Is Onsite or Offsite Power the Smartest Bet for Data Centers?

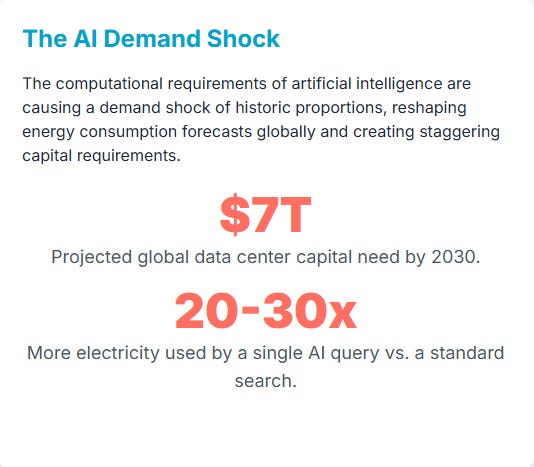

Power is the first constraint in every AI-scale data center. Here's how smart operators use onsite solar and offsite PPAs to de-risk timelines, satisfy ESG pressure, and accelerate execution.

Welcome to Global Data Center Hub. Join 1500+ investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

Land can be bought. Fiber can be routed. Cooling can be engineered. But clean, scalable, and reliable power?

That’s the real constraint.

As demand for AI infrastructure surges, energy strategy is no longer an afterthought.

It’s the foundation of the deal.

And that strategy often starts with a binary-looking choice: onsite vs offsite renewable energy.

It seems simple. But under the surface, the tradeoffs are deeper, the risks are higher, and the right answer isn’t one or the other.

It’s how you layer both.

This article breaks down the core challenges of onsite and offsite renewable power and reveals how the smartest operators are building flexibility, speed, and resilience into their energy strategies.

The Case for Onsite Power and the Operational Reality

The promise of onsite renewables is powerful: greater energy sovereignty, lower long-term costs, and faster deployment in markets with long interconnection queues.

For developers stuck behind 3- to 5-year delays for grid access, building your own power supply seems like the obvious path.

But the reality is more constrained than most project models assume.

To generate meaningful capacity onsite, developers need significant land. Utility-scale solar installations require open acreage, and wind turbines face strict siting, permitting, and setback challenges.

For urban or space-constrained campuses, the idea of powering a 100MW+ facility from onsite renewables becomes more fantasy than strategy.

Even when onsite systems are built, they rarely provide more than 10 to 30 percent of total load.

That leaves operators reliant on grid power or backup systems such as diesel generators, hydrogen fuel cells, or batteries. This creates a complex, capital-intensive dual infrastructure stack. The economics of this model are challenging unless projects can tap into portfolio-level procurement or structured energy finance.

What begins as a clean, self-sufficient solution quickly becomes a blended, expensive compromise.

Offsite PPAs: Scale, Leverage, and a New Set of Risks

Offsite renewable energy procurement, especially through Power Purchase Agreements (PPAs), has become the model of choice for hyperscalers.

These deals offer access to lower-cost, utility-scale solar and wind projects, and provide pricing certainty over 10 to 20 year horizons.

But PPAs are not turnkey solutions.

Structuring a PPA is time-consuming and complex. Legal negotiations, credit approvals, and energy market dynamics mean it can take a year or more to close a deal.

For many developers, especially those in emerging markets or without an investment-grade balance sheet, this becomes a non-starter.

Even with a signed agreement, the energy must still flow across the grid. And in many markets, the grid is not ready. Overloaded substations, transmission bottlenecks, and curtailment risk reduce the reliability of offsite delivery.

And while a PPA might show carbon-free sourcing on paper, it often lacks hourly alignment with actual consumption. This leaves operators exposed to carbon mismatch risks.

Why Smart Operators Are Layering Energy Strategies

The most effective developers aren’t choosing onsite or offsite.

They’re building both into a layered energy stack.

In these hybrid strategies, onsite solar shaves grid load and accelerates early-phase deployment. Offsite PPAs provide scale and long-term cost stability.

Battery storage or diesel provides firm capacity. Software-defined dispatch ensures that energy supply and demand are synchronized in real time.

This approach unlocks speed, flexibility, and regulatory headroom.

But it requires new skills and investment capabilities.

The best players today are not just building data centers. They’re building power systems that operate like infrastructure portfolios.

How Energy Became the First Layer of Infrastructure

The traditional sequence was to buy land, design the building, plug into the grid, and then build.

That model is now obsolete.

Today, power leads everything.

If energy access is uncertain, you won’t secure permits, tenants, or financing. Investors are flipping the model.

They’re sourcing power before finalizing site control and using energy strategy as the first and most critical underwriting variable.

In many ways, the data center is no longer just a real estate asset. It is a digital utility with grid-level complexity, cost, and consequences.

What the Best Are Doing Differently

The leaders in this space are not waiting for grid connections.

They’re co-locating compute with generation, using short-term backup power to bridge permitting lags, and designing around carbon compliance timelines, not just rack densities.

And they are getting creative on capital.

From ESG-linked loans to renewable infrastructure partnerships, they are stacking financial tools to reduce CapEx and accelerate time to power.

They are not just asking, “How much power can we get?”

They are asking, “How do we control every layer of energy risk?”

What This Means for Investors and Operators

Onsite vs offsite is no longer a debate. It is a design constraint.

The real question isn’t which path to choose. It’s how to combine them intelligently based on local risk, timing, and capital structure.

Done right, hybrid energy models offer a faster path to commissioning, better control of long-term costs, and greater resilience in volatile regulatory and pricing environments.

Done poorly, they add complexity without control. And timelines slip.

If you want to outperform in this cycle, you’ll need to stop thinking like a tenant and start thinking like a power developer.

How to Use Onsite Solar and Offsite PPAs to Reduce Energy Risk

A global step-by-step guide for data center investors and operators navigating power constraints, permitting bottlenecks, and rising ESG pressure.

Step 1: Diagnose Your Power Exposure Before Design Begins

Before a project breaks ground, energy strategy needs to be mapped with the same rigor as fiber routes and site topography.

Ask yourself:

How long is the expected grid connection process in this market?

Is land available for onsite generation, and if so, how much?

How reliable is the local grid? Are there curtailments or outages?

Do ESG requirements (from tenants, lenders, or regulators) demand renewable procurement or real-time carbon matching?

In places like Ireland, Indonesia, Nigeria, and Mexico, grid congestion and permitting delays are no longer exceptions. They are expected. Even in mature markets like Germany or Singapore, government limits on new grid allocations for data centers are becoming the norm.

Step 2: Use Onsite Generation as an Execution Speed Lever

Onsite renewables, especially solar PV, are not designed to power the entire site. Their strategic value lies in timing and flexibility.

A modestly sized onsite solar and battery system can:

Offset critical grid demand

Accelerate phased activation while awaiting full grid connection

Demonstrate real sustainability alignment with regulators and tenants

In dense markets like Nairobi, Tokyo, or Mumbai, creative solutions like vertical solar façades, rooftop installations, and nearby brownfield retrofits are becoming essential.

The goal is not full coverage. It is control.

Step 3: Layer Offsite PPAs to Scale Sustainably

Offsite renewables are essential for scale but must be tailored to local market realities.

Common mechanisms include:

Physical PPAs with nearby renewable projects

VPPAs (virtual PPAs) that hedge energy price and emissions without physical delivery

I-RECs, GOs, and market-based certificates to meet Scope 2 compliance

The challenges vary widely by region. In LATAM and Africa, political and FX risks complicate structuring. In Europe, congestion pricing, grid codes, and balancing markets require deep regulatory knowledge. In APAC, deal terms must often conform to localization requirements or state-owned utility frameworks.

Global leaders de-risk this by working with trusted IPPs, sourcing through regional aggregators, and aligning PPA durations with tenant lease terms.

Step 4: Integrate Onsite and Offsite into a Unified Power Stack

Avoid the silo trap. Best-in-class hybrid energy strategies operate through a single dispatch logic:

An energy management system (EMS) dynamically routes load

Battery and grid inputs shift based on time-of-day pricing and emissions

Carbon matching and uptime guarantees are programmed into daily operations

In carbon-variable markets like India or Brazil, this integrated approach maximizes cost savings and sustainability credibility.

The future is not about where the power comes from. It is how it is orchestrated.

Step 5: Align Capital Stack with the Energy Stack

Hybrid energy strategies require flexible capital strategies.

Across regions, the most financeable structures include:

Long-term PPAs with credible offtakers

Green bond frameworks tied to real-time carbon reduction

Joint ventures with energy developers for CapEx deferral

Shared procurement vehicles for multi-tenant campuses

Global investors increasingly expect data center sponsors to underwrite energy risk as if they were independent power producers.

Those who can speak both languages—digital infrastructure and renewable finance—will win deal flow and accelerate deployment.

Hybrid Energy Strategy Is the Real Moat

You’re not just designing a data center anymore.

You’re designing the energy system it will depend on for the next 20 years.

Control the energy stack.

Build it in layers.

Finance it flexibly.

And you’ll stay ahead of those who are still waiting for the grid.