Fiber in the Crossfire: Why Subsea Networks Are the Next Geopolitical Battlefield

The global AI race runs on fiber. And that fiber is under threat.

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

What’s Changing Beneath the Surface

In March 2024, a single underwater landslide off the coast of Côte d’Ivoire cut four subsea cables, knocking 16 African economies offline. Weeks later, cable cuts in the Red Sea disrupted 25% of Asia-Europe traffic. These weren’t anomalies. They were early signals of a larger, systemic vulnerability.

For decades, subsea and cross-border fiber has been treated as a neutral utility technological plumbing that simply worked. But that mental model is obsolete. In today’s geopolitical climate, fiber is not just infrastructure it’s a battleground.

This article maps the evolving risk landscape facing global data infrastructure and explains why investors and operators can no longer afford to treat these risks as edge cases. What’s at stake is more than uptime. It’s capital preservation, strategic control, and long-term differentiation.

Where the Pressure Is Building

Subsea cables carry over 95% of intercontinental internet traffic and enable over $10 trillion in financial transactions daily. These systems also link the growing constellation of hyperscale data centers that power AI, cloud computing, and real-time applications. As generative AI workloads demand higher bandwidth, low-latency throughput, and predictable performance, the fiber layer becomes a constraint and a risk surface.

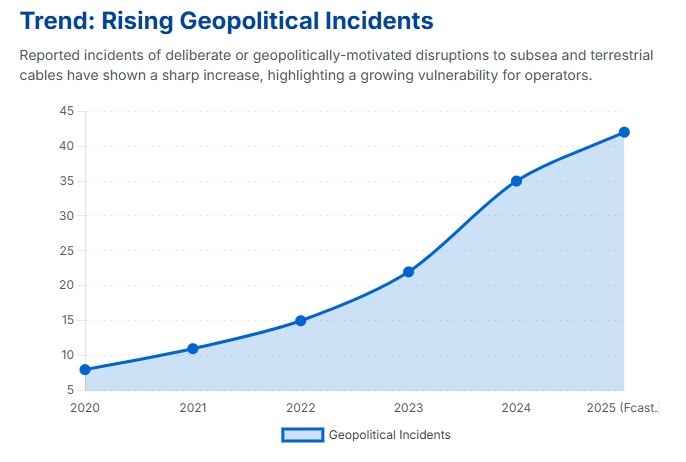

In recent years, there has been a marked increase in physical and regulatory pressure on these links. Sabotage incidents have shifted from hypothetical to tactical. In the Baltic Sea, cables were cut near Russian and Chinese vessel movements. In Taiwan, multiple cable breaks have been traced to Chinese ships operating under false pretense. In the Red Sea, strikes near active conflict zones damaged multiple systems in a matter of days. Often, these disruptions were blamed on “accidents.” But the frequency and context suggest something more deliberate.

Espionage is another concern. The U.S. has rejected cables terminating in Hong Kong and rerouted others to avoid Chinese-linked landing stations. Chinese regulators, in turn, have delayed or denied approvals for routes transiting their sphere of influence. Specialized vessels capable of tapping cables are now operational in several militaries. Data center operators cannot ignore the implications: if data can be accessed in transit, sovereignty and compliance frameworks may be compromised.

Meanwhile, regulation is becoming an enforcement tool. Foreign ownership reviews, data localization laws, and digital sovereignty mandates are forcing the rerouting of cables and reshaping where hyperscale campuses can viably interconnect. The Pacific Light Cable Network was effectively shelved after U.S. regulators flagged security concerns. In Latin America and the EU, cables are now selected and built not for speed or cost but for political alignment and legal compliance.

Friction Between Fiber and Facility

Fiber-to-data center connectivity was once a solved problem. Today, it’s a gating factor.

In secondary markets like Salt Lake City, Phoenix, or Jakarta, fiber constraints are quietly becoming a primary bottleneck even where land and power are available. Metro dark fiber may be limited, submarine landing stations may be hours away, and permits for new long-haul routes are increasingly difficult to secure. These delays compound when hyperscalers need multiple diverse paths with at least 24 to 48 fiber pairs per route to support AI workloads.

In more mature hubs like Northern Virginia or Frankfurt, the challenge is different but no less urgent. The density of cables and proximity to key landing stations has made these regions strategic but also high-risk in terms of single points of failure. A concentrated landing site that once enabled interconnection now represents a security liability. Investors are starting to price that in.

Operators are also grappling with higher demands from tenants. AI firms want deterministic latency, high throughput, and full visibility into their transmission paths. That means dark fiber control not just lit services. The result: fiber has moved from a utilities line item to a strategic asset class.

The Financial Picture Is Shifting

Geopolitical exposure is now impacting investor returns. Capital previously committed to subsea projects has been written down due to permit denials or sanction exposure. Forced rerouting adds millions in unplanned capex. And delays from interconnection bottlenecks are pushing revenue recognition back by quarters.

Insurance is becoming more selective. Some providers have excluded coverage for politically motivated sabotage. Others are demanding more robust scenario planning and compliance documentation before underwriting. Investors without contingency plans are seeing risk-adjusted returns fall below target thresholds.

Compliance, too, is more expensive. Team Telecom reviews, FCC disclosures, and new EU directives all add legal and administrative overhead. And because these rules vary by jurisdiction and often change with political tides they must be reassessed regularly. Projects that were greenlit under one administration may be delayed or reversed under another.

How Capital Is Responding

The most sophisticated investors and operators are taking a forward-looking approach.

First, they are integrating geopolitical and permitting risk directly into project underwriting. Routes that pass through contested waters, high-conflict zones, or tightly regulated jurisdictions now carry higher hurdle rates and scenario-based downside models. Risk-adjusted returns are calculated not just from bandwidth or demand projections, but from assumptions about disruption timelines, rerouting costs, and insurance gaps.

Second, diligence is deeper and more forensic. Investors want full transparency on vendor relationships, cable construction and repair rights, and landing station governance. Legal exposure is being mapped in parallel with technical feasibility. In high-risk zones, some are even building alternate systems concurrently or entering joint ventures with local partners to gain regulatory shelter.

Third, strategic resilience is becoming part of core operations. Operators are modeling blackout scenarios for key corridors, negotiating backup connectivity with satellite providers, and pre-positioning resources to shorten repair cycles. They are also collaborating more closely with governments to gain early insight into permitting pipelines, trade policy shifts, and dual-use concerns

Where Fiber Becomes a Strategic Moat

The age of neutral fiber is over. In its place is an investment category defined by control, redundancy, and political alignment.

Subsea and cross-border fiber routes don’t just carry packets. They carry geopolitical baggage. And for investors building long-term positions in digital infrastructure especially AI-aligned facilities that baggage has real implications for site viability, customer reliability, and return stability.

Success now depends on whether an operator can answer three questions:

Can we secure diverse, high-capacity fiber routes with acceptable permitting and compliance exposure?

Can we manage cable incidents and latency risks without disrupting tenant workloads?

And can we build where others can’t because we’ve mastered the connectivity layer others overlook?

Those that can will define the next generation of hyperscale infrastructure.