Is Digital Realty Quietly Rewriting the Data Center Playbook in Malaysia?

Interconnection First, Scale Second: Digital Realty’s Malaysia Entry and the Rise of Node-Centric Data Center Investing

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

Digital Realty recently announced a definitive agreement to acquire CSF Advisers, the owner of TelcoHub 1 in Cyberjaya, together with adjacent land capable of supporting up to 14MW of future IT load.

At first glance, the asset appears modest. TelcoHub 1 operates just 1.5MW today. By conventional hyperscale standards, it would barely register.

Strategically, the facility sits at one of Malaysia’s densest connectivity nodes, with over 6,000 dark-fiber cores, 40+ network providers, and direct access to MYIX and DE-CIX ASEAN, alongside established cloud connectivity.

For investors outside Tier-1 markets, the deal matters less for its capacity than for what it signals: in Asia, underwriting advantage is shifting toward owning digital ecosystems not just megawatts.

The investor thesis: interconnection before scale

Most entrants still lead with capacity securing land, power, capital, and anchor tenants. That model works only when power is plentiful, timelines are predictable, and tenants lack alternatives.

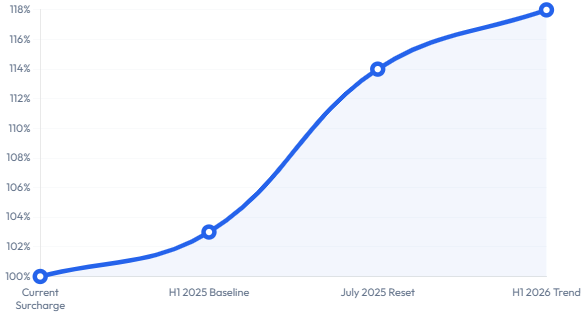

Malaysia increasingly fails all three. Power is available, but access is more gated and costs more variable. July 2025 tariff changes could raise energy costs 10–14% for large users, forcing “build big” strategies to underwrite grid timing, tariffs, sustainability, and leasing risk simultaneously.

Interconnection-led entry reduces these bets. TelcoHub 1’s value is not power density but network density. Concentrating carriers, exchanges, and cross-connects compounds value, raises switching costs, and stabilizes connectivity revenue, which is less cyclical than wholesale capacity.

For capital formation, this matters. Connectivity-heavy assets function as platform anchors, providing downside protection while preserving the option to add incremental megawatts next door.

This logic where control over network intersections creates durability independent of capacity cycles aligns with the broader shift toward interconnection-led advantage analyzed in Equinix Q3 2025: The $394 Million Quarter That Signals the AI Interconnection Supercycle.

Sequencing market entry: wedge first, campus later

Digital Realty’s sequencing in Malaysia is deliberate. It first acquired a strategically placed interconnection hub in Cyberjaya, secured adjacent land for up to 14MW of future IT load, and integrated the asset into its global PlatformDIGITAL and ServiceFabric stack.

This approach aligns development with demand visibility. Rather than building a speculative large-scale campus, Digital Realty bought a node already embedded in live traffic flows, allowing capacity to be added in phases as customer demand becomes clear.

For investors, this creates option value. The base case monetizes recurring connectivity and enterprise colocation revenue. Upside comes from phased expansion once demand signals or pre-leases emerge, while the hub also serves as a low-friction on-ramp for customers extending from Singapore or Jakarta into Malaysia.

Crucially, it is a risk-allocation strategy. Digital Realty limits upfront exposure to construction and power procurement by acquiring an asset that already expresses demand, using development capital as a controlled lever rather than a one-way bet.

Why this structure attracts institutional capital

Different types of capital seek different exposure. Core and core-plus investors prioritize stability, contracted cashflows, and controllable capex. Value-add investors focus on leasing and operational improvements, while development capital targets merchant risk or pre-leased build-to-suits for higher returns.

The wedge-then-campus model unfolds in phases: Phase 1 delivers core-plus interconnection with sticky ecosystem revenues. Phase 2 adds value-add or development risk once power and permits are de-risked. Phase 3 enables institutional scale-out through replication or expansion into adjacent platform services.

Matching evolving asset risk to distinct pools of capital has become a defining feature of modern data center investing, a dynamic examined in How to Invest in Data Centers (And the Risks That Actually Matter).

Competitive positioning: interconnection over megawatts

Malaysia has no shortage of hyperscale ambition, especially in Johor and Greater Kuala Lumpur but megawatts aren’t the only axis of competition.

Interconnection is different: ecosystems concentrate, and fewer nodes dominate. Digital Realty’s entry via a hub signals it is competing for the control plane where networks meet, enterprises peer, and cloud adjacency becomes a product.

The market is likely to bifurcate. Large-campus operators compete on power, delivery speed, and hyperscaler relationships. Interconnection-centric operators compete on network density, cloud on-ramps, and platform services that simplify multi-site operations.

For underwriting, the distinction matters. Commodity capacity risks price-taking as supply grows, while ecosystem nodes shift risk toward maintaining neutrality, service quality, and community growth.

The macro risk beneath the surface

Malaysia’s growth has benefited from regional spillovers and strong capital inflows, but investors must still underwrite less visible constraints. Power economics, in particular, are becoming a more material source of risk.

The July 2025 tariff changes are an early signal. The trajectory is toward clearer cost recovery for grid and high-voltage infrastructure, which can compress margins or force repricing, especially at scale.

Two implications follow. First, “cheap power” is not durable; it can reprice as data centers become systemically significant loads. Second, scale economics can invert. Very large facilities face greater exposure to tariff tiers and grid charges, while smaller, phased builds retain flexibility and negotiating leverage as power and renewable structures are secured.

Interconnection-led entry mitigates this risk. It enables operators to establish revenue and market presence while sequencing power, sustainability, and expansion decisions rather than front-loading them.

Implications for investors, operators, and policymakers

For investors, the edge is shifting from “who can build the most megawatts” to “who can control the most valuable nodes.” In APAC markets where policy, tariffs, and sustainability criteria can shift returns quickly, node control is a durability strategy.

For operators, market-entry sequencing is becoming a competitive advantage. Even if you cannot win the largest campus race, you can still win by owning the interconnection layer and expanding outward from that position.

For policymakers, becoming a digital hub is not just about approving large campuses. It requires enabling neutral exchanges, predictable rights-of-way, robust fiber buildout, and transparent power pricing. Poorly messaged or unpredictable tariff changes can chill investment even when demand remains strong.

The takeaway

The next phase of data center investing in Asia will be won not by who builds the most megawatts, but by who controls the most valuable nodes where networks converge, switching costs rise, and ecosystems compound. Digital Realty’s Malaysia entry shows interconnection, not scale, is becoming the key source of durable advantage.

TelcoHub 1 may be small in capacity, but it is large in leverage. By anchoring at Malaysia’s connectivity center and keeping the option to scale, Digital Realty optimizes for control, flexibility, and capital efficiency especially in markets facing tighter power pricing, policy, and sustainability constraints.

It feels like a pragmatic adjustment to how the market is actually behaving. When power, capital, and delivery timelines tighten, operators naturally become more selective about where and how they deploy capacity. That can look strategic from the outside, but from a delivery perspective it’s could be about risk management rather than reinvention. Location, grid certainty, customer profile, and time to revenue start to matter more than headline expansion. If anything, this reflects a maturing phase of the sector as much as growth.