Fiber & Connectivity Bottlenecks (Part 2): How to Evaluate Dark Fiber Availability Before Acquiring Data Center Land

A step-by-step playbook to avoid stranded assets, missed timelines, and ROI-killing connectivity delays in the AI era.

Editor’s Note:

This is Part 2 of a two-part series on one of the most overlooked risks in AI infrastructure: fiber.

In Part 1, we explored why fiber bottlenecks, more than power, are threatening to derail the next wave of AI-driven data center investment.

Here, in Part 2, I walk through the practical framework top investors and operators are using to evaluate dark fiber availability before they commit to land, power, or permitting.

The Power-Fiber Blind Spot

In 2025, most data center investors know they need power and land.

But there’s a third leg of the stool that’s quietly derailing projects, blowing budgets, and killing returns:

Fiber.

More specifically, access to scalable, diverse, and low-latency dark fiber.

If you’re selecting data center sites based on land and power, but not fiber, you’re not just missing a detail.

You’re taking an eight- (or nine-) figure bet with a blindfold on.

This article gives you a battle-tested, investor-ready system to:

Map fiber availability

Evaluate route redundancy

Estimate build-out timelines

Avoid dead zones

And protect your IRR from the #1 hidden risk in digital infrastructure.

Why Fiber Has Become the New Bottleneck

Everyone’s talking about power grid delays. But fiber is the silent killer.

AI workloads need 10x more fiber than legacy compute

Lead times hit 60 weeks during the 2022–23 crunch

Fiber prices surged 70% between 2021–2024

Many secondary markets have no usable dark fiber nearby

Even well-powered sites are functionally stranded without connectivity

You can’t run generative AI clusters, or even basic GPU workloads, without high-density, low-latency, redundant fiber.

And yet, fiber diligence is still missing from many investor site selection models.

That stops here.

The 5-Step System to Evaluate Fiber Before You Buy

This is the exact framework used by sophisticated capital when evaluating data center land across global markets.

If you apply this rigor up front, you can eliminate 50% of unsuitable sites, before spending on studies, deposits, or negotiations.

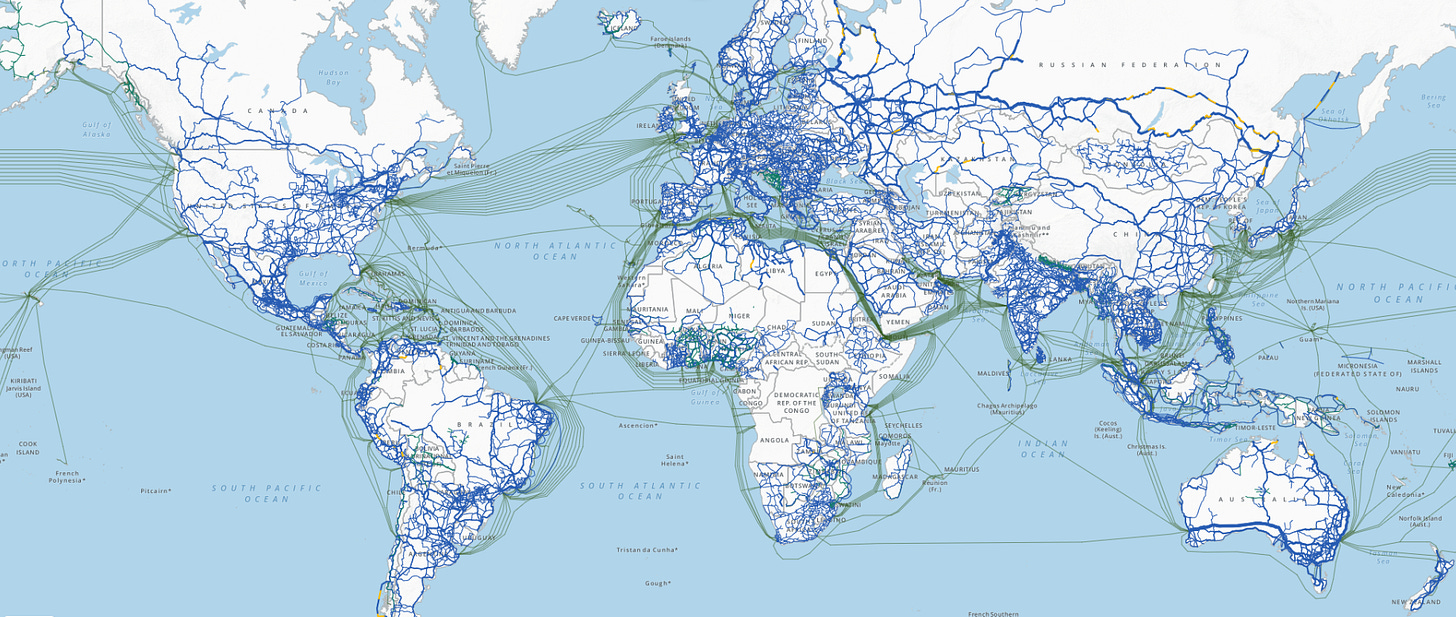

Step 1: Overlay Fiber Maps in Your Initial Site Screen

Before power, before price per acre, before tax incentives, ask one question:

Is this site within 5 miles of high-capacity dark fiber?

Use tools like:

Commercial fiber mapping platforms (e.g., Lightyear, Cloudscene, InfraMaps)

Local IXPs and carrier-neutral facilities

Conversations with regional telecom providers and municipalities

Key filters to apply:

Does the route offer dark fiber, not just lit services?

Is there provider diversity or a single incumbent?

What’s the estimated strand count available?

Red flag: “Fiber nearby” often means lit-only, low-capacity loops controlled by a single provider. That’s not scale-grade.

Step 2: Score Carrier Density and Route Redundancy

AI workloads are hypersensitive to jitter, latency, and network interruption.

That means fiber isn’t binary. It’s graded based on availability, quality, and diversity.

Ask:

Are there two or more dark fiber providers with network presence at the site or within trenching distance?

Do routes offer geographic separation (e.g., diverse conduits and entry paths)?

Can you secure non-discriminatory access and negotiate IRU terms?

If you only have one path out, your AI tenant won’t meet its SLA. And neither will you.

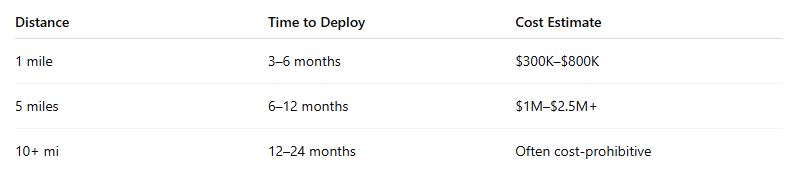

Step 3: Estimate Time and Cost of Route Extension

If the site is 3–10 miles from the nearest dark fiber loop, you don’t have to reject it, yet.

But you do need a precise sense of what you’re facing:

Contact providers for make-ready cost estimates

Request construction timelines, permits, and rights-of-way status

Review crossing agreements, easements, and municipal trenching requirements

Typical estimates:

Important: Costs are rising. Inflation in conduit, permitting, and labor can easily derail pro forma assumptions if not modeled upfront.

Step 4: Vet for Subsea, Long-Haul, and DCI Connectivity

For global AI infrastructure and inter-region training workloads, proximity to:

Submarine cable landing stations

Long-haul fiber backbones

Interconnection hubs (IXPs, meet-me rooms)

…is non-negotiable.

Use regional maps, subsea cable consortium data (e.g., TeleGeography), and hyperscaler partnership announcements to guide diligence.

Sites more than 100–150 miles from a landing point or interconnection hub may struggle to meet international latency requirements.

Step 5: Plan for Long-Term Control with Dark Fiber and Supply Agreements

The final step isn’t about access. It’s about control.

If you want your infrastructure to scale with AI workloads, you need:

Indefeasible Rights of Use (IRUs) for long-term capacity

Multi-year supply agreements with vendors like Corning, CommScope, STL

Participation in buildouts through co-investment or pre-sales

Optional: Metro dark fiber acquisition or leasing via regional ISPs

Smart capital is locking in 10–20 year rights with scale clauses, backhaul guarantees, and performance SLAs. Treat fiber like power: buy it before the next wave arrives.

Fiber Diligence Summary Table

Why This Playbook Matters Now

Power grabs attention.

But fiber determines who actually wins the compute race.

McKinsey projects data center demand will triple by 2030.

Hyperscalers are already buying 24–48 fiber pairs per route.

AI latency budgets are measured in microseconds, not milliseconds.

If your site doesn’t connect to the right fiber at the right capacity, it won’t matter how cheap the land is.

It’s not a data center location.

It’s a stranded investment.

Final Take: Fiber Is the New Due Diligence Priority

In this cycle, the winners will be those who treat:

Fiber like power

IRU contracts like PPAs

Route maps like zoning overlays

Interconnection like currency

If you want to build, scale, and exit data center assets in the AI age, integrate fiber mapping into your site selection on day one.

Because in 2025 and beyond?

Fiber isn’t a utility.

It’s a moat.

This article is Part 2 of my series on navigating fiber risk in AI infrastructure.

If you missed Part 1, start here → Fiber and Connectivity Bottlenecks (Part 1): The Hidden Crisis That Could Derail the Global AI Infrastructure Boom

As a paid subscriber, you now have access to the full 2-part breakdown, designed for capital allocators, developers, and operators making long-term bets on global compute infrastructure.