You received this email because you subscribed to Global Data Center Hub, a newsletter about the global data center sector.

Thank you very much for supporting my newsletter this month. Your readership encourages me to provide these insights, and I’m truly grateful for it.

We publish new insights seven days a week, helping you stay ahead of the most important shifts in data centers, AI infrastructure, and global connectivity.

Our premium insights are reserved for paid subscribers.

If you haven’t upgraded yet, now’s a great time:

👉 Subscribe and join hundreds of readers of “Global Data Center Hub” with a 20% discount on the annual plan: Subscribe here

Galaxy Digital just signed a 15-year, $4.5B deal with CoreWeave.

And in doing so, it may have triggered one of the most important infrastructure shifts of the decade.

Let’s break it down:

What Just Happened?

Galaxy will convert its West Texas Helios site (a 200MW Bitcoin mining facility) into a high-density AI compute hub.

CoreWeave gets 133MW of IT load.

Galaxy gets $300M a year in revenue.

EBITDA margins? Nearly 90%.

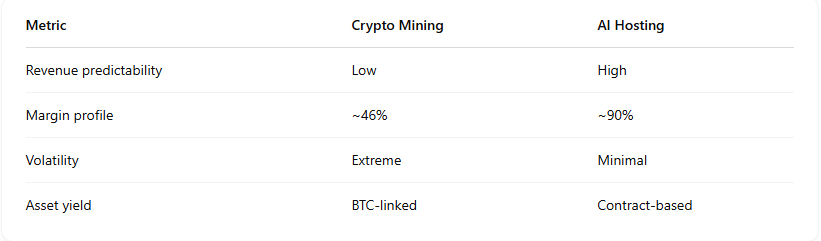

Compare that to crypto mining:

Why It Matters

Galaxy isn’t chasing hype.

It’s following the gravitational pull of capital.

Bitcoin mining is struggling post-halving.

AI workloads are surging, with CoreWeave serving giants like Microsoft and OpenAI.

Infrastructure is being repriced, from speculative assets to productive powerhouses.

This is the “From Gold Rush to Railroads” moment for digital infrastructure.

The Infrastructure Pivot Playbook

This move follows a new trend:

Digital asset firms are converting stranded mining assets into AI compute real estate.

Others following suit:

Hive Digital

Core Scientific

Northern Data

Their playbook:

Convert cheap land and power into AI-ready capacity

Partner with GPU-rich cloud providers like CoreWeave

Lock in long-term, high-margin contracts

What This Signals to Investors

Galaxy’s shift is not just a pivot, it’s a philosophical departure.

From decentralized currencies to centralized compute.

From speculation to infrastructure.

From tokens to terawatts.

The Upside

Galaxy is now valued by analysts at up to $3.5B for its data center division alone.

That’s nearly the market cap of the entire company.

In other words:

The market hasn’t priced in the full implications of this transformation.

But you can.

Because the next wave of alpha isn’t in coins.

It’s in colocation.

One More Thing

I publish daily on data center investing, AI infrastructure, and the trends reshaping global data center markets.

Join 900+ investors, operators, and innovators getting fresh insights every day and upgrade anytime to unlock premium research trusted by leading investors and developers.