India’s $25B Green Gigacampus; Microsoft Densifies the U.S.; Google Anchors Thailand

Inside the capital, power, and policy shifts redefining global AI infrastructure

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

If you’re not a subscriber, here’s what you’ve missed so far:

Where the Next Gigawatt of AI Capacity Will Actually Be Built [Inside the New Global Hierarchy Shaped by Power Availability, Policy Alignment, and Platform Capital.]

How to Invest in Data Centers (And the Risks That Actually Matter) [An intelligence synthesis of the reports shaping AI-driven infrastructure, capital allocation, and market direction.]

9 Reports Shaping Global Data Center Strategy — Q4 2025 Intelligence Briefing [An intelligence synthesis of the reports shaping AI-driven infrastructure, capital allocation, and market direction.]

Q4 2025: The Quarter AI Infrastructure Became State Power [How power, capital, and policy fused to redefine the global AI buildout.]

Interested in sponsorship? info@globaldatacenterhub.com

In This Issue

Global Buildout at a Glance — India’s $25B, 1GW green AI megacampus, Microsoft’s U.S. densification strategy, and Nordic hyperscale expansion show AI capacity accelerating where power and policy align.

Power + Policy = Advantage — ERCOT approvals, Canada’s sovereign-backed AI procurement, and Finland’s grid readiness reinforce that megawatts not capital are now the gating variable.

Sovereign Capital Meets AI — Saudi Arabia’s $1.2B Humain expansion and Gulf capital reserving U.S. capacity highlight state-aligned balance sheets reshaping global compute.

Notable Transactions — Digital Realty’s Malaysia acquisition, DAMAC’s $12B U.S. capacity lock-in, and subsea-linked builds in Brazil signal platform-level scaling over single assets.

Dear Friends,

A new phase of AI infrastructure is taking shape defined not by isolated data center announcements, but by programmatic capital deployment, power security, and multi-continent execution.

This week made the shift clear. India committed $25B to a 1GW, fully green AI campus, marking a move to sovereign-scale compute. Microsoft continued densifying where power is already locked in. ERCOT approvals and Canada’s sovereign-style procurement reinforced that grid access, not capital, is now the constraint. Meanwhile, Gulf-backed platforms expanded globally, reserving U.S. capacity and scaling state-aligned AI infrastructure.

The message is direct: the next decade will be won not by better models, but by those who control power, land, and long-dated capital together and at scale.

Global Buildout at a Glance

A 1-minute scan of the week’s biggest moves — by region.

North America — Microsoft’s proposal to add 15 additional data centers at Mount Pleasant, combined with Galaxy Digital securing ERCOT approval to double capacity at its Helios campus, reinforced a clear U.S. pattern: AI infrastructure growth is concentrating where power is already energized. In parallel, Canada’s federal call for 100MW+ AI data centers signaled the rise of quasi-sovereign procurement as a competitive response to U.S. grid congestion.

Europe — DayOne’s planned 560MW hyperscale campus near Helsinki reinforced the Nordics as Europe’s primary release valve for AI growth amid grid congestion elsewhere. Global Switch’s Welsh wind power deal showed power security overtaking land as the key siting advantage, while the UK’s forced hyperscale approval highlighted rising regulatory risk as AI capacity accelerates.

Asia-Pacific — India’s $25B, 1GW fully green AI data center announcement marked a shift toward sovereign-scale compute anchored in captive renewables. In Southeast Asia, Google’s launch of a Bangkok cloud region and Digital Realty’s acquisition of a Malaysian platform confirmed that hyperscale expansion is moving beyond Singapore into power- and policy-ready spillover markets.

Middle East & Africa — Saudi Arabia’s $1.2B expansion of its Humain AI platform reinforced the Kingdom’s sovereign-underwritten approach to AI infrastructure, while DAMAC’s move to secure $12B of U.S. AI data center capacity highlighted how Gulf balance sheets are increasingly arbitraging power scarcity in mature markets.

South America — V.tal’s plan to pair a new U.S.–Brazil subsea cable with a data center in Porto Alegre signaled a more integrated model of connectivity-plus-compute, strengthening Brazil’s southern corridor and reducing overreliance on São Paulo-centric capacity.

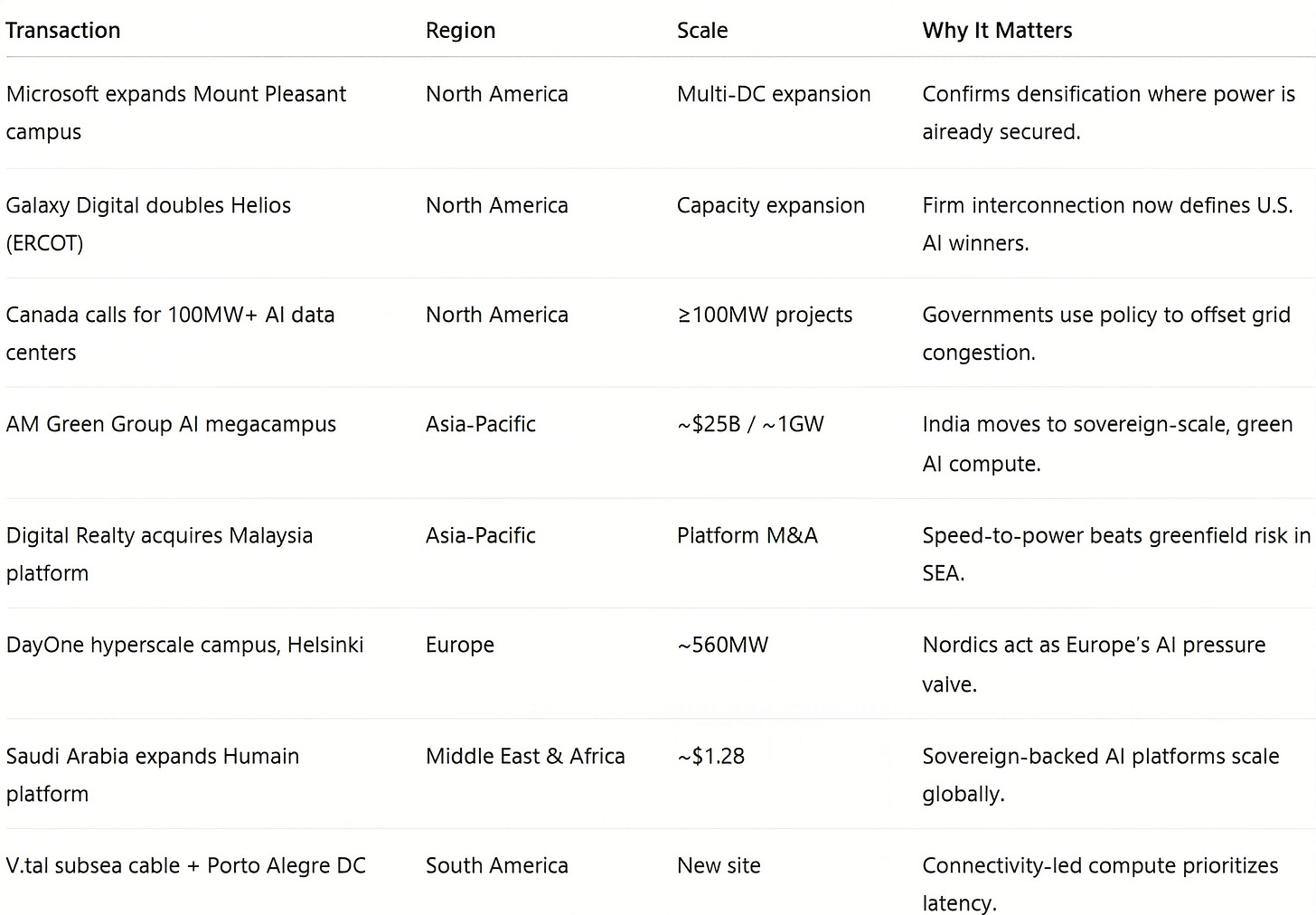

Notable Transactions

Key shifts, structures, and risks across this week’s global deal tape.

This week confirmed that AI-scale growth is now portfolio-driven, with data center infrastructure executed at program scale and anchored by secured power, grid alignment, and sovereign-backed capital.

Microsoft’s expansion of Mount Pleasant alongside Galaxy Digital’s ERCOT approval to double Helios capacity reinforced that firm interconnection not land or capital is the binding constraint for hyperscale growth. Canada’s federal call for 100MW+ AI data centers showed governments using procurement and policy to relieve U.S. grid congestion.

Across Asia-Pacific, India’s $25B, 1GW fully green AI campus and Digital Realty’s Malaysian acquisition highlighted how AI demand is accelerating grid planning, entitlements, and M&A at national scale. Google’s Bangkok cloud launch further confirmed Southeast Asia’s shift from overflow capacity to primary hyperscale markets.

In Europe, DayOne’s planned 560MW Helsinki campus reaffirmed the Nordics as a pressure valve for power-constrained growth, while adaptive-reuse projects signaled capital favoring inherited power and zoning over greenfield risk. In the Middle East & Africa, Saudi Arabia’s $1.2B Humain expansion and DAMAC’s $12B U.S. capacity reservation marked a shift toward sovereign-backed, globally deployable AI platforms.

Across South America, V.tal’s plan to pair a new U.S.–Brazil subsea cable with a Porto Alegre data center signaled that future projects will hinge less on headline megawatts and more on localized demand, latency, and regulatory clarity as compute moves closer to users.

If you’re enjoying this newsletter, share it with a colleague.

Have a great week.

Global Data Center Hub

This totally highlights how large-scale data centre development in India is increasingly about system alignment rather than capacity alone. At this scale, outcomes depend on how power, grid planning, land, and policy are coordinated over time. It’s a useful example of how “green” data centres are defined less by individual technologies and more by integrated infrastructure planning.

Brilliant synthesis here. The shift from capital-constrained to power-constrained growth really explains why we're seing Nordic and ERCOT markets accelerate while traditional hubs stall. I've watched projects sit with funding locked but stuck in grid queue for months it's a wierd reversal. The sovereign angle adds another layer too, basically states treating compute infra like strategic reserves now.