Meta + Blue Owl’s $27B Bet: Is This the US Blueprint for Financing AI Data Centers?

Inside the largest private credit deal in history and how it could redefine how America funds the AI buildout.

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

In October 2025, Meta Platforms and Blue Owl Capital closed a $27 billion financing for the Hyperion data-center campus in Richland Parish, Louisiana the largest private-credit transaction ever executed.

It didn’t just fund another hyperscale build. It redefined how America might finance the trillion-dollar AI infrastructure boom.

A $27 Billion Experiment in Financial Engineering

At first glance, Hyperion looks like a standard mega-campus: 4 million square feet, 2–5 GW of power, thousands of jobs.

But beneath the surface lies a financing structure that could reset how every hyperscaler builds in the United States.

Meta owns just 20% of the joint venture. Blue Owl-managed funds own 80%.

Through a special purpose vehicle (SPV) arranged by Morgan Stanley, the project issued $27 billion in A+-rated debt and $2.5 billion in equity, anchored by PIMCO ($18 B) and BlackRock ($3 B).

Meta keeps operational control but not the debt. It leases back the finished campus under a long-term operating lease, converting what would have been CapEx into predictable OpEx.

It’s the first hyperscale project to combine off-balance-sheet treatment, investment-grade credit, and a residual value guarantee (RVG) three ingredients that together create an entirely new asset class: AI infrastructure-backed securities.

Why It Works and Why It Matters

Meta will spend $60–65 billion on CapEx in 2025, with the majority going to AI infrastructure. Across Big Tech, total AI-related CapEx will surpass $400 billion this year, up 70% from 2024.

Financing that through traditional corporate debt would erode credit ratings and squeeze flexibility. Private credit solves that problem.

By letting Blue Owl fund 80% of the cost through its institutional investors, insurance companies, and pensions hungry for long-duration yield, Meta preserves its balance sheet while locking in control of one of the world’s largest compute campuses.

The debt priced at +225 bps over Treasuries, roughly double the spread on Meta’s own corporate bonds. Yet for insurance investors, the yield looks attractive. They get Meta’s implied credit strength thanks to the RVG, which guarantees the project’s residual value for 16 years without the correlation risk of owning Meta equity.

That guarantee, according to S&P, was “the linchpin” that earned the debt its A+ rating. It effectively transfers technology-obsolescence risk (the danger that AI chips age faster than the building) back to Meta.

Private Credit Steps Into the Power Lane

Until recently, private credit meant mid-market lending. Now it means infrastructure enablement of multi-billion-dollar, asset-backed, long-duration deals that banks can’t (or won’t) hold.

Morgan Stanley estimates that between 2025 and 2028, $800 billion of private-credit capital will be required to finance AI data centers, renewable power, and fiber networks roughly a third of the $2.9 trillion total CapEx expected.

Blue Owl’s $145 billion credit platform sits at the center of this shift. It can mobilize tens of billions per transaction, tapping insurers, pensions, and sovereigns. For those investors, AI campuses resemble infrastructure bonds more than tech risk: long-term leases, strong sponsors, and predictable cash flow.

The Hyperion deal marks the convergence of two trends:

Tech companies offloading CapEx to preserve ratings and accelerate buildouts.

Private-credit giants scaling up to replace bank balance sheets as long-duration lenders.

Together, they create a new feedback loop: hyperscalers design, private credit funds, insurers hold.

Power, Scale, and the Louisiana Test

Hyperion isn’t just financially massive; it’s electrically massive. Entergy Louisiana will build 3 GW of new generation capacity including three new gas-fired plants to serve Meta’s load by 2028.

That’s enough electricity for four million American homes.

The campus will anchor Louisiana’s digital-energy corridor, but it also raises a new question: How far can AI data centers stretch the U.S. grid before politics and ratepayers push back?

Meta has pledged 100% renewable sourcing by 2030, yet the near-term reality is gas and transmission lines. Power, not capital, may become the real bottleneck.

A Template for Future Deals

Advisors already call Hyperion a “template transaction.”

Why? Because it proves that a hyperscaler can:

Secure off-balance-sheet treatment without losing control.

Tap insurance-grade capital through structured debt.

Transfer technology risk back to itself through a guarantee.

Preserve ratings and liquidity while scaling CapEx by tens of billions.

Expect Microsoft, Amazon, and Google to follow. Each is exploring SPV-based or programmatic financing platforms that mirror Hyperion’s architecture. Microsoft’s rumored partnership with BlackRock’s GIP, Oracle’s Project Stargate with Blue Owl, and Google’s financing support for TeraWulf all trace their lineage to the same idea: AI infrastructure as a securitized asset class.

The Macro Shift: From Bank Lending to Asset-Backed Credit

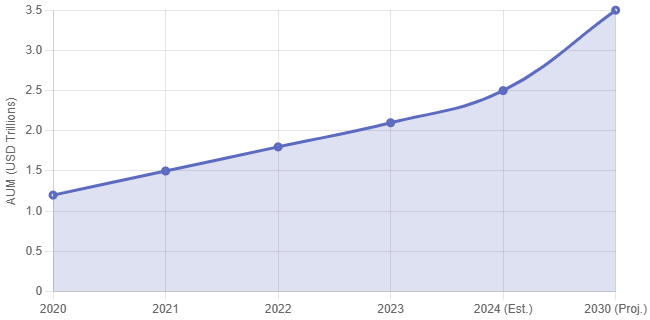

Bank balance sheets are shrinking under Basel III capital rules and duration-mismatch constraints. Meanwhile, private credit has grown into a $2.1 trillion market projected to reach $3.5 trillion by 2030.

Asset-backed finance (ABF) is the next frontier. KKR projects that global ABF could reach $9 trillion by 2029, outpacing corporate lending.

What started as corporate lending is evolving into digital infrastructure securitization where yield-seeking investors finance hyperscale campuses, battery storage, subsea cables, and renewable interconnects through long-duration debt anchored by blue-chip tenants.

Hyperion just gave that model its first trillion-dollar-scale proof of concept.

The Risks Beneath the Hype

Still, not everyone’s convinced.

Morgan Stanley’s CIO Lisa Shalett warned that AI has become a “one-note market,” with 75% of S&P 500 returns driven by AI-related stocks. Paul Kedrosky called deals like Hyperion “speculative finance,” citing thin equity cushions (~8–10%) and potential obsolescence within 5–7 years.

If AI workloads or margins stumble, these SPVs could echo the dark-fiber overbuild of the 1990s vast capacity sitting idle while debt remains outstanding.

And the power mismatch looms larger still. Grid Strategies estimates U.S. data-center demand will rise +60 GW by 2030 roughly Italy’s peak load. Yet utility infrastructure builds at a fraction of that speed.

The question isn’t just whether private credit can fund the AI boom. It’s whether the grid, regulators, and technology cycles can sustain it.

Why This Matters for Investors, Operators, and Policymakers

Investors: Hyperion proves you can earn fixed-income-like returns from AI infrastructure if the sponsor’s credit and RVG are bulletproof. Expect more insurance portfolios allocating to “AI-linked infrastructure debt.”

Operators: The SPV model turns build-own into build-operate-lease-and-monetize. It accelerates capital recycling but demands precision in design, commissioning, and uptime because the rating case now depends on operational metrics.

Policymakers: States like Louisiana, Texas, and Virginia are now competing as AI infrastructure jurisdictions. Their success will hinge less on land and incentives and more on power availability, permitting speed, and regulatory stability.

Conclusion: A Blueprint or a Warning?

Meta’s $27 billion bet with Blue Owl isn’t just a financing milestone. It’s the prototype for how the U.S. may fund its next wave of AI infrastructure through private credit, securitized risk, and corporate guarantees instead of traditional debt.

If it works, it could unlock hundreds of billions in off-balance-sheet capital, accelerating America’s AI advantage. If it doesn’t, it could expose the fragility of financing ultra-short-cycle technology with ultra-long-cycle credit.

Either way, Hyperion has redrawn the map not just of data centers, but of how capital, power, and compute now converge.