expansion mode, but their build physics differ.

Combined, the four firms will deploy over $400 billion in 2025–2026. The competitive advantage now rests not on absolute dollars, but on time-to-compute, the interval between committing capital and energizing usable AI capacity.

Every month of delay carries an opportunity cost: slower model training, deferred customer onboarding, or lost first-mover advantage in emerging regions.

Implications for investors and operators

Capital intensity and margin compression.

The hyperscale CapEx surge increases depreciation and delays free-cash-flow realization. For example, Meta’s $19 billion Q3 spend temporarily suppressed operating margin despite record revenue. Expect this across peers through 2026.

Supply-chain risk becomes strategic risk.

Microsoft and Meta explicitly cite GPU/CPU availability as gating factors. Lead-times for next-gen accelerators now dictate the effective speed of capacity delivery.

Regional fragmentation deepens.

Google’s sovereign-cloud emphasis and Microsoft’s local-region partnerships in Japan, Saudi Arabia, and France signal a lasting policy-driven segmentation of global compute. For investors, this creates arbitrage: regional developers aligned with compliance mandates will command premium valuations.

Time becomes the new KPI.

Infrastructure throughput, how quickly megawatts become monetized compute, defines enterprise value more than occupancy or NOI. In the industrial age, capital efficiency was measured by production per dollar; in the AI age, it’s compute per dollar per month.

Power scarcity converts to pricing power.

Every hyperscaler references constraints in connecting new megawatts to the grid. Developers that control energized land near substations now possess the upstream leverage in hyperscale site selection.

Closing frame

The global AI infrastructure cycle has entered its exponential phase. Each hyperscaler is now an infrastructure utility, operating under its own physics of scale:

Microsoft builds for velocity, collapsing time.

Amazon builds for control, owning every layer.

Google builds for sovereignty, aligning with nations.

Meta builds for self-reinvention, internalizing compute.

Their combined CapEx will likely surpass $1 trillion by 2028 if current trajectories persist. The outcome will shape not only cloud competition but global energy markets, real-estate values, and national AI capacity.