Amazon and Nvidia Reaffirm AI Data Center Demand: A Strategic Shift in Global Compute

Amazon and Nvidia just made it clear: AI infrastructure demand isn’t slowing it’s entering a smarter, more strategic era. Here’s what’s shifting and what it means for the future of global compute.

Welcome to Global Data Center Hub. Join 900+ investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

In This Issue

Global Data Center News Roundup — Why energy, sovereignty, and specialization are reshaping infrastructure investment worldwide.

Amazon and Nvidia’s Strategic Signal — What two of the biggest players just revealed about the real future of AI infrastructure.

The New Growth Bottlenecks — How energy availability, sovereign policy, and hyperscale design constraints are rewriting the playbook.

New Global Hotspots — Where next-generation AI infrastructure is scaling fastest, from Hyderabad to Abu Dhabi.

Dear Reader,

The AI infrastructure boom isn't slowing down. It’s entering a smarter, more strategic phase.

This week, Amazon and Nvidia reaffirmed that AI data center demand remains strong, despite market fears, recession worries, and growing energy constraints. Their message is clear: scaling AI infrastructure isn’t just about ambition anymore. It’s about power, policy, and precision.

Infrastructure growth is evolving from a race for capacity to a race for energy-secure, sovereign-aligned, AI-specialized ecosystems.

In this issue, we dive deep into:

How Amazon and Nvidia’s strategies signal a fundamental shift in global infrastructure expansion.

Why energy constraints, sovereign data policies, and hyperscale specialization are now the primary levers of success.

Where the next great AI infrastructure hubs are rising and what it will take to compete.

The next decade of AI infrastructure won’t belong to those who build the biggest. It will belong to those who build smartest, fastest, and where it matters most.

Let’s dive in.

Global Perspective: What’s Happening in Data Centers Around the World

North America

Amazon Freezes Global Data Center Projects Amid Power Crunch Amazon has joined Microsoft in pausing new data center developments, signaling growing pressure from energy shortages and permitting delays. This shift could reset timelines for AI infrastructure expansion across key global markets.

Tariffs on Building Materials Could Raise U.S. Data Center Costs New U.S. tariffs on steel, aluminum, and construction components threaten to drive up data center development costs by 10–15%. Rising expenses could slow down hyperscaler expansion plans just as AI infrastructure demand accelerates.

Stonepeak Commits $1.5B to New Hyperscale Venture Stonepeak launched Montera Infrastructure with a $1.5 billion equity commitment focused on North American hyperscale projects. The move highlights sustained private equity confidence despite growing regulatory and energy headwinds.

Europe

UK’s 5GW AI Data Center Ambition Takes Center Stage Frontier and Ethos are partnering to build one of Europe’s largest AI-focused campuses, targeting the UK’s booming demand for sovereign compute. If completed, it would mark a transformative expansion of Europe’s AI infrastructure footprint.

Marseille’s Digital Boom Raises Sustainability Alarms Marseille’s meteoric rise as a digital hub is straining local power grids, real estate, and water resources. The city’s success story highlights the hidden costs of hyperscale and subsea infrastructure growth in dense urban areas.

Scotland Leverages Renewables to Power AI Infrastructure Scotland is positioning itself as a leader in green AI infrastructure by channeling its abundant renewable energy into data center projects. This sustainable focus could give Scotland an edge as AI-related power demands skyrocket.

Asia-Pacific

Adani's $10B Push Aims to Make India an AI Infrastructure Giant Adani’s $10 billion AI data center expansion is repositioning India as a heavyweight in global AI infrastructure development. The investment signals a power shift as Asia stakes a stronger claim in the AI economy.

Keppel’s $580M Fund Backs Southeast Asia’s AI Future Keppel’s latest fund closure targets AI and cloud data centers across Singapore, Vietnam, and Malaysia. The deal confirms institutional investor appetite for hyperscale infrastructure in fast-growing digital markets.

Viettel Breaks Ground on Vietnam’s First Hyperscale Facility Viettel’s Ho Chi Minh City development marks Vietnam’s entry into the regional hyperscale landscape. The project reflects Southeast Asia’s accelerating push to capture AI and cloud data center growth.

Middle East & Africa

UAE Expands AI Infrastructure with Khazna’s New Data Centers Khazna has broken ground on two AI-optimized facilities in Abu Dhabi, strengthening the UAE’s leadership in Middle East digital infrastructure. The expansions align with national strategies to anchor sovereign AI capabilities.

Microsoft and du Partner on $544M Dubai Hyperscale Build Microsoft’s latest deal with du will deliver a major hyperscale project in Dubai, enhancing regional AI and cloud capabilities. The partnership reinforces Dubai’s positioning as a digital and AI powerhouse.

Saudi Arabia Introduces AI Hub Law Offering Data Sovereignty Saudi Arabia’s new AI-focused legislation grants foreign firms localized data control to attract AI investment. The move could accelerate hyperscaler entry into the Kingdom’s fast-evolving digital market.

South America

TikTok Parent ByteDance Explores Data Center Build in Brazil ByteDance is evaluating a major data center project in Brazil to support regional AI and cloud service growth. This expansion could solidify Brazil’s role as Latin America’s emerging AI infrastructure hub.

Sponsored By: Global Data Center Hub

Your trusted source for global AI infrastructure analysis. Every week, we break down the trends shaping the future of data centers, cloud, and AI—from emerging markets to hyperscale battlegrounds.

📰 Subscribe to get expert insights delivered to your inbox.

Amazon and Nvidia Reaffirm AI Infrastructure Demand

Executive Summary

AI data center demand is not slowing, it's shifting to regions and builders that solve for power, sovereignty, and speed.

Amazon and Nvidia’s leaders reaffirmed strong growth at the Hamm Institute's AI Summit, rejecting market fears of a slowdown.

Infrastructure success now depends on managing energy scarcity, sovereign data policies, and hyperscale specialization.

Energy is the new gating factor: without natural gas, nuclear, and geothermal partnerships, AI ambitions will stall.

The next 5 years will reward those who build flexible, sovereign-aligned, energy-anchored AI ecosystems, everyone else will fall behind.

Introduction: What Most Analysts Are Missing

This year, market headlines have been quick to speculate: Is AI infrastructure growth slowing? Is demand softening?

But the real story is not about whether AI infrastructure demand is growing. It’s about where, how, and who will be able to meet it.

At the Powering AI: Global Leadership Summit, Amazon and Nvidia reset the narrative: Demand is not the problem. Infrastructure readiness is.

The real constraint isn’t funding. It’s power, policy, and permission.

The Reality: Why AI Demand Is Stronger and Smarter

Amazon’s VP of Global Data Centers, Kevin Miller, rejected reports of slowing demand as "tea leaf reading." Nvidia’s Josh Parker reinforced that AI compute and energy needs are only increasing.

This affirmation aligns with hard data:

50 GW of new power needed by 2027 (Anthropic estimate), the equivalent of 50 nuclear plants.

AI inference workloads exploding in parallel with foundation model training.

Energy demands per AI task increasing exponentially, not flattening.

Why This Matters:

AI Workloads Are Evolving Faster than Infrastructure Pipelines: Most data centers today are not ready for 400W+ GPUs and 100kW+/rack densities.

AI Demand Is Stickier and Harder to Displace: Training runs, LLM fine-tuning, and real-time inference are becoming core business functions for every sector—from finance to pharma.

This isn't another cloud wave. It’s the industrial revolution of intelligence.

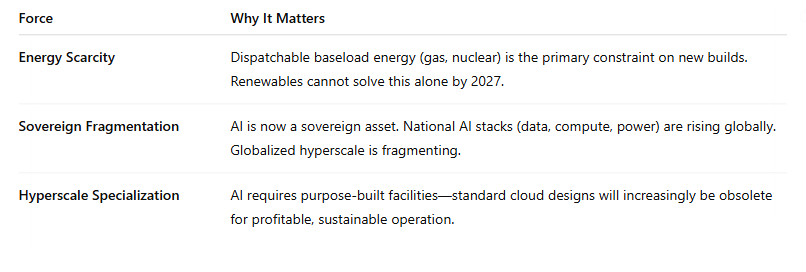

Three Forces Reshaping Global AI Infrastructure

If you’re building, investing, or regulating infrastructure today, you need to understand the new dynamics:

Where Amazon and Nvidia Are Betting

Rather than retreating, Amazon and Nvidia are adjusting their strategies:

Amazon: Accelerating hyperscale expansions selectively in energy-advantaged and sovereign-friendly regions (India, Texas, Southeast Asia).

Nvidia: Extending from hardware into AI-native data center designs, private cloud ecosystems, and sovereign partnerships (Nvidia DGX Cloud, sovereign AI cloud pilots).

Adaptability, not just capacity, has become the moat.

Energy: The Invisible Backbone of the AI Future

The energy conversation is no longer optional. It is existential.

Natural Gas = Immediate Bridge: 80 new gas plants in the U.S. pipeline. Cheapest dispatchable energy to bridge AI demand gaps.

Small Modular Nuclear = Strategic Advantage: Microsoft, Google, Amazon are quietly piloting SMR partnerships.

Geothermal = Long-Tail Opportunity: High-capacity, low-footprint geothermal projects are being explored for sovereign hyperscale facilities.

The new hyperscale playbook is simple: No energy plan, no AI infrastructure.

Strategic Playbook for Builders, Operators, and Investors

If you want to survive and thrive in the 2025–2030 AI infrastructure race, focus here:

Energy-first site selection: Prioritize regions with guaranteed baseload expansion, not just cheap land.

Sovereign-aligned infrastructure: Partner with local governments on data sovereignty guarantees and sovereign cloud frameworks.

AI-specific facility design: Build for >100kW/rack, liquid cooling, and GPU-optimized networking from day one.

Supply chain sovereignty: Secure diversified supply for GPUs, power systems, and network fabrics early.

Resilience thinking: Build in redundancies for energy, compute, and fiber, especially in politically volatile regions.

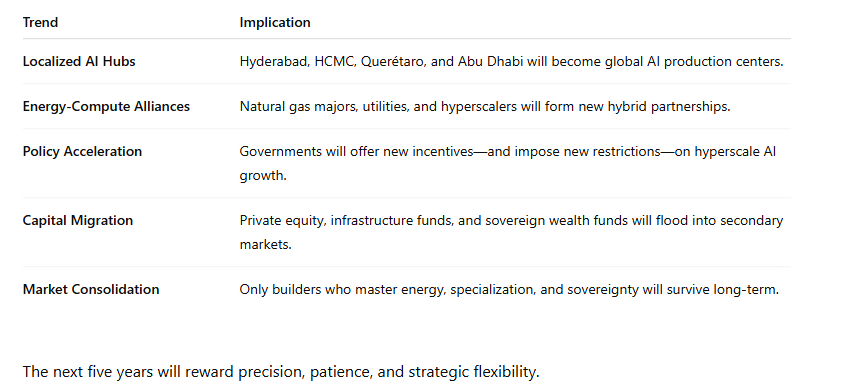

Forecast: What Happens Next

This Isn’t a Cycle. It’s a Shift.

The AI infrastructure boom isn’t peaking. It’s evolving into a smarter, tougher, and more geopolitically entangled phase.

Those who continue building with old assumptions (cheap energy, open globalization, linear scaling) will be left behind.

Those who embrace the new rules (energy alignment, sovereign strategies, hyperscale specialization) will shape the next industrial era.

The race is not just for scale. It’s for strategic dominance.

The winners will build faster, power smarter, and align politically—and they will own the AI economy of 2030.

Tell us what you thought of today’s email.

Good?

Ok?

Bad?

Hit reply and let us know why.

PS... If you're enjoying this newsletter, share it with a colleague.

And whenever you’re ready, here’s how I can help you:

1. Subscribe to Global Data Center Hub’s weekly newsletter for expert insights.

2. Have a question? Hit reply, and I’ll answer it in the next edition.

3. Explore our archive for more in-depth analysis on AI’s impact on data centers.

Let’s tackle the future of data center infrastructure together.