Does HUMAIN’s $1.2B Saudi Framework Signal a New Model for AI Data Centers?

The Emergence of Sovereign-Backed, Institutional-Grade Platforms for Scaling AI Infrastructure

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

Saudi Arabia’s HUMAIN–National Infrastructure Fund $1.2B framework for 250MW of AI data center capacity is easy to misread as just another sovereign-backed check.

That view misses the deeper signal.

The framework signals a shift in capital formation for AI data centers from one-off projects to repeatable, institutional-grade platforms designed to absorb capital over time, with sovereign balance sheets taking early, asymmetric risk.

In 2026, the question isn’t whether Saudi Arabia can build 250MW.

It clearly can.

The real test is whether HUMAIN is building a capital machine that can fund, sequence, and de-risk a multi-gigawatt pipeline while retaining operational control and preserving customer optionality.

AI Compute Has Become Infrastructure, Not IT

AI training and inference have crossed a threshold. Compute is no longer an IT input but a form of infrastructure, on par with power, land, and connectivity.

As compute becomes infrastructure, the financing logic shifts. Scale no longer comes from one-off deals, but from platforms built around standardization and repeatable capital deployment.

In mature markets, constraints are physical and political: interconnection delays, transmission bottlenecks, permitting friction, and long equipment lead times. Capital is available, but timelines cannot be compressed.

The Gulf faces a different constraint set.

Power and land are abundant, and policy coordination can accelerate delivery. The binding risks move to export controls, advanced silicon access, talent, and durable demand gaps HUMAIN aims to arbitrage by combining sovereign advantages with global partners.

This reclassification of compute mirrors a broader transition already underway across digital infrastructure, as examined in AI’s Next Phase Is Being Built, Not Coded.

What the $1.2B Framework Actually Enables

The agreement is structured as a non-binding strategic financing framework rather than a committed project loan, a distinction that matters.

Early AI campuses carry significantly higher uncertainty than traditional colocation assets, from uneven utilization ramps and rapid hardware cycles to concentrated customer risk.

A framework allows capital to be deployed in tranches, sequenced against construction, power delivery, and commercial de-risking rather than drawn upfront.

It also sends a broader market signal.

By anchoring AI data centers within Saudi Arabia’s development capital stack, the framework validates them as infrastructure assets and creates a bridge from sovereign balance-sheet risk to institutional capital.

The Real Signal: A Platform, Not a Project

The most consequential element of the announcement is HUMAIN and Infra’s intent to explore a co-anchored AI data center investment platform.

This mirrors how infrastructure markets have historically scaled. Renewable energy, toll roads, and transmission assets only attracted institutional capital once they shifted from bespoke projects to standardized platforms. Capital scales into platforms, not projects.

Applied to AI data centers, a platform enables aggregation of multiple campuses under common governance, standardized contracting and design, diversified demand, and repeatable equity deployment.

For operators targeting multi-gigawatt scale, this is not optional ambitions of that size cannot be financed one site at a time without permanent reliance on sovereign balance sheets.

The Emerging Sovereign Compute Capital Stack

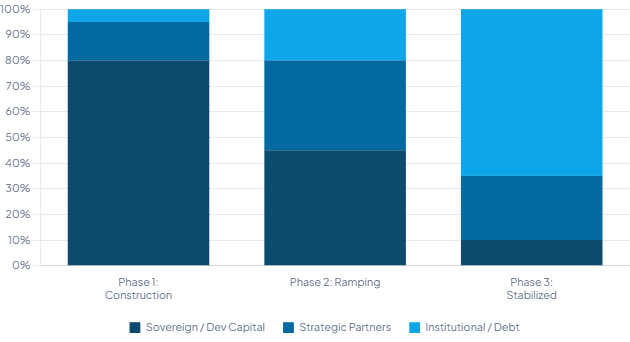

What is emerging is a layered capital stack built to sequence risk. Early AI data center capacity carries uncertainties that conventional infrastructure capital cannot price efficiently.

Initial phases are financed like development infrastructure, with sovereign capital absorbing construction, utilization, and technology-cycle risk. Strategic partners contribute execution certainty through equipment access, operating capability, and demand pull-through.

As assets move into operation and reporting becomes institutional-grade, the financing profile shifts. Platform equity and asset-level debt become priceable at scale, supported by observable performance rather than narrative.

The sequencing is the point. Early capacity is de-risked through sovereign alignment, while later capacity is financed as scaled digital infrastructure once utilization and cash flows stabilize.

Risk Allocation Is the Real Underwriting Question

From an investor perspective, the key diligence question is not whether the sovereign is involved. It is which risks remain implicitly sovereign and which are genuinely transferred.

In sovereign compute models, the state typically retains control over permitting velocity, land access, grid prioritization, and power economics. Early demand may be anchored by government or quasi-government entities, and the state has a vested interest in ensuring platform success.

Other risks remain firmly commercial. Hardware obsolescence and refresh capex do not disappear. Customer concentration can be lumpy. Export controls can cap access to leading-edge accelerators. Execution risk at high density and scale is unforgiving. Governance and minority protections become decisive for institutional investors.

If these boundaries are not explicit, private capital will price the exposure as political risk rather than infrastructure risk.

Power Is Abundant, but Delivery Is the Constraint

Saudi Arabia’s energy advantage is real, but AI data centers require more than cheap generation. They require high-quality, stable delivery, accelerated interconnection, and disciplined execution of substations and transmission infrastructure.

At 250-megawatt increments, grid delivery quality becomes the true factory floor. A completed data hall without energized capacity is stranded capital.

For AI facilities, where hardware can represent tens of millions of dollars per month in opportunity cost, schedule discipline is as important as price.

Demand Still Has to Be Earned

“AI demand” is not inherently bankable demand. Compute need does not automatically translate into durable, financeable revenues.

Sovereign workloads are sticky but budget-bound. National champions are durable but price-sensitive. Hyperscalers bring scale yet negotiate aggressively, while frontier model developers consume large capacity with high volatility.

Enterprise inference demand is broad but fragmented, offering limited anchoring power on its own.

HUMAIN’s full-stack narrative helps create internal demand pull but increases complexity. The infrastructure layer becomes investable only once it shows utilization and pricing power independent of narrative support.

Saudi vs UAE Is a Race of Models, Not Megawatts

The competitive dynamic with the United Arab Emirates is often framed as a race of gigawatts. That framing is misleading.

This is a race of operating models. The winners will be jurisdictions that can deliver low-cost, reliable power without hidden curtailment risk, secure advanced silicon under evolving export regimes, operate at hyperscale standards, and attract customers beyond domestic mandates.

If HUMAIN proves that its platform is repeatable, it will not only attract capital to Saudi assets. It will establish a template for other resource-rich states seeking to convert energy advantage into sovereign compute capacity.

This divergence in sovereign compute strategies reflects a wider realignment across regions where governments are shaping AI infrastructure outcomes through capital structure and policy coordination, as examined in Middle East & Africa: $100B+ AI and Data Center Buildout Redefines the Region.

The Takeaway

The signal in this deal is not the $1.2B figure or the 250MW headline. It is the move to institutionalize AI data centers as infrastructure platforms designed to absorb capital repeatedly, sequence risk, and scale without permanent reliance on sovereign balance sheets.

For capital allocators, the edge is no longer in underwriting megawatts alone, but in understanding how platforms compound through risk allocation, governance, revenue durability, and power execution at scale.

Everything else is noise. Megawatt counts and deal size create headlines, but platform mechanics determine outcomes. In this market, discipline not scale is what compounds.

Announcements at this scale tend to signal intent, alignment, and positioning. The harder work comes after...grid capacity, land readiness, approvals (or not), cooling strategy, and actual workloads turning up. From an infrastructure point of view, money alone doesn’t compress timelines. What matters is whether power, water, and supply chains can move at the same pace. If those pieces line up, the capital follows. If they don’t, the headline number stays mostly symbolic for a while.

Jaz zzzzz