How Amazon’s $20B AI Infrastructure Deal Just Redrew the Map for U.S. Tech Growth

This isn’t just cloud expansion. It’s a blueprint for how America wins the AI race by fusing compute, carbon-free power, and community reinvention.

Welcome to Global Data Center Hub. Join 1400+ investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

Executive Summary

Amazon will invest $20 billion in Pennsylvania to construct multiple hyperscale campuses designed to support cloud and AI workloads at scale.

Two sites have been confirmed: one adjacent to the Susquehanna nuclear plant and another on a redeveloped steel mill site in Falls Township.

After a direct nuclear interconnection plan was blocked by regulators, Amazon and Talen Energy restructured the deal into a 1.9-gigawatt front-of-meter power purchase agreement, offering stable, carbon-free power through 2042.

The move signals a strategic shift from reliance on intermittent renewables toward firm baseload energy optimized for round-the-clock AI workloads.

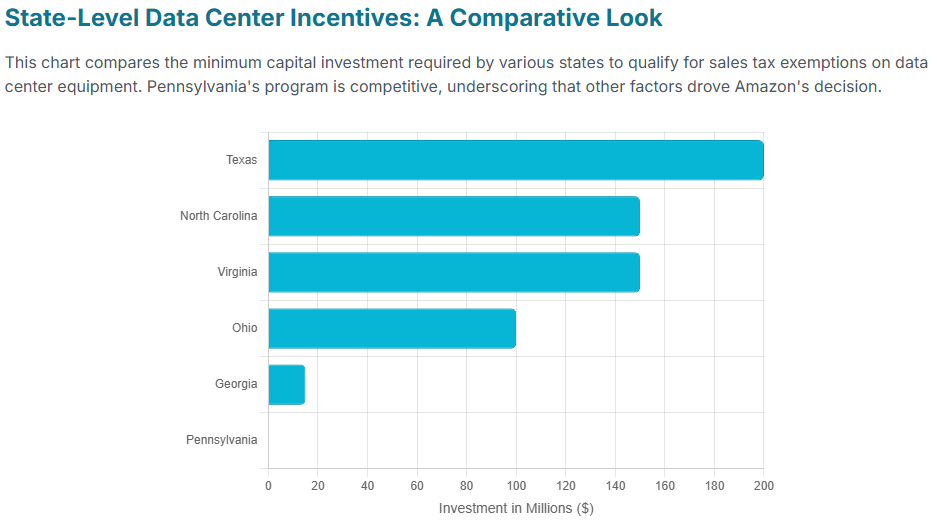

Pennsylvania won this project not with financial subsidies, but with speed. A fast-tracked permitting framework, skilled labor pool, and industrial land reuse made the state a launchpad for Amazon’s broader $30 billion U.S. AI expansion.

This investment redefines how states compete for hyperscale infrastructure and signals that energy, not real estate, is now the primary constraint

What Happened

In June 2025, Amazon Web Services and Pennsylvania Governor Josh Shapiro announced a landmark partnership. Amazon will build a multi-site network of cloud and AI campuses across the state, beginning in Salem Township and Falls Township.

Salem offers proximity to nuclear power. Falls provides legacy industrial land already zoned and grid-connected.

Amazon’s original plan involved a 480-megawatt direct power connection from the nearby Susquehanna nuclear plant. That agreement was rejected by the Federal Energy Regulatory Commission, citing grid integrity concerns and cost implications for other ratepayers.

Rather than abandon the site, Amazon and Talen Energy responded by restructuring the agreement into a 1.9-gigawatt financial power contract. The electricity will now flow into the regional PJM grid, with Amazon matching its draw to nuclear generation through long-term settlement mechanisms.

In tandem, Pennsylvania committed $10 million toward workforce training. Amazon added technician apprenticeships, pre-employment bootcamps, and a community innovation fund. The entire package positions the state to become a long-term AI infrastructure corridor

Why It Matters

Amazon’s Pennsylvania pivot highlights the new formula for scaling AI compute in a world of physical bottlenecks.

This isn’t just about data center capacity. It’s about long-duration power, permitting certainty, and regional energy planning that matches exponential workload growth.

1. Firm Power Is Now Strategic Infrastructure

AI data centers are not intermittent workloads. They operate at high density, full duty cycles, and require consistent megawatt-scale delivery.

The nuclear PPA offers Amazon predictable, carbon-free power with no reliance on peak pricing or weather variability. It reduces risk and aligns directly with infrastructure investment horizons. In short, this is not an ESG play. It is operational necessity.

2. Long-Term Contracts Lock in Price and Stability

Natural gas and wholesale electricity prices are increasingly volatile. AI workloads, by contrast, are persistent.

Amazon’s 17-year contract allows it to hedge power costs while providing energy security across multiple facilities. This turns electricity from a cost center into a strategic input, protecting both margin and uptime.

3. AI Workloads Have Rewritten the Power Curve

Yesterday’s data centers drew 5 to 10 kilowatts per rack. Tomorrow’s AI clusters will exceed 30 to 60 kilowatts per rack, often with liquid cooling and continuous GPU utilization.

This demand profile turns the data center into a utility-scale energy customer. Nuclear power, with its high uptime and low emissions, is uniquely suited to meet the next decade of AI infrastructure demands.

4. The New AI Stack Begins with Power

AI infrastructure used to be chips, code, and buildings.

Today it starts with megawatts. Amazon’s pivot signals that energy access now defines site selection, project velocity, and cost competitiveness. The winners are those who can secure long-term power at scale, not just fiber and land.

5. U.S. Clean Energy Assets Are Now Competitive Moats

Keeping Susquehanna’s nuclear generation online through 2042 doesn’t just benefit Amazon. It supports regional reliability, preserves skilled jobs, and enhances U.S. energy security.

Amazon gets predictable clean power. Pennsylvania gets tax revenue, employment, and a leadership position in digital infrastructure. This is the new blueprint for public-private partnerships in the AI era.

What This Means

For Investors

This is a new pricing benchmark for firm, long-duration energy tied to digital infrastructure. Players like Talen, Constellation, and uranium suppliers stand to benefit as hyperscalers race to lock in clean power. Expect accelerated capital deployment into nuclear, geothermal, and grid-tied baseload generation.

For Operators

Energy is no longer a line item. It is the foundation. Operators that can pre-secure power at scale, particularly in regulatory environments that support fast-track PPAs, will command hyperscaler attention. In regions like Southeast Asia, Africa, and Latin America, this could drive a shift toward energy-aligned joint ventures.

For Policymakers

The playbook has changed. Economic development now means offering speed, energy alignment, and community support. Pennsylvania’s win came from aligning permitting, training, and energy assets into a cohesive package. Other states will need to respond or risk being left behind

The Bottom Line

Amazon’s $20 billion AI expansion in Pennsylvania is not just a tech announcement.

It is a redefinition of how hyperscale infrastructure will grow in the age of AI. Clean firm power, regulatory speed, and physical siting are the new bottlenecks and the new competitive advantages.

The next frontier won’t be claimed by those with the biggest land banks or cheapest labor.

It will be secured by those who control long-term access to energy, streamline execution, and can scale capacity without sacrificing uptime.

If your strategy begins with compute but ends without a megawatt plan, you are already behind.