How to Invest in Data Centers (And the Risks That Actually Matter)

Navigating the Billion-Dollar AI Backbone: Where Capital Flows, Risk Hides, and Value Is Made

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

This article is the 18th article in the series: From Servers to Sovereign AI: A Free 18-Lesson Guide to Mastering the Data Center Industry

Data centers were once a niche corner of industrial real estate. That world is gone.

AI, cloud scale, and digital sovereignty have pulled them into the center of global capital markets faster than most investors anticipated.

Data centers are no longer back-office infrastructure. They are now the physical backbone of artificial intelligence, cloud computing, digital trade, and national digital sovereignty.

Capital has noticed. Investors that once questioned whether data centers were “too technical” are now rushing in. Private equity, infrastructure funds, sovereign wealth funds, and pension capital are all converging but demand alone does not guarantee returns.

It does not.

Investing in data centers today requires understanding not only where growth is coming from, but also how risks have shifted and why the sector functions more like critical infrastructure, with embedded technology risk, than traditional real estate.

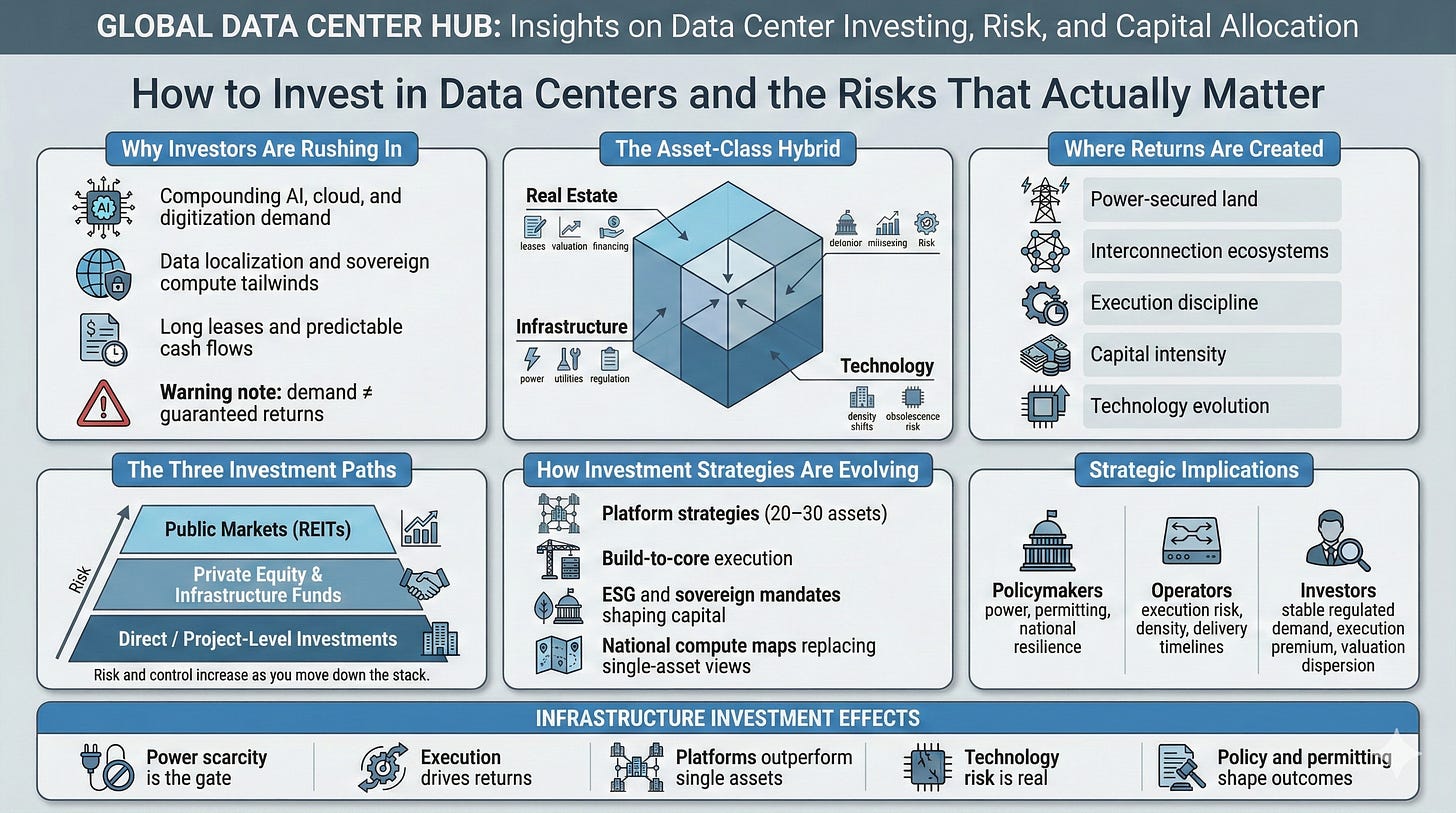

Why Investors Are Rushing In

The demand story is real, but it is incomplete.

At a macro level, the story is straightforward. Digital demand is compounding, not cycling. AI workloads, cloud services, enterprise digitization, and government data localization mandates are all pushing compute closer to power, people, and policy.

Data centers sit at the intersection of real estate, infrastructure, and technology. They are financed, leased, and valued like property, governed by utilities and regulation like infrastructure, and exposed to rapid design shifts and obsolescence risk like technology assets.

That hybrid profile is what makes them compelling and what makes them easy to misprice.

Long-term leases with hyperscalers and large enterprises create predictable cash flows. Rising compute intensity increases the value of scarce, power-secured sites. Global tailwinds from AI adoption to sovereign cloud strategies provide a sense of inevitability.

But inevitability is not immunity. The rush of capital has compressed yields, intensified competition for sites, and exposed weak underwriting discipline in newer markets.

How yield compression and weak underwriting are emerging in newer markets mirrors warning signs identified in this examination of hidden risks inside the hyperscale boom.

The 3 Main Investment Paths

1. Public Markets

Publicly traded data center REITs remain the most accessible entry point for many investors. Platforms like Digital Realty, Equinix, and Iron Mountain provide diversified exposure across regions, customers, and workloads.

Performance in this segment is driven by occupancy, net operating income growth, and critically interconnection revenue. In dense ecosystems, cross-connects and network effects often generate higher-margin income than raw space or power.

However, public markets introduce volatility that has little to do with data center fundamentals. Interest rate sensitivity can overwhelm operational performance. Lease concentration with hyperscalers creates headline risk even when contracts remain strong. Investors gain liquidity but surrender control.

Public REITs offer exposure to the asset class but not insulation from macro sentiment.

2. Private Equity and Infrastructure Funds

Private capital dominates the next layer of the market. Firms such as Blackstone, KKR, Brookfield, DigitalBridge, Stonepeak, and EQT pursue platform strategies rather than single assets.

These investors are not buying individual buildings. They are assembling portfolios often 20 to 30 facilities across regions designed to absorb hyperscale demand, regulatory complexity, and long development timelines.

Long-duration capital enables build-to-core strategies: accept early-stage risk, fund expansion, stabilize cash flows, then exit at infrastructure-grade multiples. ESG mandates, sovereign compute requirements, and AI-driven demand have made data centers a core allocation for infrastructure funds.

The trade-off is complexity. Returns depend on execution across power procurement, construction, tenant negotiations, and regulatory navigation. This is not passive capital.

3. Direct and Project-Level Investments

At the sharpest end of the spectrum sit direct investments: regional developers, colocation startups, edge platforms, and single-campus projects.

These opportunities offer the highest potential returns and the highest failure rates. They require deep diligence on permitting, utility interconnection, anchor tenants, and delivery timelines. A single misstep on power or zoning can wipe out projected equity returns.

Direct investing rewards operators who understand local utilities, politics, and customer behavior. It punishes those who assume that demand will solve structural constraints.

Return Profiles and Risk Factors

Risk is not binary. It is layered.

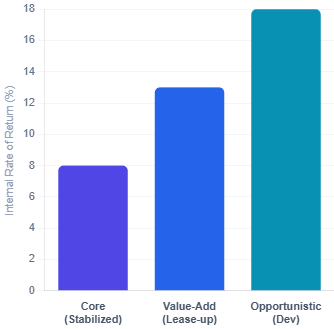

Not all data center returns are created equal. Risk and reward are shaped by a handful of structural variables.

Core assets typically feature hyperscale or enterprise tenants, long leases spanning 10 to 20 years, and locations in established markets such as Ashburn or Singapore. Power is fully contracted. Development risk is minimal. These assets often deliver IRRs in the mid-single to high-single digits.

Value-add strategies introduce shorter lease durations, partial lease-up risk, and markets that are proven but still scaling. Returns move into the low-to-mid teens, driven by operational improvements, densification, or re-leasing.

Opportunistic strategies push further: emerging markets, greenfield sites, uncontracted power, or unproven tenant profiles. These deals can generate IRRs north of 15 percent but only if execution risk is actively managed.

Why higher IRRs in emerging or power-constrained markets depend almost entirely on execution is consistent with findings in this analysis of where the next gigawatt of AI capacity will actually be built.

The mistake is not taking risk. The mistake is taking unpriced risk.

Key Risks to Watch

This is where many models break.

Power scarcity has become the gating factor for the entire industry. In many mature markets, grid interconnection queues stretch years beyond construction timelines. Land without power is no longer optionality it is dead capital.

Land use and zoning battles have intensified as communities push back against large-scale development. What once sailed through planning boards now faces litigation, moratoria, and political scrutiny.

Oversupply is a real risk in second-tier markets where capital rushed in ahead of demand, assuming hyperscalers would follow. Some will. Many will not.

Tenant credit risk is evolving. AI-native firms may grow quickly, but they lack the balance sheets of traditional hyperscalers. Lease structure matters more than logo value.

CapEx creep from cooling upgrades, electrical gear delays, or density retrofits—can quietly erode returns. So can exit risk if hyperscaler strategies shift toward self-build or alternative geographies.

Strategic Due Diligence Checklist

Serious investors interrogate fundamentals beyond square footage and headline yield.

Anchor tenants and lease terms are examined closely, with attention to duration, escalation, and termination rights. Power availability and utility interconnection are evaluated not only for capacity, but for timing and reliability.

Fiber density and latency are assessed in relation to cloud regions and internet exchanges, alongside regulatory exposure tied to ESG requirements, data localization rules, and environmental permitting.

Construction schedules and contractor track records are pressure-tested, and the operator is underwritten as carefully as the asset itself. In data centers, execution is the differentiator.

Due diligence in data centers is not about checking boxes. It is about identifying where assumptions can fail.

What’s Next? The AI Infrastructure Investment Wave

This cycle is structural, not cyclical.

Between 2025 and 2030, global digital infrastructure investment is expected to exceed one trillion dollars. This is not incremental growth. It is a re-architecting of the compute layer of the global economy.

GPU clusters, sovereign compute mandates, and edge deployments are creating durable, multi-decade demand. But they are also increasing technical requirements and capital intensity.

The strategic opportunity lies in platforms that integrate real estate, energy, and compute not those that treat them as separate problems. The winners will control power, manage density, and align with policy.

Key Takeaway

The best data center investments are not about chasing megawatts or headlines. They are about resilience, relationships, and relevance in a world where compute demand is relentless but constraints are real.

Capital will continue to flow into the sector. But only investors who understand where risk has moved and how value is truly created will compound returns over the next decade.

Awesome opportunity if you play it right. Exciting to watch this game playout