Storage and Intermittency: The Invisible Constraints on AI-Ready Data Centers

You might have power. But can you count on it every minute, every day?

Welcome to Global Data Center Hub. Join 1400+ investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

Executive Summary

AI workloads demand continuous, high-density power, but renewables are intermittent.

Storage technologies (BESS, thermal) are essential yet under-deployed.

Power continuity, not just capacity, now defines data center viability.

Cooling systems are a critical but often overlooked point of failure.

Investment models must shift from PPA coverage to real-time availability.

Why This Matters

As the data center sector races to meet the demands of AI, cloud, and digital transformation, it’s not just raw megawatts that matter, it’s when and how those megawatts arrive.

Too many operators and investors have focused solely on power capacity without understanding power continuity. But AI workloads are revealing a harder truth: intermittent power is unusable power.

Storage and intermittency risks are no longer edge-case issues. They are reshaping the economics, site selection, design priorities, and investment underwriting of digital infrastructure globally.

What Are Storage and Intermittency Challenges?

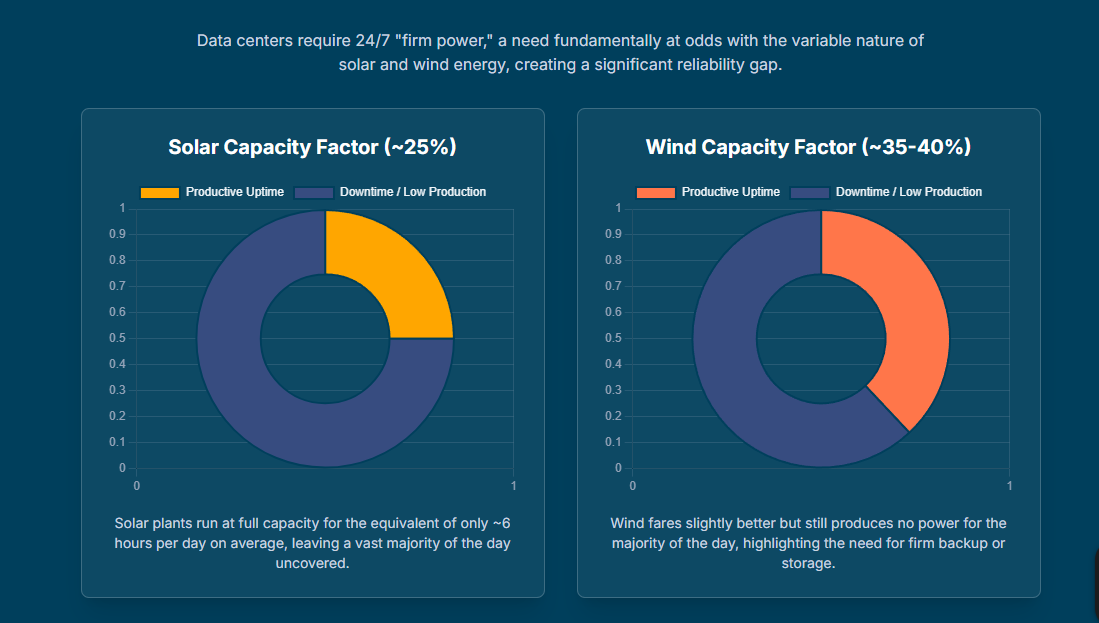

Intermittency refers to the inconsistent output of renewable energy sources like wind and solar. These resources are variable by nature, dependent on weather and time of day, while data centers require constant, high-quality power 24/7.

Storage refers to the systems used to buffer that variability. This includes Battery Energy Storage Systems (BESS), thermal storage (e.g., chilled water or underground cooling), and increasingly, hydrogen and flow batteries. But the technology is still catching up to the demands of high-density, always-on compute.

Together, these two factors create a gap between energy supply and operational uptime. Without robust storage, clean power can’t be delivered reliably. And without reliability, mission-critical workloads stall.

Why This Is Becoming a Problem

1. Data Center Load Growth Is Outpacing Grid Readiness

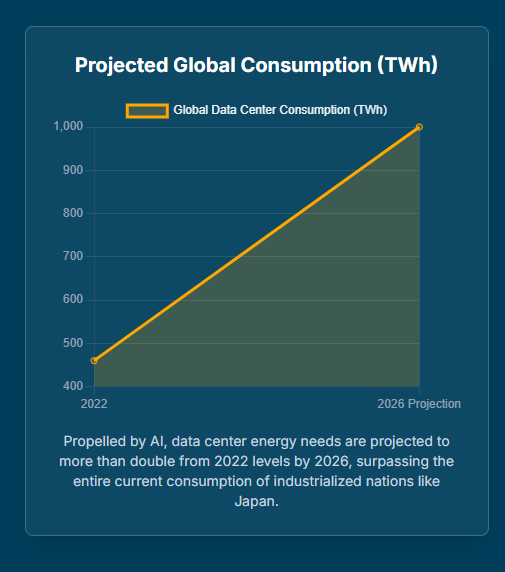

Data center electricity usage is projected to double by 2026, reaching 1,000 TWh globally. In the U.S., it could comprise up to 12% of total electricity demand by 2028. Yet, grid modernization and utility-scale storage deployment are trailing far behind.

Many projects are moving forward with signed PPAs and interconnection plans, but with no clear path to manage power variability or ensure uptime.

2. AI Workloads Have Zero Tolerance for Interruption

AI training and inference workloads aren’t elastic. They require sustained, uninterrupted processing, often at power densities of 80–100kW per rack. Even a brief voltage sag or thermal disruption can lead to expensive job failures or hardware stress.

Legacy backup systems weren’t built for this load profile. The combination of continuous demand and power volatility creates a perfect storm.

3. Cooling Systems Are an Overlooked Storage Dependency

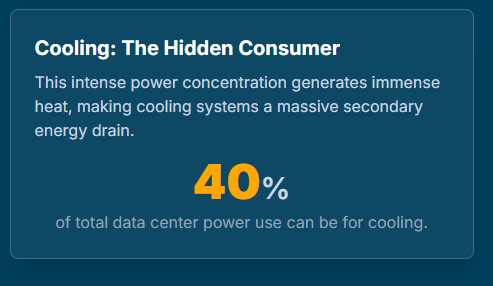

Cooling consumes 30–40% of a facility’s total energy. And it’s vulnerable.

When the grid flickers or on-site generation lags, cooling can collapse within minutes. Thermal storage options, such as chilled water tanks or underground cooling, are underutilized, expensive, or insufficient for multi-hour reliability.

Ignoring this layer of the stack is an existential risk.

4. Grid Events Are Disrupting Hyperscale Loads

In July 2024, 1.5 GW of hyperscale data center load in Northern Virginia disconnected from the grid due to voltage instability. Not because the generation failed, but because the grid couldn’t deliver consistent power.

These protective disconnections may safeguard hardware, but they threaten uptime, SLAs, and grid stability at scale.

The risk is no longer theoretical. It’s operational. And it’s growing.

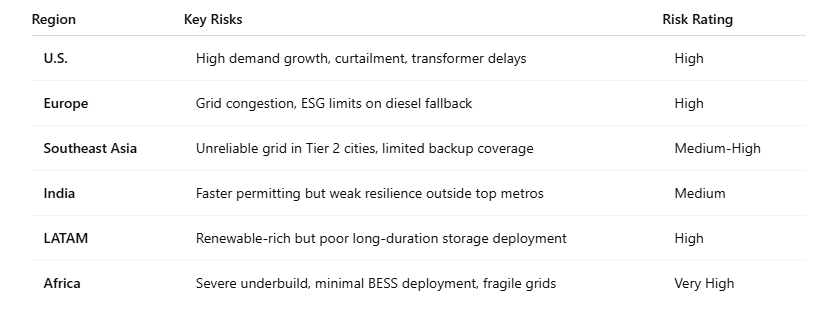

The Geography of Storage and Intermittency Risk

What Investors and Developers Need to Understand

This is not a technical inconvenience. It’s a strategic risk with capital consequences:

Facilities dependent on intermittent generation are failing to meet tenant expectations.

Operating costs are spiking due to inefficient backup systems.

ESG credibility is collapsing due to excessive diesel fallback.

IRRs are shrinking because of hidden costs, curtailment, and schedule delays.

The biggest myth in today’s energy modeling?

That a signed renewable PPA = guaranteed clean, available, dispatchable power.

It doesn’t.

And every model that assumes it does is setting investors up for disappointment.

A Simple 3-Part Framework: De-Risking Storage and Intermittency

1. Model Power Availability, Not Just Nameplate Capacity

Before you lock in a site, answer:

How often is the renewable energy curtailed?

What duration of storage would be needed to bridge supply gaps?

Are backup systems engineered for cooling continuity, not just compute?

What’s the grid event history in this location over the past 3 years?

Availability, not MW, is the metric that matters.

2. Treat Storage as Foundational, Not Optional

In 2025, BESS and thermal storage must be considered core infrastructure, not just resilience upgrades.

A best-in-class storage stack includes:

Short-duration BESS for rapid frequency regulation

Long-duration thermal storage for cooling redundancy

Onsite hybrid generation to hedge against curtailment

Plan for 4–12 hours of autonomous operation, not the industry’s traditional 30-minute minimum.

3. Integrate With (and Influence) the Grid

Forward-leaning operators are:

Partnering with IPPs to co-develop storage-backed renewables

Participating in grid support and ancillary service markets

Advocating for AI-ready infrastructure to receive priority queue treatment

Case in point:

In Kenya, a wind + BESS co-site halved interconnection timelines.

In Brazil, diesel-solar hybrids enabled reliable service in rural zones.

Grid engagement isn’t a compliance checkbox, it’s a strategy.

10 Companies Leading in Energy Storage & Resilience for Data Centers

Fluence Energy – Grid-scale battery storage and digital optimization platforms.

Form Energy – Long-duration iron-air battery technology for 100+ hour storage.

Nuvve – Vehicle-to-grid (V2G) platforms for distributed storage.

Microsoft – Integrating grid-interactive BESS for data center campuses.

Tesla Energy – Deploying Megapacks for hyperscale backup and grid support.

Nidec Industrial Solutions – Industrial-grade UPS and energy storage systems.

Schneider Electric – End-to-end energy management including thermal storage integration.

Redflow – Zinc-bromine flow batteries for long-duration storage in hot climates.

Ice Energy (now Thule Energy Storage) – Ice-based thermal storage for data center cooling.

Verdagy – Green hydrogen developer exploring fuel cell backup for AI-ready campuses.

These firms are shaping the technical frontier of uptime, dispatchability, and grid-resilience.

Final Take: Continuity Is the New Capacity

You can have:

Land

Tenants

Megawatts

PPAs

But if you can’t guarantee that power 24/7, your site isn’t investable. It’s a stranded liability.

The winners in this next wave of digital infrastructure will not be those with the most land or even the cheapest energy.

They’ll be the ones who can keep the lights, and the cooling, on without exception.

If you're not de-risking storage and intermittency from day one, you’re not building infrastructure.

You’re gambling with uptime.