Meta $135B AI CapEx; Nvidia–CoreWeave $2B Integration; Indonesia, Saudi Arabia & UK Shift Global Compute

Inside the capital, power, and policy shifts redefining global AI infrastructure

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

If you’re not a subscriber, here’s what you’ve missed so far:

Where the Next Gigawatt of AI Capacity Will Actually Be Built [Inside the New Global Hierarchy Shaped by Power Availability, Policy Alignment, and Platform Capital.]

How to Invest in Data Centers (And the Risks That Actually Matter) [An intelligence synthesis of the reports shaping AI-driven infrastructure, capital allocation, and market direction.]

9 Reports Shaping Global Data Center Strategy — Q4 2025 Intelligence Briefing [An intelligence synthesis of the reports shaping AI-driven infrastructure, capital allocation, and market direction.]

Q4 2025: The Quarter AI Infrastructure Became State Power [How power, capital, and policy fused to redefine the global AI buildout.]

Interested in sponsorship? info@globaldatacenterhub.com

In This Issue

Global Buildout at a Glance — From Meta and Microsoft resetting North American AI infrastructure to Indonesia’s $4.5B hyperscale push and Saudi Arabia refocusing megacity ambition around compute, every region moved toward AI-ready capacity.

Power + Policy = Advantage — The UK’s AI Growth Zones, NextEra’s 15GW U.S. generation target, and Australia’s 500MW Sydney filing reinforce a single reality: grid access and permitting velocity now define who can scale.

Sovereign and Strategic Capital Rise — Saudi Arabia, France, and Kenya signal how state alignment, cloud sovereignty, and public-private structures are reshaping where AI workloads land.

Notable Transactions — Nvidia’s $2B CoreWeave investment, Blackstone’s ₹10,000 crore Chennai park, and Digital Edge’s $4.5B Indonesia campus show capital stacks shifting from incremental expansion to platform-scale commitments.

Dear Friends,

A new phase of AI infrastructure is emerging defined not by isolated data center announcements, but by programmatic capital deployment, power security, and global scale.

This week made the shift clear. Meta and Microsoft are normalizing nine-figure AI capex, setting a new floor for compute investment. Nvidia’s $2B stake in CoreWeave collapses the line between silicon and infrastructure. Power has moved upstream: U.S. developers are underwriting AI demand years ahead, Europe ties data centers to industrial policy, Asia locks in land and megawatts, and sovereign moves Saudi Arabia’s compute pivot and Kenya’s first public cloud region show AI is now treated as national infrastructure.

The message is clear: the next decade will be won not by better models, but by those who can control power, land, and long-dated capital at scale and across continents.

Global Buildout at a Glance

A 1-minute scan of the week’s biggest moves — by region.

North America — Meta and Microsoft’s defense of record data-center spending, combined with Nvidia’s $2B investment in CoreWeave, reinforced a clear U.S. pattern: AI infrastructure growth is concentrating where power and supply chains are already secured. In parallel, NextEra’s plan to target 15GW of new generation for data-center hubs shows utilities increasingly underwriting AI demand, turning firm power not capital into the decisive constraint.

Europe — The UK’s designation of DataVita North Lanarkshire as an AI Growth Zone and France’s 250MW Bordeaux proposal show AI compute being absorbed into industrial policy, with planning speed and grid access now core advantages. At the same time, Google’s Austria approval signals Central Europe’s return as a release valve for power-constrained Tier-1 markets.

Asia-Pacific — Digital Edge’s $4.5B Indonesia hyperscale campus, Blackstone’s ₹10,000 crore Chennai park, and Goodman’s 500MW Sydney filing underscored that APAC’s next wave of AI capacity is moving to markets willing to lock in land and megawatts early. The common thread is national-scale coordination between developers, utilities, and capital providers, rather than incremental, tenant-led expansion.

Middle East & Africa — Saudi Arabia’s reported pivot from The Line megacity toward data-center-centric development reinforced the Kingdom’s view of compute as sovereign infrastructure. In East Africa, the iXAfrica–Oracle partnership launching Kenya’s first public cloud region positioned Nairobi as a regional anchor, signaling that cloud sovereignty is now a development catalyst.

South America — Brazil’s advance toward AI-capable data centers, led by Engemon’s new build, reflects a pragmatic model: targeted capacity aligned with enterprise and sovereign demand, prioritizing localized compute, latency control, and regulatory clarity over sheer megawatt scale.

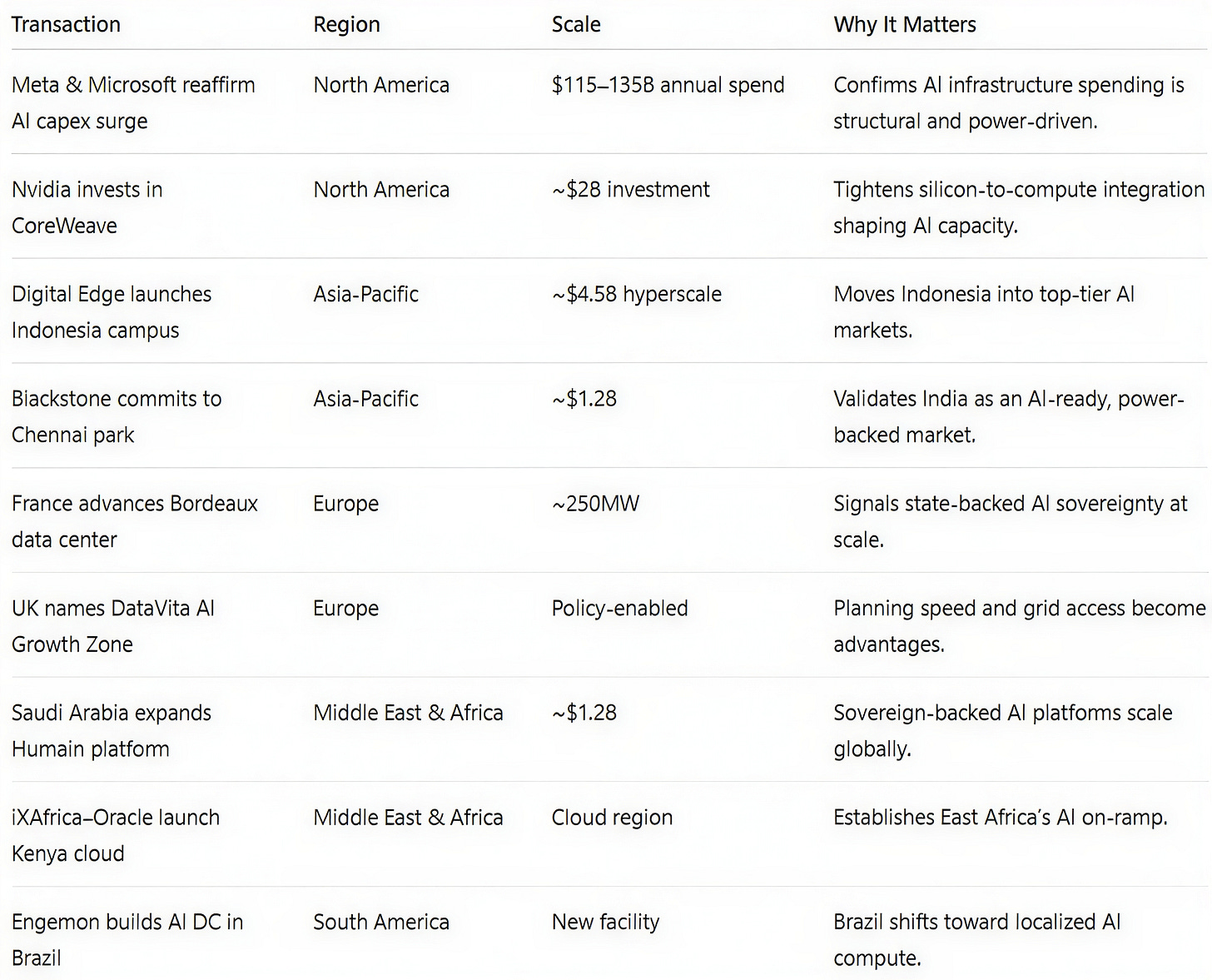

Notable Transactions

Key shifts, structures, and risks across this week’s global deal tape.

This week confirmed that AI-scale growth is now platform-driven, with capital deployed in repeatable programs anchored by secured power, long-term capital, and rising sovereign alignment.

Nvidia’s $2B investment in CoreWeave underscored the shift toward vertically integrated AI infrastructure, where silicon providers shape where and how capacity is built. In parallel, U.S. utilities made clear that firm generation not land or equity is the binding constraint, with power build-outs explicitly tied to data-center demand.

In Asia-Pacific, Digital Edge’s $4.5B Indonesia campus and Blackstone’s ₹10,000 crore Chennai park show AI demand accelerating grid commitments, land banking, and permitting at national scale. These are not speculative expansions but long-horizon platforms built to absorb hyperscale and AI workloads.

In Europe, France’s 250MW Bordeaux plan and the UK’s AI Growth Zones point to policy-enabled platforms, while Google’s Austria and Nordic projects position power-rich, cooler markets as relief for constrained Tier-1 metros. In the Middle East and Africa, Saudi Arabia’s compute push and Kenya’s Oracle-backed cloud launch reflect a shift toward sovereign-aligned, function-first digital infrastructure.

Across South America, activity remains more targeted but telling. Brazil’s AI data-center build and enterprise-led expansions reflect a focus on localized demand, latency, and regulatory clarity rather than sheer megawatt accumulation.

If you’re enjoying this newsletter, share it with a colleague.

Have a great week.

Global Data Center Hub

Sharp analysis on the power-first constraint flipping traditional datacenter economics. The Nvidia-CoreWeave integration really underscores how silicon providers are now directly underwriting infrastrucure rather than just hardware sales. I've watched similar dynamics play out in renewable energy siting where regulatory velocity mattered way more than captial cost, and seeing this shift hit AI compute is kinda wild. The sovereign angle in Kenya and Saudi Arabia probably signals a whole new tier of geopolitcal complexity most operators aren't prepped for yet tbh.