Meta’s Nuclear Pivot; KKR’s $2B Platform Bet; Saudi Arabia’s 480MW Launch

Inside the power, capital, and policy shifts driving portfolio-scale AI infrastructure worldwide.

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

If you’re not a subscriber, here’s what you’ve missed so far:

Where the Next Gigawatt of AI Capacity Will Actually Be Built [Inside the New Global Hierarchy Shaped by Power Availability, Policy Alignment, and Platform Capital.]

How to Invest in Data Centers (And the Risks That Actually Matter) [An intelligence synthesis of the reports shaping AI-driven infrastructure, capital allocation, and market direction.]

9 Reports Shaping Global Data Center Strategy — Q4 2025 Intelligence Briefing [An intelligence synthesis of the reports shaping AI-driven infrastructure, capital allocation, and market direction.]

Q4 2025: The Quarter AI Infrastructure Became State Power [How power, capital, and policy fused to redefine the global AI buildout.]

Interested in sponsorship? info@globaldatacenterhub.com

In This Issue

Global Buildout at a Glance — Meta’s nuclear-backed AI strategy, Crusoe’s 1.8GW campus approval, a $2B European platform raise, and Saudi Arabia’s 480MW launch show AI capacity accelerating where power and land remain controllable.

Power + Policy = Advantage — Nuclear PPAs, vertically integrated generation, and sovereign-priced energy are redefining AI competitiveness, shifting development toward markets with faster approvals and firmer power access.

Capital Consolidates Platforms — KKR and Oak Hill’s $2B Europe bet and DayOne’s $2B+ raise confirm the move from single assets to platform-scale AI infrastructure.

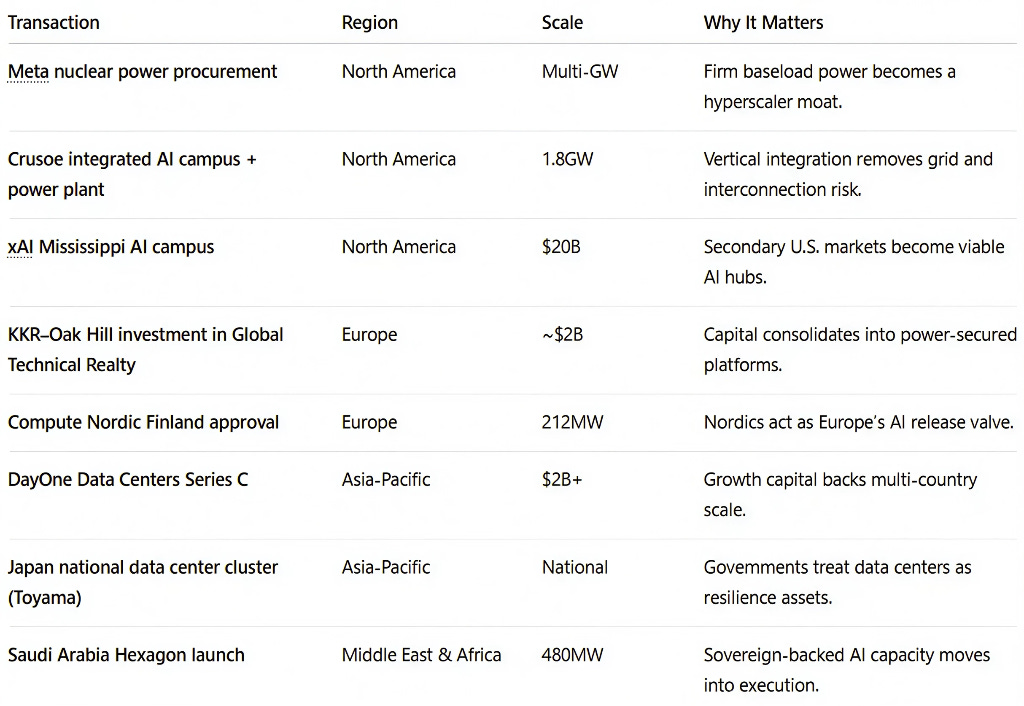

Notable Transactions — Meta’s nuclear commitments, Crusoe’s 1.8GW build, Saudi Arabia’s Hexagon launch, and fresh institutional capital in Europe and APAC signal portfolio-level scaling of AI infrastructure.

Dear Friends,

A new phase of AI infrastructure is emerging defined less by individual data center announcements and more by programmatic capital, secured power, and multi-region execution.

This week made the shift unmistakable. Meta moved upstream into nuclear-backed power to underwrite AI growth in the U.S., while Crusoe advanced a fully integrated 1.8GW campus that pairs generation with compute. In parallel, nearly $2B of institutional capital flowed into a pan-European platform, Saudi Arabia launched a 480MW sovereign-scale facility, and APAC platforms raised growth capital to accelerate multi-market expansion.

The signal is consistent across regions: the next decade of AI infrastructure will be won not by who designs the smartest architecture, but by who controls megawatts, land, approvals, and long-dated capital at scale and in sync.

Global Buildout at a Glance

A 1-minute scan of the week’s biggest moves — by region.

North America — Meta’s multi-gigawatt nuclear procurement and Crusoe’s 1.8GW Wyoming campus show U.S. AI infrastructure is now power-first and balance-sheet-driven, where firm generation and vertical integration matter more than proximity to legacy hubs. xAI’s $20B Mississippi commitment underscores the rise of secondary markets with executable power and political support.

Europe — Nearly $2B of institutional capital flowing into Global Technical Realty confirms Europe’s pivot toward platform consolidation as grid congestion and permitting tighten. At the same time, Finland’s approvals for 212MW and 120MW-class projects underscore the Nordics’ role as Europe’s primary release valve for AI growth, absorbing demand that core metros can no longer accommodate.

Asia-Pacific — DayOne Data Centers’ $2B+ Series C confirms continued growth capital for multi-country platforms, while Japan’s Toyama cluster signals compute decentralization beyond Tokyo. Summit Group’s first data center in Bangladesh highlights early-stage expansion into population-scale, underbuilt markets where local power and regulatory execution matter most.

Middle East & Africa — Saudi Arabia’s 480MW Hexagon launch demonstrates how sovereign-backed capacity is moving from planning to execution, pairing energy advantage with national AI ambitions. In East Africa, RailTel’s planned data center in Ethiopia represents an early but foundational step toward state-led digital infrastructure formation.

Notable Transactions

Key shifts, structures, and risks across this week’s global deal tape.

This week reinforced a clear reality: AI-scale growth is now portfolio-driven, executed through programmatic capital, firm power access, and sovereign alignment rather than isolated projects.

In North America, Meta’s move into multi-gigawatt nuclear power procurement and Crusoe’s approval for a fully integrated 1.8GW power-paired campus underscored that firm generation not land or equity is the binding constraint for hyperscale expansion. xAI’s $20B Mississippi commitment further validated the shift toward secondary markets with executable power and political support.

Across Europe, KKR and Oak Hill’s nearly $2B investment in Global Technical Realty signaled investor preference for repeatable, power-secured platforms as grid congestion and permitting tighten. Concurrent approvals for 200MW-class projects in Finland reinforced the Nordics’ role as Europe’s primary release valve for AI demand.

In Asia-Pacific, DayOne’s $2B+ Series C highlights growth capital for multi-country expansion, while Japan’s largest data center cluster shows national efforts to shift compute to power-rich regions.

Across the Middle East & Africa, Saudi Arabia’s 480MW Hexagon moves from planning to execution, while RailTel’s Ethiopia project shows how state-linked assets are shaping emerging cloud ecosystems.

If you’re enjoying this newsletter, share it with a colleague.

Have a great week.

Global Data Center Hub