Meta’s $72B AI Power Play Is a Data Center War Plan in Disguise

Meta just raised its CapEx to $72B, fueling the largest data center expansion in tech history. But this isn’t about AI hype. It’s about building the physical empire that AI will run on.

Welcome to Global Data Center Hub. Join 1000+ investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

Everyone’s talking about AI.

Meta is building the battleground.

In a world obsessed with the next large language model, Meta is quietly rewriting the rulebook.

Not through code.

Through concrete.

In May 2025, Meta raised its capital expenditure forecast to a jaw-dropping $64–72 billion. The largest in the company’s history and one of the most aggressive infrastructure commitments the tech world has ever seen.

And while headlines screamed “AI arms race,” the real story slipped past most analysts:

Meta is building the physical operating system for the future of artificial intelligence.

The Infrastructure Play Hidden Inside Meta’s AI Narrative

Let’s break it down:

1. Compute Power: 1.3M GPUs by Year-End

Meta plans to deploy over 1.3 million GPUs—hardware that powers everything from training LLMs to real-time inference and recommendations.

That’s not a software strategy.

That’s a compute-first land grab.

2. 1GW of New Capacity Going Online in 2025

That’s more than what some national governments deploy across entire cloud platforms. And it’s just one year of Meta’s rollout.

3. Massive Data Center Projects:

Wisconsin: ~$1 billion hyperscale investment with regional incentives, tapping into low-cost, reliable power in the Midwest.

Louisiana: A 2GW+ hyperscale campus in Richland Parish. Estimated to cover an area "the size of Manhattan."

Temple, TX & Kuna, ID: Restarted construction with AI-optimized architecture after a 2022 pause. These aren’t retrofits. They’re redesigned from scratch for high-density AI workloads.

This is not about chasing OpenAI or Google in model development.

It’s about owning the rails every model must run on.

The Strategic Shift: From Social to Sovereignty

Mark Zuckerberg no longer sees Meta as just a social media company.

He sees it as a digital infrastructure empire.

And this empire is built to serve five core pillars:

Meta AI – the company’s universal assistant for 1B+ users

Llama 4 – Meta’s flagship open-source LLM

Ads – still Meta’s cash cow, now AI-enhanced

Messaging – turning WhatsApp into an AI-native platform

AI devices – including the next-gen Ray-Ban smart glasses

Each of these needs low-latency, high-performance infrastructure.

So instead of renting cloud space, Meta is building its own AI nation-state, one data center at a time.

The Cost? Billions in Trade Risk

Here’s the kicker: Meta isn’t just spending more because it wants to. It’s also spending more because it has to.

Why?

Because the supply chain is melting under the weight of tariffs, trade wars, and regulatory volatility.

145% tariffs on Chinese imports are driving up infrastructure hardware costs.

Global trade tensions are straining supply chains for GPUs, power gear, and networking hardware.

Meta CFO Susan Li confirmed that this uncertainty forced them to raise their CapEx forecast, just to maintain the buildout timeline.

They’re also signaling a move toward pre-positioned build sites, ready to go vertical on short notice as capital and capacity align.

That’s not cost optimization.

That’s war-time logistics.

What Makes Meta Different?

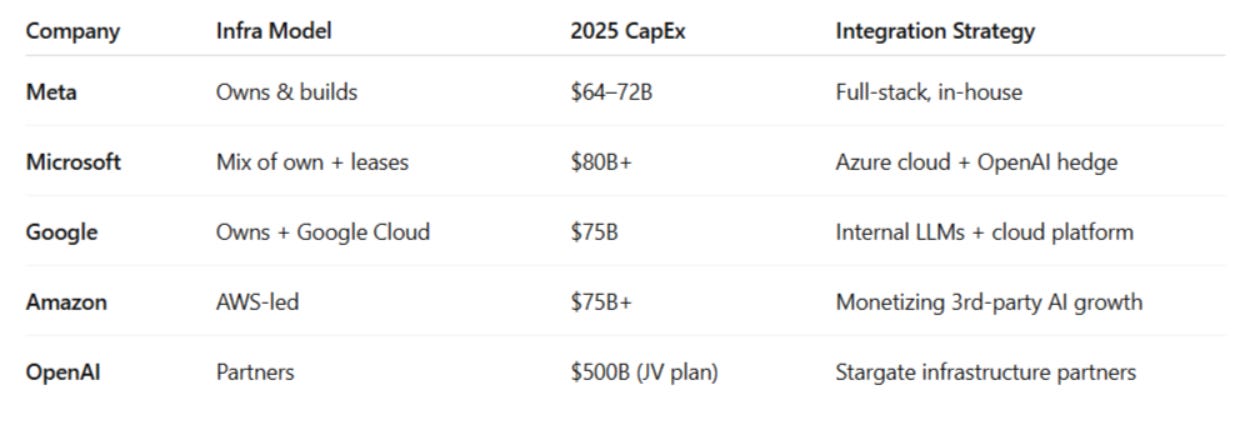

Let’s compare Meta’s playbook to the rest of Big Tech:

Meta is the only hyperscaler going fully vertical: designing, owning, and operating nearly all of its own AI infrastructure.

That’s more expensive. But it’s also:

More customizable

More defensible

Less exposed to pricing volatility or cloud margins

Built for long-term control

And that’s the moat Zuckerberg is betting on.

The AI Infrastructure Wars Are Officially On

Meta isn’t just playing offense. It’s reshaping the battlefield.

With this kind of CapEx and operational control, Meta could become the “compute landlord” of the AI era—forcing competitors, startups, and even governments to run on its rails.

And this isn’t a one-year spike.

Meta is expected to sustain this level of spending through the decade.

The implications are enormous:

For real estate: hyperscale demand will push new zoning and land prices

For energy: 2GW data centers will reshape local grids

For geopolitics: nations that can’t attract this CapEx may fall behind

For AI startups: the infrastructure bottleneck is becoming a survival threat

This isn’t just an arms race.

It’s an infrastructure war.

And Meta is building like it plans to win.

Final Thought: The Cloud Was an Abstraction. AI is an Empire.

The cloud let us pretend that infrastructure didn’t matter.

But AI has brought us back to the physical world.

Every model needs metal.

Every inference run needs electrons.

Every insight needs a supply chain of silicon, fiber, and cooling.

And those who control that chain?

They don’t just serve the future.

They shape it.

Meta isn’t building for today’s revenue.

It’s building to own tomorrow’s terrain.

One More Thing

I publish daily on data center investing, AI infrastructure, and the trends reshaping global data center markets.

Join 900+ investors, operators, and innovators getting fresh insights every day and upgrade anytime to unlock premium research trusted by leading investors and developers.