Is Singapore’s 200MW Release the Most Valuable Megawatt Window in Asia?

Inside the low-carbon, high-regulation system that now determines who gets to build in Singapore.

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

The Shift From Capacity Release to Policy Filter

DC-CFA2, often described as a 200MW expansion, is actually a controlled mechanism to select operators capable of building AI-grade digital infrastructure in one of the world’s most constrained markets.

Singapore now uses capacity allocation to reward technical depth, financial strength, and long-term alignment.

The context matters: the 2019–2022 moratorium forced careful planning to balance growth with grid stability and decarbonization goals.

The 2023 80MW pilot was a calibration, not a ramp-up. DC-CFA2 scales this concept, signaling that Singapore values precision over volume.

DC-CFA2 as a Premium Asset

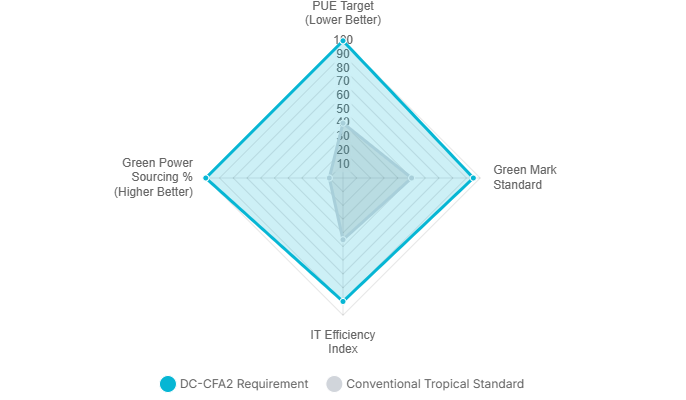

DC-CFA2 facilities must achieve PUE 1.25 in a tropical climate, meet Green Mark DC 2024 Platinum standards, operate IT aligned with SS 715:2025, and source at least half of power from approved green pathways like biomethane, low-carbon hydrogen, ammonia, advanced fuel cells, or solar.

These are structural shifts, not incremental upgrades they increase capital intensity, operational complexity, and require active engagement with Singapore’s long-term energy transition rather than relying on marginal efficiency or offsets.

How elevated performance and sustainability thresholds are redefining data centers as regulated infrastructure rather than commodity assets aligns with conclusions drawn in this examination of how compute is being reclassified as strategic infrastructure.

Investors are underwriting high-performance, low-carbon infrastructure in one of the world’s most demanding climates. This is a regulated, policy-driven, scarcity-based digital asset not a commodity.

Evaluating Strategic, Economic, and Sustainability Value

Singapore evaluates proposals through three lenses: strategic value, economic contribution, and sustainability, turning projects from real estate plays into national infrastructure.

Strategic value measures how a project strengthens Singapore as a global AI, financial, and digital hub enhancing resilience, international connectivity, and sovereign-grade compute.

Economic contribution requires durable investments, talent development, R&D partnerships, and product innovation, reflecting long-term commitment to the country.

Sustainability is the strict filter: projects must meet PUE, green-energy, and IT-efficiency standards. Conventional energy or minor efficiency gains are not acceptable.

Power and Fuel: The Central Underwriting Challenge

The most challenging part of a DC-CFA2 investment is the fuel strategy. Bids must align with Singapore’s low-carbon ecosystem, including biomethane imports, low-carbon ammonia pilots, and future hydrogen infrastructure.

Applicants must evaluate each fuel’s maturity, cost trajectory, and scalability, navigate verification regimes, and model long-term procurement beyond traditional PPAs.

Investors must accept that power costs will reflect low-carbon import economics rather than conventional gas-fired generation.

For these reasons, DC-CFA2 is fundamentally an energy-transition investment, not a conventional data center project.

Why low-carbon power sourcing is now inseparable from data center underwriting is examined in this breakdown of how energy strategy has become the decisive competitive advantage.

Jurong Island: A Strategic Hub

Jurong Island is the clearest signal of Singapore’s intent. With land reserved for a 700MW low-carbon data center park, Singapore is embedding its next wave of digital infrastructure inside one of the world’s most advanced energy and petrochemical ecosystems.

The island already houses power plants, industrial utilities, pipelines, and storage infrastructure. It is also the center of pilot programs for hydrogen, ammonia, and future fuels.

By situating digital infrastructure alongside these assets, Singapore reduces logistical uncertainty for operators and accelerates the commercialization of low-carbon fuels. Jurong is more than a location. It is an operating model that synchronizes energy transition and digital expansion.

Determining Capital Fit

DC-CFA2 is not suitable for every investor. The requirements favor platforms able to deploy patient, low-cost capital; manage technically demanding, AI-grade facilities; and negotiate deeply integrated partnerships with hyperscalers, utilities, OEMs, and energy suppliers.

Operators built around quick-cycle development, cost arbitrage, or thin engineering teams will struggle.

The opportunity aligns best with sovereign wealth funds, infrastructure funds, large-scale strategic developers, and hyperscalers who intend to build long-term AI footprints anchored by Singapore’s governance, legal certainty, and connectivity.

An investor must decide whether it is underwriting a long-duration, low-carbon infrastructure asset or mistakenly approaching a highly regulated, strategic market as if it were another hyperscale campus in a lower-cost jurisdiction.

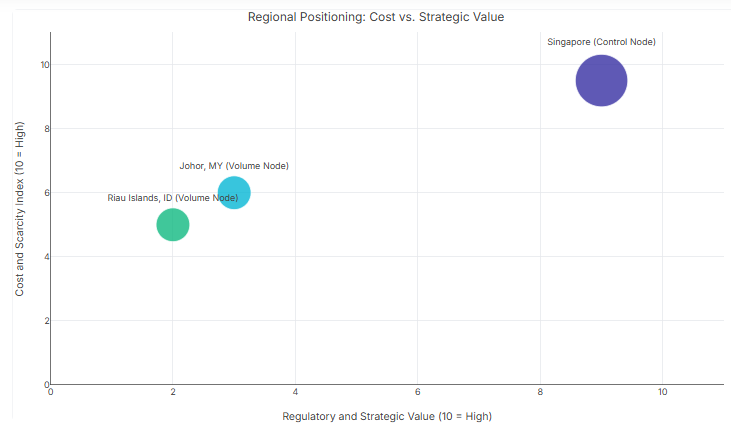

Singapore, Johor, and Riau: The New Tri-Node System

DC-CFA2 is most powerful when viewed inside the regional system forming around Singapore. The country is positioning itself as the control node for high-value, latency-sensitive, and sovereign workloads. Johor and the Riau Islands are naturally becoming the volume nodes for training clusters, storage, and bulk compute.

Singapore’s strict standards push lower-margin deployments outward, while retaining high-value, high-stakes compute inside its borders. The triangle is no longer theoretical. It is now Southeast Asia’s structural response to AI demand.

A rational capital strategy does not choose between these markets. It sequences them.

Crafting a Bankable Memo

A credible DC-CFA2 investment case must position Singapore as a long-term strategic hub within a global platform. It should show how the project aligns with national energy pilots and delivers sustained efficiency in a tropical environment.

The case must also demonstrate that the facility’s compute architecture meets SS 715:2025 standards and that its economic impact extends across decades, not just individual lease cycles.

Most critically, the plan must include a realistic, contractible fuel strategy aligned with Singapore’s national energy transition. Without this, both the project’s economics and eligibility are at risk.

The Real Question Investors Must Answer

The common mistake is comparing Singapore’s cost per megawatt to Johor, Batam, or Bangkok. Singapore’s scarcity, regulatory certainty, and strategic role make such comparisons misleading.

The key question isn’t whether Singapore is expensive it’s whether DC-CFA2 megawatts are structurally more valuable and defensible than nearly any other in Asia.

DC-CFA2 is not a 200MW project; it’s a policy tool, the first phase of a decade-long integration of AI infrastructure, digital sovereignty, and national energy strategy, selecting the operators who will shape Singapore’s next era of digital and economic power.