Site Selection: How Billion-Dollar Data Centers Pick Their Land

Billion-dollar data centers aren’t just built they’re placed where power, fiber, and policy align.

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

This article is the 13th article in the series: From Servers to Sovereign AI: A Free 18-Lesson Guide to Mastering the Data Center Industry

Every large-scale data center begins with a choice of land. In this industry, land is more than a location. It determines power access, network reach, build time, and long-term operating costs. A strong site decision can support decades of expansion. A weak one can stall a project before it starts.

AI has raised the stakes. Facilities now demand hundreds of megawatts, direct fiber access, and fast permitting. A single misstep in site selection can delay construction by years or erase a margin entirely. Developers that treat this phase as an engineering or real estate task often learn too late that it is a capital decision.

Power Availability

Power is the first and hardest constraint. Modern data centers require continuous, redundant supply. A hyperscale campus can draw more than 300 megawatts. Sites near substations or transmission corridors reduce interconnection costs and time.

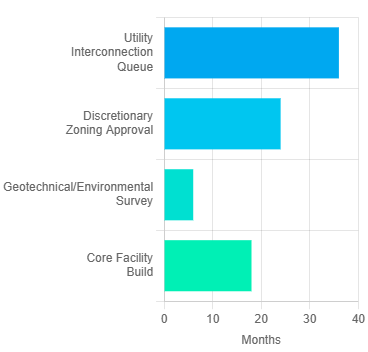

Developers evaluate both current and future capacity. Many utilities have multi-year connection queues, and power delivery upgrades can take as long as the build itself. Successful projects begin coordination with utilities early, often before land acquisition.

Renewable power is increasingly a factor in pricing and finance. Long-term power purchase agreements stabilize costs and meet investor requirements for carbon reduction. Sites tied to grids with a strong renewable mix command premiums because they simplify ESG compliance and future-proof operations.

Fiber Connectivity

After power, connectivity defines a site’s value. Hyperscale tenants expect low-latency connections to major cloud zones and diverse carrier options for redundancy.

Ideal sites sit along long-haul and metro fiber routes with multiple providers. Latency targets below two milliseconds to key markets are standard. In established hubs such as Northern Virginia, Marseille, and Singapore, proximity to dense fiber exchanges has created durable market advantages.

Developers now build meet-me rooms and cross-connect platforms to capture interconnection revenue and strengthen the commercial case for a location.

Land and Entitlement

Land conditions determine buildability and cost. Large, flat parcels reduce grading and drainage work. Flood-prone or unstable soil adds engineering expense and delays.

Zoning is often the deciding factor. Land zoned for industrial or data center use can proceed immediately. Parcels requiring discretionary approvals face lengthy public reviews. In high-demand regions, developers pay premiums for entitled or pre-approved sites to shorten development cycles from several years to under twelve months.

Parcel size reflects the long-term view of operators. A single phase may occupy 20 to 100 acres, but master plans often cover hundreds more to reserve future expansion.

Water and Cooling

Cooling systems shape both design and site choice. Traditional evaporative systems rely on large volumes of water, which is no longer viable in many regions. A 40-megawatt facility can use over 100 million gallons annually.

Local water availability and public tolerance now influence approvals. Many jurisdictions require closed-loop or air-cooled systems to conserve resources. The rise of liquid cooling for AI workloads introduces new infrastructure needs, such as water treatment and discharge permits.

Developers now include water risk mapping in early feasibility studies. Municipal supply reliability, competing industrial use, and climate projections all feed into the financial model.

Regulatory and Political Risk

Policy and permitting can determine whether a project proceeds on schedule. States and municipalities offer tax exemptions and infrastructure incentives to attract investment, but processes vary in complexity.

Fast-moving markets like Virginia and Texas offer clear paths to approval. Others, such as California or Ireland, apply stricter environmental review. Delays in those regions can double the pre-construction timeline.

Political risk also includes community sentiment. Residents often oppose large data centers over concerns about noise, power consumption, or water use. Developers that engage early and present clear mitigation plans are more likely to secure a lasting license to operate.

Due Diligence

Before finalizing a site, developers run a set of technical and legal checks. Environmental assessments identify protected habitats and potential contamination. Utility studies confirm available load and interconnection timelines. Geotechnical surveys test soil stability and drainage. Title reviews ensure zoning compliance and clear ownership.

Community engagement is now a formal part of this process. Understanding local expectations helps prevent legal challenges and reputational harm later

Strategic Trends in Site Selection

The market is shifting from opportunistic to power-first strategies. Developers are purchasing land near substations years in advance, betting on the rising scarcity of grid capacity. These powered parcels are becoming a tradable asset class in their own right.

As primary hubs reach saturation, investors are turning to secondary markets with cheaper land and faster permitting. Portugal, Spain, and parts of the U.S. Midwest have emerged as attractive alternatives due to renewable access and regulatory support.

Energy co-location is another growth trend. Developers are partnering directly with utilities or power producers to build adjacent to gas, hydro, or nuclear plants. This shortens interconnection timelines and provides stable, often cleaner, supply.

The AI boom is also driving cluster development. Instead of single campuses, operators are acquiring multiple parcels within pre-zoned corridors to enable phased growth over decades. These clusters share power infrastructure, fiber routes, and permitting frameworks, reducing cumulative risk.

Real-World Example

Microsoft’s 2024 project in Malaysia shows how strategic alignment drives site success. The company chose land beside a 500-megawatt power plant and a new fiber corridor, supported by state incentives tied to national AI goals. The result was power certainty, network reach, and policy stability all achieved faster than traditional market routes.

The case highlights a broader shift in data center strategy: land value now depends on energy access and regulatory clarity, not just cost. When power, fiber, and policy converge, development moves from speculative to inevitable.

Key Takeaway

Effective site selection determines who scales and who stalls. Power, fiber, water, land, and policy form a single equation. The companies that secure reliable megawatts and fast connectivity first will define the next generation of global infrastructure.

Great data centers are not engineered into existence; they are placed where the conditions for growth already exist. In the AI era, those conditions start with power and end with precision.