Is Vertiv’s $1B PurgeRite Move Set to Reshape the AI Cooling Market?

Inside Vertiv’s Bid to Dominate the Reliability Layer That Now Determines AI Cooling Performance

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

A New Center of Gravity in AI Cooling

Vertiv’s $1 billion acquisition of PurgeRite signals a structural shift in thermal leadership.

AI data centers are no longer limited by space or equipment. They are constrained by heat.

As GPU densities rise and liquid cooling becomes standard, the bottleneck is moving inside the coolant loop itself. Vertiv is buying the capability that ensures loops meet hyperscaler standards from day one.

The size of the deal reflects this new frontier: clean, stable coolant is now foundational to AI infrastructure reliability.

Why Fluid Management Became the Hidden Bottleneck

PurgeRite operates in the narrow window between mechanical completion and live operation, where cooling systems are vulnerable to debris, trapped air, and chemical instability.

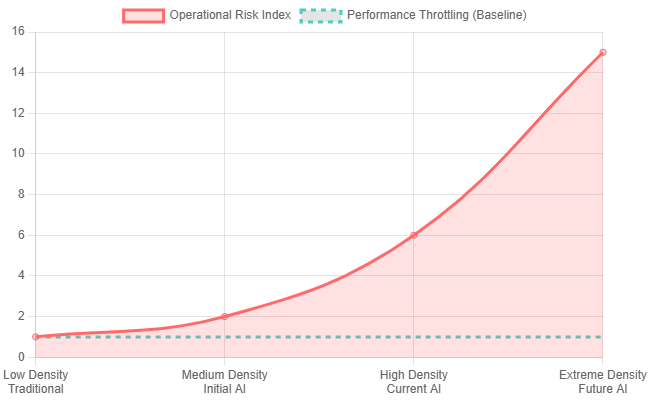

In AI environments with unprecedented GPU densities, small deviations can cause major performance losses and operational risk.

The company specializes in flushing, air purging, and fluid stabilization to create ultra-clean, air-free coolant loops.

This precision service applies across all OEM hardware, giving Vertiv control over a critical chokepoint in every liquid-cooled deployment.

The Deal Structure Signals Vertiv’s Intent

The deal includes roughly $1 billion in cash at closing and a $250 million earn-out tied to 2026 performance. The implied valuation is ~10x times 2026 EBITDA, falling if PurgeRite meets its targets.

Vertiv is funding the acquisition entirely from its balance sheet, signaling urgency and confidence in near-term revenue growth. The earn-out structure reflects expectations that PurgeRite’s growth will accelerate immediately within Vertiv’s global network.

Strategic Context: The Thermal Arms Race

The timing is deliberate. Eaton announced a $9.5 billion acquisition of Boyd’s thermal business the same day, and Schneider previously acquired Motivair to expand liquid cooling hardware capabilities.

A pattern is emerging: some acquirers focus on hardware scale, while Vertiv is building operational dominance.

By consolidating commissioning, fluid management, and lifecycle maintenance, Vertiv positions itself as the reliability gatekeeper for liquid-cooled AI data centers, capturing recurring revenue tied to uptime as equipment providers compete over capital budgets.

The Growth Optionality Vertiv Is Buying

PurgeRite’s relationships with hyperscalers give Vertiv access to design conversations shaping next-generation cooling architecture. It also brings engineering capabilities that can be applied across geographies.

With AI construction accelerating in markets like India, Malaysia, Saudi Arabia, UAE, and Brazil where fluid-management ecosystems are less mature, Vertiv can extend PurgeRite’s discipline globally, transforming a North American specialist into a worldwide platform.

The Integration Challenge and Why It Matters

PurgeRite’s engineering talent and procedural knowledge are its core assets. Retaining these teams is essential for maintaining capability.

The earn-out supports retention, but cultural integration and operational continuity remain risks.

Vertiv must scale these specialized processes without losing precision. Its acquisition of Waylay, a predictive monitoring platform, suggests a plan to link real-time monitoring with field remediation.

The New Economics for Developers and Operators

Developers who once treated cooling as a late-stage subcontract must now integrate fluid management from the earliest design phase. The thermal profile of an AI facility depends as much on coolant quality as on equipment specification.

Operators evaluating liquid cooling require risk-transfer arrangements covering commissioning, monitoring, and remediation. Vertiv positions itself as the partner that can guarantee these outcomes across the full lifecycle.

How Investors Should Read This Deal

The service layer around liquid cooling is becoming one of the most attractive segments in AI infrastructure. It is recurrent, unavoidable, and directly tied to uptime.

Companies with engineering moats in this space command premium valuations. PurgeRite is one example, and more will emerge as liquid cooling becomes mainstream.

The multiple Vertiv paid sets a benchmark for investors, while the deal highlights the strategic roadmap OEMs are using to consolidate the reliability layer of AI data centers.

The Structural Shift Underway

Vertiv is not just expanding its cooling portfolio; it is focusing on the layer of thermal management that determines AI data center performance.

Fluid quality is now a gating factor for compute, and PurgeRite sits at this critical point.

By acquiring PurgeRite, Vertiv secures the service, insight, and lifecycle control that increasingly define competitive advantage in the AI era.