Oracle’s $25B Cloud Gambit: Why Ellison Is Betting Everything on AI Infrastructure

Oracle just made the boldest capacity bet in cloud history, 5GW for OpenAI alone. Here’s how Larry Ellison plans to outbuild AWS and Azure in the race for AI infrastructure dominance.

Welcome to Global Data Center Hub. Join 1300+ investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

Executive Summary

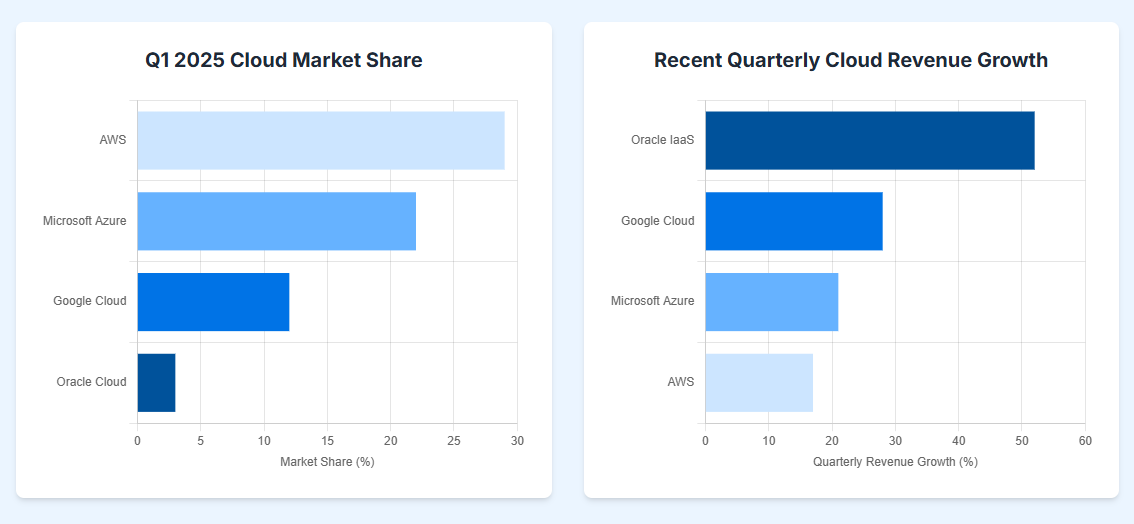

Oracle reported $15.9B in Q4 FY25 revenue up, 11% YoY, driven by a 52% surge in cloud infrastructure revenue and a 244% spike in GPU consumption for AI training.

Cloud infrastructure (OCI) revenue reached $3.0B, while total cloud (SaaS + IaaS) hit $6.7B, now 42% of Oracle’s revenue base.

Remaining performance obligations (RPO) surged 41% to $138B, including over $48B in new bookings in Q4 alone.

Capex rose from $7B in FY24 to $21.2B in FY25, with Oracle guiding to exceed $25B in FY26, nearly all tied to AI-driven infrastructure demand.

Oracle is seeking 5GW of U.S. data center capacity for OpenAI-related training workloads by the end of 2026.

Larry Ellison has declared that Oracle will “build more cloud infrastructure data centers than all our competitors combined.”

This growth is anchored by Oracle’s lead role in the $500B Stargate initiative with OpenAI, SoftBank, and MGX, Phase 2 is now underway in Abilene, Texas.

Oracle Powers Up for Hyperscale AI at Global Scale

What Happened

Oracle’s Q4 FY25 performance exceeded expectations across the board. Adjusted EPS came in at $1.70 (vs. $1.64 est.), revenue reached $15.9B (vs. $15.58B est.), and cloud infrastructure growth outpaced all major peers.

OCI revenue jumped 52% to $3.0B, while total cloud revenue (SaaS + IaaS) grew 27% to $6.7B. GPU consumption for AI training rose 244% year-over-year, fueled by partnerships with OpenAI, xAI, Meta, and NVIDIA.

Fusion ERP and NetSuite ERP both crossed $1B in quarterly revenue. Oracle’s multicloud strategy also gained traction, with database revenue from Microsoft, Google, and AWS rising 115%.

RPO grew 41% to $138B, providing multi-year visibility. Oracle signed over $48B in cloud contracts in Q4 alone. Over 70% of total revenue is now recurring.

To meet this demand, Oracle raised CapEx from $7B in FY24 to $21.2B in FY25 and is planning to exceed $25B in FY26, with most of it directed at hyperscale data center expansion.

As part of this, Oracle is seeking 5GW of U.S. data center capacity to power OpenAI training workloads by 2026. According to TD Cowen, this is the largest single-source AI data center requirement ever disclosed.

Phase 2 of the Stargate buildout is in motion. Oracle is constructing six hyperscale buildings in Abilene, Texas, each supporting 12,500 Blackwell GPUs. This site alone is expected to surpass 75,000 GPUs once completed.

And Larry Ellison isn’t being coy. He told analysts directly:

“Oracle will build more cloud infrastructure data centers than all our competitors combined.”

Why It Matters

Oracle’s Q4 results are not just strong, they signal a structural shift in how the company sees itself and how the market should value it.

The company has moved beyond databases and SaaS. It’s now building a vertically integrated, AI-optimized cloud infrastructure platform that rivals AWS and Azure, not in market share today, but in growth trajectory, architecture, and intent.

This matters because the AI era is no longer defined by model breakthroughs alone. It’s about who can supply the infrastructure: compute, energy, and physical capacity. Oracle is investing and building for this new stack.

Oracle’s approach is distinct. While others prioritize scale through general-purpose cloud services, Oracle is purpose-building for AI workloads. Its tight integration of GPU compute, Exadata databases, high-speed fabric, and multi-cloud access makes it uniquely suited for enterprise-scale inference and training.

The growth in GPU demand is exponential and Oracle isn’t waiting to catch up. Its 5GW U.S. data center expansion plan and Stargate commitments show it’s planning like a hyperscaler but executing like an infrastructure utility.

RPO of $138B proves the demand is real. CapEx north of $25B in FY26 confirms Oracle’s willingness to meet it.

And Ellison’s claim to outbuild every competitor? It’s not bravado. It’s a signal that Oracle views the infrastructure layer, not applications, as the new center of gravity in enterprise tech.

What This Means

For Investors

Oracle is no longer a mature software company trading on license growth. It is becoming a rerated growth story with multi-decade tailwinds.

The company now provides investors with exposure to three key trends:

Cloud infrastructure demand for AI workloads

Recurring SaaS application revenue

Enterprise database modernization across multi-cloud environments

Expect further analyst upgrades as Oracle’s OCI margins expand and CapEx converts into high-value consumption revenue. The scale of signed contracts ($48B in Q4 alone) derisks future growth and supports long-term valuation premiums.

For Operators

Oracle’s demand for new data center capacity is unprecedented. Its 5GW U.S. target is on par with the entire annual buildout of the U.S. hyperscale market in recent years.

Operators with access to scalable land, energy, and permits will find Oracle to be an eager and aggressive buyer, particularly in secondary or underdeveloped regions with grid headroom.

This is an opportunity for colocation providers, developers, and energy-aligned infrastructure partners to step into long-term JV roles. Oracle doesn’t just want space, it wants repeatable capacity.

For Policymakers

Oracle’s global expansion strategy shows how hyperscaler demand can become a development engine. In Texas, cooperative permitting and grid alignment enabled Phase 2 of Stargate to move forward quickly.

Regions that can streamline zoning, expedite interconnects, and provide grid flexibility will attract not only Oracle, but the broader ecosystem of AI infrastructure buildout.

This includes everything from substations and modular campuses to workforce training and tax frameworks. Oracle’s promise to “build more cloud infrastructure data centers than all competitors combined” means there’s opportunity for dozens of regions to emerge as AI hubs, if they move fast.

The Bottom Line

Oracle isn’t just entering the AI race. It’s redefining the field it wants to play on—and how it plans to win.

This story matters because it signals a new era where:

The biggest driver of cloud growth won’t be SaaS, or storage, or compute. It will be AI infrastructure at global scale.

Oracle sees that clearly. And it’s building for it, faster than almost anyone expected.