The Zoning Moat Is Now the Asset

Billions blocked, IRRs compressed, and land prices soaring: zoning is the new bottleneck for U.S. data centers

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

Event: When a county hearing blocks billions

The clearest signal that U.S. data center investing has changed is not a hyperscaler earnings call. It is the fact that local zoning fights are now large enough to show up as delayed national capacity, trapped capital, and re-priced land.

Since 2023, community opposition and permitting conflict have blocked $18 billion and delayed $46 billion of U.S. data center projects $64 billion of stalled value.

That is not “noise.” That is a market-wide gating function.

Prince William County’s Digital Gateway valued at $24.7 billion has become the emblem of this new reality: a project large enough to matter at the national infrastructure level, yet vulnerable to a local entitlement process and ongoing legal challenge.

Investors should read this not as an isolated political drama, but as a pricing mechanism. When permission becomes uncertain, the value of time goes up, the value of entitlement goes up, and the value of “raw land optionality” collapses.

Why time certainty is now a primary underwriting input is consistent with valuation dynamics discussed in this case examining how execution speed is being repriced across AI infrastructure platforms.

Cause: Land isn’t scarce compatible land is

The industry keeps saying “we need more land.” That framing is lazy. The U.S. has land. What the industry lacks is land that survives the intersection of zoning, infrastructure, and community tolerance.

Start with the zoning mismatch. Many jurisdictions still treat data centers as generic commercial uses, despite their infrastructure-scale footprint and utility draw. The result is inconsistent interpretation and delays, as projects are forced into discretionary approvals instead of by-right permitting.

Then comes the real accelerant: community opposition has matured into an organized constraint. The research cites at least 142 groups across 24 states mobilizing since 2023, with petitions exceeding 31,000 signatures, and public hearings drawing crowds as large as 500 attendees in Virginia.

This is not a handful of upset neighbors. It is an operational environment.

Opposition is not ideological in the abstract. It is tactical. It anchors on three pressure points that resonate with voters and translate into permitting leverage:

Noise and diesel risk: generators, cooling systems, and the perception of an industrial facility arriving next to homes.

Week 3_ Land and Zoning Challen…

Resource consumption narratives: energy intensity framed as grid strain, and cooling framed as water stress.

Jobs-per-acre skepticism: a belief that communities absorb impacts without proportional long-term employment.

Now add the final ingredient: saturation in the most important hub. Northern Virginia processes an estimated 70% of global internet traffic, and vacancy fell to 1.9% in 2024, which is precisely the kind of tight market that triggers political backlash against continued expansion.

When the easiest industrial parcels are gone, developers move outward into places where the zoning culture is not pre-aligned to data centers and conflict becomes the default.

This is why “land” is the wrong noun. The constraint is compatibility.

Impact: Entitlement risk is now return risk

The direct financial cost of zoning conflict is already large, but the second-order effects are what should worry institutional capital: delay-driven IRR compression, stranded pursuit capital, and a bifurcation between “permissioned” assets and everything else.

First, delay destroys the pro forma. The research notes a stark timing mismatch: grid upgrades can take 8+ years, while physical construction may take 2–3 years.

Investors who treat land entitlement as a late-stage box-check are underwriting a timeline illusion. You do not “catch up” after a permitting slip when power and civil schedules are already stretched.

Second, land pricing is splitting into two markets. For large parcels (50+ acres), prices jumped 23% in 2024 to an average of $5.40 per square foot.

That is a market signal that the product being traded is not dirt; it is a probabilistic package of zoning viability plus proximity to power.

Third, the cost of time is becoming quantifiable and punitive. One cited benchmark pegs a month of delay at roughly $14.2 million in lost revenue potential and carry costs.

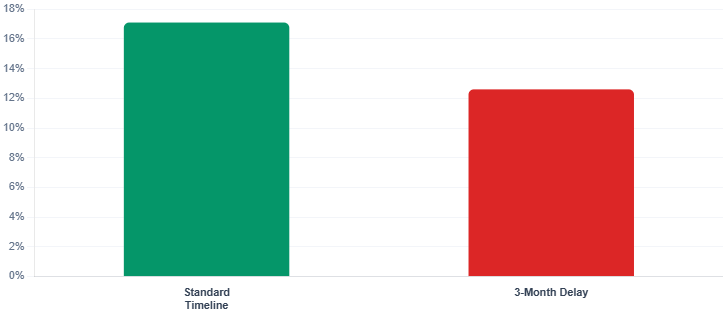

Another shows how a common three-month delay can compress a project IRR from 17.1% to 12.6% effectively wiping out the development alpha that most investors are chasing.

Fourth, the stalled-project ledger is now a portfolio-level reality. The $64 billion figure is not just a headline; it implies billions in engineering, legal work, deposits, and internal labor that can become unrecoverable “pursuit capex” if a community fight turns into a moratorium or a zoning reversal.

The paradox is this: land and zoning resistance both block new builds and protect incumbents. Scarcity boosts pricing power in the short term, but it can also seduce investors into overconfident underwriting assuming the moat will last, only to find politics can shift faster than their fund horizon.

Response: Toward a Patchwork U.S. Entitlement Regime

Policy is not converging. It is fragmenting.

The research describes a mixed response: supportive frameworks in some jurisdictions, stricter constraints in others, and a rapid increase in legislative activity overall. One data point matters because it signals velocity: states enacted 40+ bills in 2025 across 21 jurisdictions addressing zoning alongside energy and taxation.

That volume is a sign the sector is no longer treated as niche real estate. It is being regulated as a high-impact land use.

Three policy patterns stand out:

1. Standardization where the industry is politically entrenched.

Loudoun County created a Data Center Overlay District (2016, revised 2022) to formalize site standards such as setbacks and utilities, and to channel approvals through defined processes.

This is what “mature market governance” looks like: not blanket approvals, but structured guardrails that reduce ambiguity.

2. Moratoriums and prohibitions where trust collapses.

Peculiar, Missouri, shows how local campaigns can drive zoning changes that effectively block data centers.

The investor lesson is simple: in some towns, the entitlement endpoint is not a negotiated compromise it is a rule rewrite.

3. Conditionality tied to externalities.

A vetoed Virginia proposal would have required sound and water studies for rezoning. Other states are pushing disclosures and efficiency standards.

This is where the industry is headed: more documentation, more public scrutiny, and more requirements that resemble infrastructure permitting rather than traditional industrial development.

This patchwork is a feature, not a bug. Land use is local power in the U.S. Investors should treat zoning not as a compliance step, but as a jurisdiction-specific political economy.

Investor strategy: How top capital is adapting

The market leaders are not “getting better at permits.” They are redesigning their risk posture around permission.

Leading investors are front-loading diligence, prioritizing shovel-ready zoning, legal opinions, and clearer local alignment before committing meaningful capital. The implication is clear: the old model of buying land first and resolving entitlement later is increasingly a trap.

Asset concepts are also becoming more flexible. In contested regions, designs are being adjusted to reduce perceived impacts noise, visual massing, and other externalities rather than assuming a fixed facility template will survive local scrutiny.

Contracting and capital structures are hardening as well. More conservative approaches are emerging, including contingency reserves, higher pre-leasing thresholds, and milestone-based exit rights intended to protect returns from entitlement slippage.

Finally, alignment with utilities and government has become central to credibility. Partnerships that secure power pathways and align incentives now shape the permitting narrative itself, not just the construction plan.

How coordination across power, policy, and permitting now shapes project viability is reinforced by this analysis of how infrastructure execution risk is increasingly centralized.

In other words, the winning strategy is not persuasion alone. It is de-risking the political timeline.

Investor lesson: Zoning is now the underwriting

The contrarian conclusion is simple: the U.S. data center market has not become riskier because demand might fall. It has become riskier because permission has become conditional.

The data is clear: $64B stalled since 2023; a $24.7B flagship project stuck in court; land prices up 23% to $5.40/sf; and delays where a three-month slip cuts IRR from 17.1% to 12.6%. The result is a bifurcated market: sites with permission and velocity and everything else.

The industry will keep talking about power, because power is the physics. But investors should be equally blunt about zoning, because zoning is the politics that decides whether physics can be monetized.

When permission becomes scarce, it becomes the moat.