Is Digital Connexion’s $11B Bet the Deal That Makes India the Next Global AI Super-Hub?

India’s $11B AI-Native Campus Set to Anchor the Next Global Compute Hub

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

A New Center of Gravity in the Global AI Buildout

Digital Connexion, the Reliance, Brookfield, and Digital Realty JV is committing $11 billion to build a 1 GW AI-native campus in Visakhapatnam. This marks a shift from routine expansions to India positioning itself as a global AI infrastructure contender.

The significance isn’t the price tag but the alignment of land, subsea routes, renewable power, political backing, and a sponsor group with proven execution strength.

Together, these factors make the project an export-grade AI hub rather than another local enterprise facility.

In global context, Vizag is India’s attempt to join regions like Ashburn, Phoenix, Johor, Santiago, Osaka, and Dublin as power and land constraints tighten across established hyperscale markets.

Why This Project Is Fundamentally Different

Digital Connexion’s 1 GW, 400-acre plan marks a break from India’s typical 20–50 MW builds. The campus is engineered for modern AI workloads high-density racks, liquid and hybrid cooling, hardened GPU floors, and high-voltage substations built for continuous, industrial-scale demand.

It represents a ground-up redesign of what an Indian data center region can be when built for AI rather than cloud. With Digital Realty’s global design standards, the site aligns with hyperscaler requirements seen in Ashburn, Frankfurt, and Tokyo.

The result is not a domestic enterprise facility but an export-grade AI compute hub built to serve global workloads while staying compliant with India’s data-sovereignty rules.

The JV Structure: The Real Engine Behind the Bet

The real reason this project works at gigawatt scale is the strength of the joint venture. Reliance brings domestic reach distribution, spectrum, fiber, political alignment, and large internal AI workloads across telecom, retail, and media.

Brookfield adds long-duration infrastructure capital, able to fund multi-phase development without the stop-start risks of project-level financing.

Digital Realty brings hyperscaler relationships and AI-native design standards that new high-density developers simply cannot replicate.

Together, they form a platform capable of absorbing the risks hyperscalers increasingly avoid: grid delays, subsea timing gaps, land fragmentation, water constraints, and political volatility.

In global context, this JV is one of the first emerging-market attempts to replicate the integrated development models seen in mature hyperscale regions without depending on hyperscalers to shoulder the risk.

Why Visakhapatnam Matters Now

Mumbai and Chennai have long led India’s compute footprint, but both face hard limits scarce land, constrained power, saturated coasts, and slow-moving regulation.

Visakhapatnam presents the opposite: large campus-ready land, strong state alignment, access to clean-energy corridors, and multiple subsea landing points.

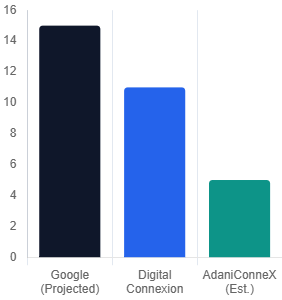

The region is also forming a multi-GW cluster, with Google’s $15B AI hub, AdaniConneX’s integrated campus, Sify’s cable landing station, and Tillman’s 300 MW plan.

As clusters emerge, infrastructure scales in parallel transmission, subsea routes, vendors, and talent while competition enforces design discipline and attracts hyperscalers at region level.

Vizag is now achieving, in real time, the compounding concentration effects that took Northern Virginia over a decade to build.

Power: India’s Biggest Constraint and Opportunity

A 1 GW AI-native campus requires industrial-scale power more than some Indian cities. Supporting it demands dedicated 400 kV transmission lines, major substations, and carefully timed renewable integration.

Andhra Pradesh’s Green Energy Open Access policy helps secure competitive renewable power and energy banking, but it also brings volatility. Shifts in charges, subsidies, or curtailment can materially impact project returns.

This development will test whether India’s regulatory and grid systems can sustain gigawatt-scale digital infrastructure without stressing local networks or pushing hyperscalers toward brown power.

If Vizag succeeds, India proves it can scale into a global AI hub. If it falters, it exposes the gap between cloud-era capability and AI-era requirements.

Water, Cooling, and the Thermal Reality of AI

AI-native workloads can’t rely on traditional cooling. Dense GPU clusters require liquid cooling, hybrid systems, and closed-loop designs and the water demand is enormous. Andhra Pradesh’s coastal location offers supply but also introduces risk.

Desalination and closed-loop reuse become mandatory to manage environmental impact. Digital Realty’s global standards help, but with Google and AdaniConneX nearby, the region will be held to international sustainability benchmarks, not local norms.

India has never deployed liquid-cooled, campus-scale facilities at this density. Vizag will be the country’s first true test.

Capital Formation and the New India Thesis

The Vizag campus anchors a platform that can raise capital at scale, expand across India, and provide hyperscalers multi-region redundancy without dealing with fragmented local developers.

This model lets Brookfield and Reliance manage investments at the portfolio level, Digital Realty leverage global standards, and institutional investors access India’s AI buildout through a single governance structure.

The question is no longer whether India can attract hyperscale AI capital, but whether it can structure it to meet global expectations. Vizag is the first attempt at doing so at industrial scale.

The Verdict: A Conditional Rise

Digital Connexion’s $11B bet positions India to compete with the world’s top AI regions. Sponsors are strong, design meets global standards, clusters are forming, subsea links are aligned, and domestic demand is rising.

The challenge is execution: transmission upgrades, renewable stability, water resilience, policy acceptance, and cluster economics versus global peers.

If successful, India becomes a key node in the global AI compute network. If not, the campus risks remaining a partially realized promise.

The bet is bold, the stakes global, and the outcome will determine whether India leads or merely participates in the AI era.