Microsoft Q2 FY2026: The $37.5B Infrastructure Surge That Repriced Azure

How Capital Intensity, Power Constraints, and Depreciation Are Reshaping Microsoft’s AI Economics

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

Microsoft’s fiscal Q2 2026 marks a structural shift from high-margin software company to capital-intensive AI infrastructure platform. The quarter ended December 31, 2025 delivered strong operating results, yet markets repriced the model.

Revenue rose 17% year over year to $81.3 billion, operating income increased 21% to $38.3 billion, and operating margin reached 47%. Even excluding a $7.6 billion OpenAI restructuring gain embedded in GAAP EPS, net income grew 23%, reflecting durable performance.

Microsoft Cloud surpassed $50 billion in quarterly revenue for the first time, up 26%, yet shares declined roughly 7%. Investors are now underwriting capital intensity and infrastructure delivery rather than software margins alone.

Intelligent Cloud: Growth Bounded by Capacity

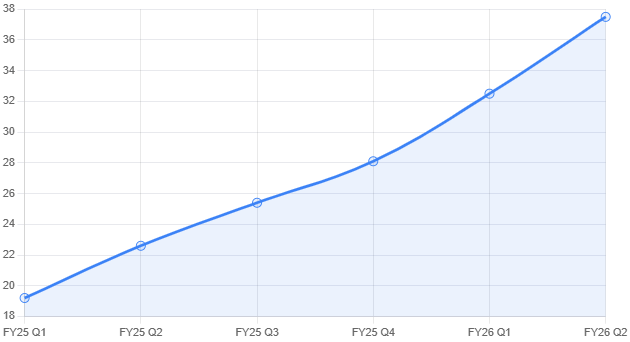

Intelligent Cloud generated $32.9 billion in revenue, up 29% year over year, with Azure growing 39%. The slight deceleration reflects supply constraints, not demand softness.

Commercial bookings surged 230%, and remaining performance obligations reached $625 billion, with approximately 45% tied to OpenAI and the balance growing 28%, signaling broad enterprise AI adoption.

Microsoft added roughly one gigawatt of capacity in the quarter, yet demand continues to exceed supply. Interconnection, equipment lead times, and GPU deployment are constraining growth through at least fiscal 2026. Azure’s expansion is now governed by energized megawatts rather than contract volume.

Capital Allocation at Industrial Scale

Capital expenditures plus finance leases totaled $37.5 billion in the quarter, up 66% year over year. Roughly two-thirds funded AI accelerators, with the balance directed toward campuses, cooling systems, networking, and long-term power infrastructure.

At this pace, Microsoft’s annualized infrastructure run rate approaches $150 billion, placing it alongside major industrial operators rather than traditional software peers.

Gross margin declined to approximately 68%, with cloud near 67%, and Q3 guidance implies further moderation from AI-related depreciation and hardware mix. Operating margin remained 47%.

The central question is alignment: whether depreciation cycles, energy procurement timelines, and campus activation schedules match AI monetization. Microsoft is front-loading capital to secure strategic control, while investors reassess return timing.

Copilot and Application-Layer Economics

The Productivity and Business Processes segment generated $34.1 billion in revenue, up 16% year over year. Microsoft now has 15 million paid Microsoft 365 Copilot seats, up more than 160%, though penetration remains just above 3% of its 450 million commercial seats, indicating significant runway.

Copilot daily usage increased tenfold year over year, with more than 90% of Fortune 500 companies deploying it. Microsoft Fabric surpassed a $2 billion annual run rate, while SQL Database Hyperscale and Cosmos DB grew 75% and 50%, reinforcing Azure’s data gravity.

The model is straightforward: Azure powers training and inference, while Copilot and agent-based applications monetize those workloads at higher margins. Sustained operating leverage depends on scaling application revenue faster than infrastructure depreciation.

Competitive and Concentration Considerations

Within the hyperscale cohort, Amazon Web Services continues to generate operating margins in the mid-30% range and retains market share leadership. Google Cloud has reported growth approaching the high-40% range as AI workloads accelerate.

Microsoft is deploying capital more aggressively than either competitor while carrying higher backlog concentration through OpenAI’s share of RPO. This concentration strengthens near-term demand visibility but introduces counterparty risk that markets are factoring into valuation.

Capacity expansion is now the decisive competitive variable. Adding one gigawatt in a single quarter is significant, yet competitors are advancing multi-gigawatt pipelines across North America and Europe. The competitive frontier has shifted from model features and developer tools to megawatts secured, energized, and monetized.

Energy as Throughput

Energy availability has emerged as the binding constraint in AI scaling. Microsoft’s partnership with Constellation Energy to facilitate the restart of nuclear capacity at Three Mile Island reflects a pivot toward long-duration baseload agreements extending into the 2050s. The objective is 24/7 carbon-free reliability rather than offset-based procurement.

Microsoft has publicly contracted for more than 10 gigawatts of clean energy capacity globally and continues expanding across nuclear, hydro, wind, and solar platforms. The company is increasingly underwriting grid expansion to secure compute continuity.

AI infrastructure and energy infrastructure are converging. Throughput depends on megawatts as much as on model performance.

Forward Outlook

For Q3, Microsoft guided revenue between $80.65 billion and $81.75 billion and Azure growth of 37% to 38% in constant currency. Management reiterated that demand exceeds supply. Cloud gross margin is expected to decline further year over year as AI infrastructure investments continue.

Capacity constraints are projected to persist through at least the end of fiscal 2026. Azure’s growth trajectory is therefore partially capped by infrastructure delivery speed rather than market opportunity.

Strategic Close

Microsoft is evolving into a vertically integrated AI infrastructure platform spanning silicon, hyperscale campuses, networking, and long-term energy sourcing. Its $50+ billion quarterly cloud base and enterprise software ecosystem provide the cash flow to sustain multi-year capital cycles.

Valuation must now account for capital intensity, depreciation timing, grid risk, and backlog concentration. The recent repricing reflects industrial constraints rather than demand concerns.

AI scaling is capital- and energy-bound. The decisive variable is no longer adoption, but how quickly infrastructure can be financed, powered, and activated to convert backlog into revenue.