Microsoft's $19B Canadian Expansion; Brookfield–Qai Launch $20B AI Platform; India Commits $17.5B to AI

Inside the capital, power, and sovereignty forces reshaping global AI infrastructure

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

If you’re not a subscriber, here’s what you’ve missed so far:

Where the Next Gigawatt of AI Capacity Will Actually Be Built [Inside the New Global Hierarchy Shaped by Power Availability, Policy Alignment, and Platform Capital.]

How Top Investors Arbitrage Renewable Energy Disparity (Instead of Being Crushed by It) [As AI Demand Surges, Grid Constraints Threaten Both Costs and Capacity.]

10 Reports Defining Global Data Center Strategy — Q3 2025 Briefing [We reviewed the 10 most influential reports, investor surveys, and policy briefings released in Q3 2025]

The $1.1 Trillion Global AI Buildout: Lessons from Five Regions [From North America’s $500B surge to South America’s nuclear bets, the first half of 2025 reveals how the next decade of data centers will be shaped.]

Interested in sponsorship? info@globaldatacenterhub.com

In This Issue

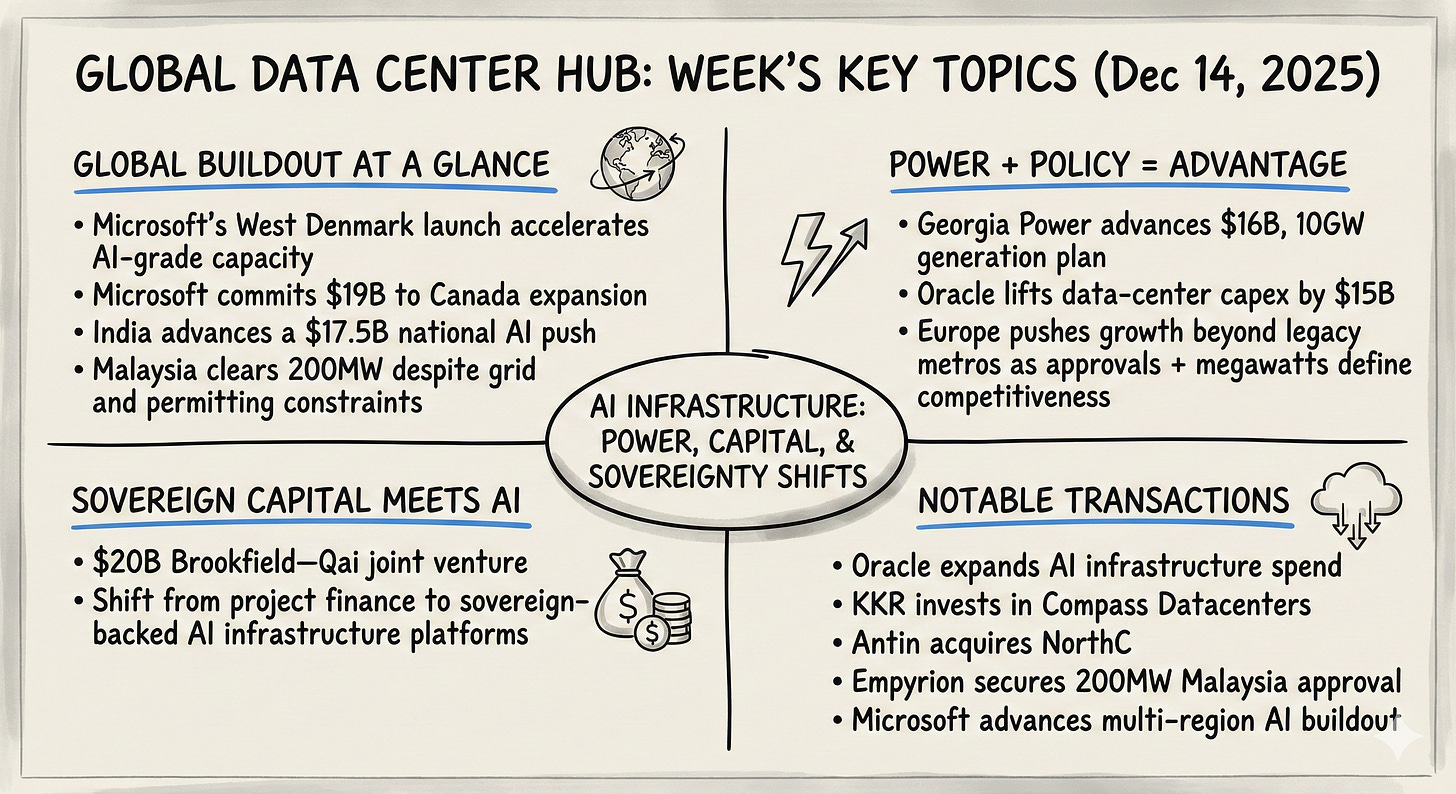

Global Buildout at a Glance — Microsoft’s West Denmark launch, its $19B Canada expansion, India’s $17.5B AI push, and Malaysia’s 200MW clearance show regions accelerating toward AI-grade capacity despite grid and permitting constraints.

Power + Policy = Advantage — Georgia Power’s $16B, 10GW generation plan, Oracle’s $15B data center capex increase, and Europe’s push beyond legacy metros signal that control of megawatts and approvals now defines AI competitiveness.

Sovereign Capital Meets AI — The $20B Brookfield–Qai joint venture marks the shift from project finance to sovereign-backed AI infrastructure platforms.

Notable Transactions — Oracle’s expanded AI spend, KKR’s investment in Compass Datacenters, Antin’s NorthC acquisition, Empyrion’s 200MW Malaysia approval, and Microsoft’s multi-region buildout all point to portfolio-level AI infrastructure scaling.

Dear Friends,

A new phase of AI infrastructure is taking shape defined not by isolated data center builds, but by programmatic capital deployment, power security, and multi-continent scale.

This week made the shift obvious. Microsoft isn’t just adding regions it’s rebalancing capacity across continents, from West Denmark to Canada and India. Oracle’s $15B data center expansion landed alongside a $16B U.S. utility plan to add 10GW, tying hyperscale demand directly to regulated energy. Meanwhile, Brookfield–Qai’s $20B AI platform moves globally, deploying compute where capital, power, and policy intersect.

The message is clear: success in the next decade won’t go to the smartest model, but to those who command megawatts, land, and long-dated capital in unison.

Global Buildout at a Glance

A 1-minute scan of the week’s biggest moves — by region.

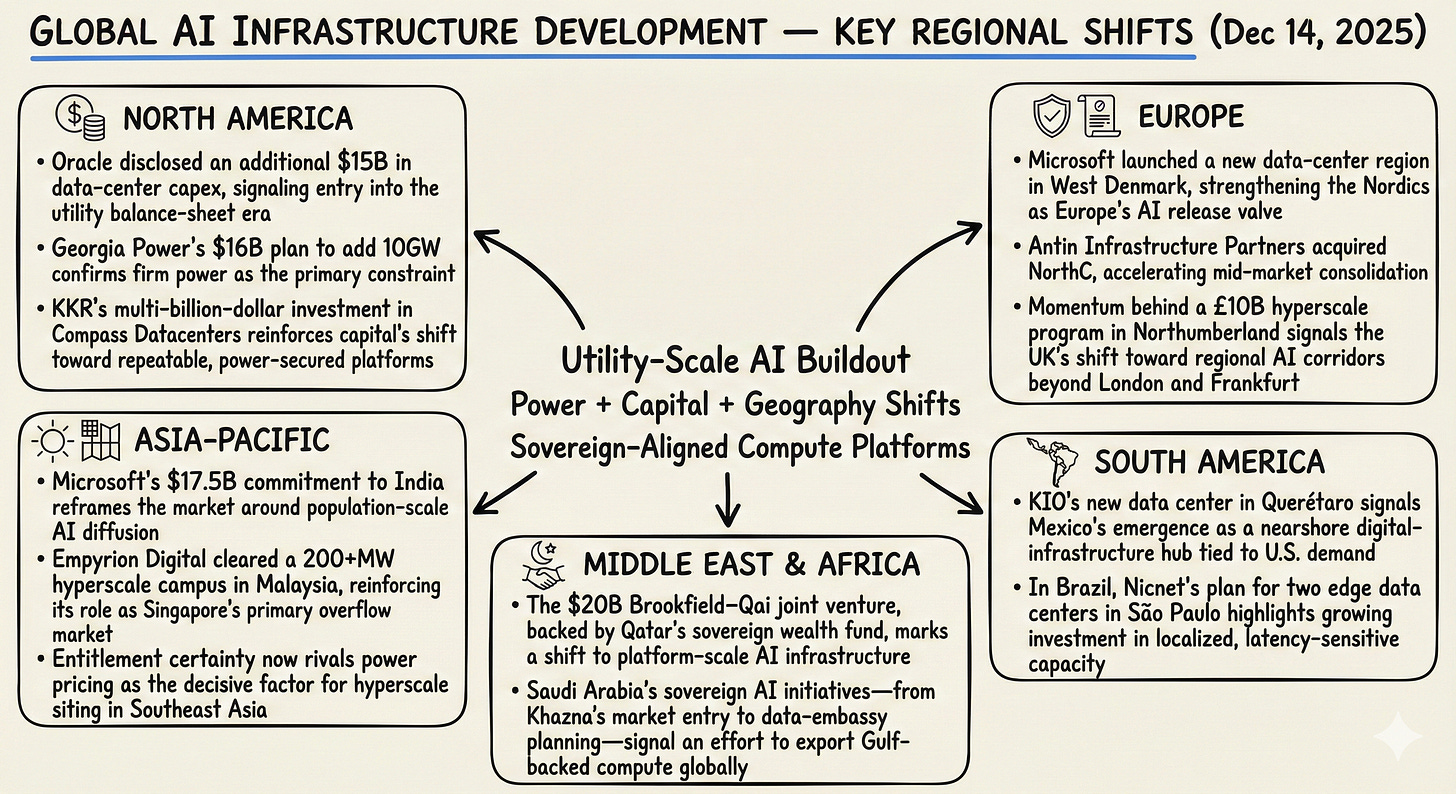

North America — Oracle’s disclosure of an additional $15B in data center capex, paired with Georgia Power’s $16B plan to add 10GW of new generation, signaled that AI infrastructure growth has entered the utility balance-sheet era, with firm power now the primary constraint. Separately, KKR’s multi-billion-dollar investment in Compass Datacenters reinforced capital’s shift toward repeatable, power-secured development platforms over single-asset bets.

Europe — Microsoft’s launch of a new data center region in West Denmark strengthened the Nordics as Europe’s primary release valve for AI growth amid grid congestion elsewhere. Antin Infrastructure Partners’ acquisition of NorthC accelerated consolidation across the mid-market, while momentum behind a £10B hyperscale program in Northumberland signaled the UK’s shift toward regional AI corridors beyond London and Frankfurt.

Asia-Pacific — Microsoft’s $17.5B commitment to India reframed the market around population-scale AI diffusion rather than export-oriented capacity alone. In Southeast Asia, Empyrion Digital’s clearance for a 200+MW hyperscale campus in Malaysia reinforced the country’s role as Singapore’s primary overflow market, where entitlement certainty now rivals power pricing as the decisive factor for hyperscale siting.

Middle East & Africa — The $20B Brookfield–Qai joint venture, backed by Qatar’s sovereign wealth fund, marks a shift to platform-scale, sovereign-backed AI infrastructure deployable beyond Qatar. In parallel, Saudi Arabia’s sovereign AI initiatives from Khazna’s market entry to data-embassy planning and overseas partnerships signal an effort to export Gulf-backed compute globally.

South America — KIO’s new data center in Querétaro signals Mexico’s continued emergence as a nearshore digital infrastructure hub tied to U.S. cloud and enterprise demand. In Brazil, Nicnet’s plan to open two edge data centers in São Paulo highlights growing investment in localized, latency-sensitive capacity as regional networks and enterprise workloads push compute closer to users.

Notable Transactions

Key shifts, structures, and risks across this week’s global deal tape.

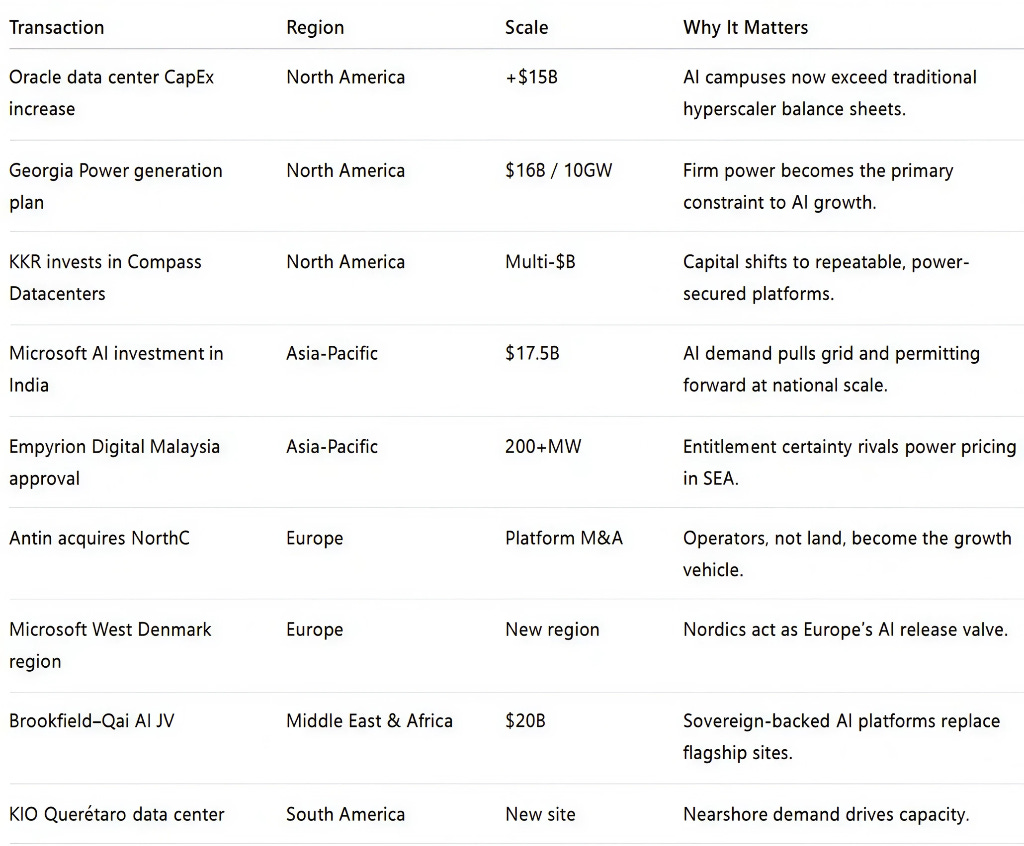

This week confirmed that AI-scale growth is now portfolio-driven: AI infrastructure is financed and executed at program scale, anchored by firm power, utility balance sheets, and sovereign-aligned capital.

Oracle’s additional $15B in North America data center capex and Georgia Power’s $16B, 10GW generation plan made clear that firm power not land or capital is now the gating variable for hyperscale growth, while KKR’s investment in Compass Datacenters reinforced investor preference for repeatable, power-secured platforms.

Across Asia-Pacific, Microsoft’s $17.5B India commitment and Empyrion Digital’s 200+MW Malaysia clearance highlighted how AI demand is pulling forward grid, entitlement, and construction decisions at national scale.

In Europe, Antin’s acquisition of NorthC and Microsoft’s West Denmark launch reinforced operating platforms and the Nordics as release valves for power-constrained growth. In the Middle East & Africa, the $20B Brookfield–Qai joint venture marked the shift from flagship sites to sovereign-backed, globally deployable AI infrastructure platforms.

Across South America, hyperscalers are targeting nearshore and edge opportunities Mexico’s KIO data center and Nicnet’s São Paulo edge expansions show future projects hinge on localized demand, latency, and regulatory clarity rather than just adding capacity.

If you’re enjoying this newsletter, share it with a colleague.

Have a great week.

Global Data Center Hub