Does Digital Edge’s $4.5B Indonesia Campus Change the Global Hyperscale Map?

Power delivery, rather than demand growth, now determines where hyperscale capital can be deployed.

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

When Digital Edge announced a $4.5 billion plan to build a 500MW hyperscale campus in Indonesia, scalable to 1GW, it was easy to dismiss it as another Southeast Asia megaproject.

That framing misses the point.

The investment is not about Indonesia’s growth, but about a shift in global hyperscale underwriting, where viable markets are now defined by a single constraint:

Power that can be delivered on time.

From Demand-Led to Power-Led Siting

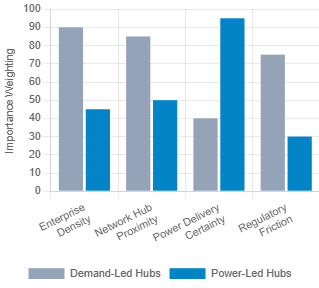

For most of the past decade, hyperscale geography followed demand. Capacity clustered in hubs like Northern Virginia, Frankfurt, London, Singapore, and Tokyo, where enterprises, network density, and institutional capital aligned.

That logic is now breaking down.

In these same markets, demand remains strong, but power delivery has become the binding constraint. Grid interconnection queues stretch into years, sustainability limits cap expansion, and regulatory and community friction increase delivery risk.

As a result, the underwriting question has shifted. It is no longer where demand is deepest, but where power can be contracted, delivered, and financed within a 24–36 month window. Digital Edge’s move into Indonesia should be read through that lens.

This inversion where demand-rich markets stall while power-rich corridors advance reflects the broader structural shift described in Power Is the Moat: How Gigawatt Data Centers Redraw Global AI Strategy.

Why the $4.5B Matters More Than Scale

A 500MW campus is not a single project, but a multi-year capital formation exercise that depends on converting early uncertainty into infrastructure-grade cash flows.

At this scale, the sponsor is underwriting a repeatable platform, not a country. Equity absorbs early risks around land, permitting, equipment, and power, while hyperscale pre-leasing converts development risk into contracted revenue. Only then does infrastructure debt unlock scalable growth.

This is why the $4.5B commitment matters. Capital of that size is deployed only when power delivery, leasing, and refinancing can be repeated across phases without disrupting the schedule.

Industrial Estates as Financial Infrastructure

The location choice is the real signal. Industrial estates with high-voltage backbone infrastructure operate differently from generic greenfield sites, converting grid uncertainty into timetable risk that lenders and customers can actually underwrite. In the current hyperscale cycle, that compression is the product.

Markets with industrial-grade power corridors can turn theoretical capacity into bankable capacity, while demand-rich markets without them remain stuck in planning. Digital Edge’s campus sits in a corridor built for heavy electrical loads, materially lowering risk compared with sites dependent on future grid upgrades.

Indonesia’s Role in the Hyperscale System

Indonesia is not replacing Singapore or Tokyo as a Tier-1 hub. It is emerging as a different type of node within the hyperscale system.

That system is bifurcating. Urban cores monetize interconnection density and latency-sensitive workloads, while power campuses monetize electrical throughput, land scale, and high-density compute, increasingly linked by resilient fiber into a single metro ecosystem.

Digital Edge’s Jakarta assets serve the first role, while the Bekasi campus serves the second. This is not sprawl but workload placement, as training, inference, and storage increasingly prioritize power, cooling, and delivery certainty over CBD proximity.

AI as an Accelerant

Artificial intelligence accelerates this remapping but does not create it. High-density workloads simply expose the limits of legacy assumptions faster. Air-cooled designs break. Electrical margins shrink. Liquid-ready infrastructure becomes a prerequisite for certain tenants rather than a premium feature.

Markets that cannot support these designs at scale fall out of contention, regardless of how mature their demand profiles are. Indonesia’s advantage is not cost. It is that certain corridors can still be engineered forward without colliding into entrenched grid constraints.

Infrastructure Capital’s Role

The capital behind the project reinforces this interpretation. Digital Edge is backed by Stonepeak Infrastructure Partners, whose core competency is underwriting long-duration, hard-asset platforms through staged risk conversion.

Infrastructure capital is indifferent to narratives about emerging versus developed markets. It responds to contracted cash flows, delivery discipline, and refinancing pathways.

A single-campus commitment of this scale signals confidence not in Indonesian demand per se, but in the sponsor’s ability to manage power, schedule, and execution better than alternatives in mature hubs.

What Changes on the Global Map

The immediate effect is not displacement. It is optionality.

Indonesia becomes a viable planning node for Southeast Asia workloads that would otherwise be forced into increasingly constrained hubs.

For investors, this reframes emerging markets from demand-risk stories into execution-risk stories. Demand is global and portable. Execution is local and decisive.

For operators, the bar rises. Competing in the next hyperscale cycle is less about announcing megawatts and more about proving that power can be delivered when others are still waiting in line.

The Execution Test

None of this removes risk. At 500MW, small delays compound quickly, as transformer lead times, grid commissioning, cooling integration, and renewable procurement can each push timelines by months. In a market where customers plan years ahead, months matter.

The project will be judged not by its announcement size, but by its first delivery.

If phase one arrives on schedule, Indonesia’s position on the hyperscale map strengthens quickly. If it slips, the lesson is clear: scale amplifies execution risk faster than it amplifies returns.

These risks are not unique to Indonesia but are increasingly visible across mature markets as well, where interconnection delays and grid congestion have become binding constraints, as analyzed in The Interconnection Bottleneck: How Renewable Delays Are Rewriting the AI Power Map.

Conclusion: Power Redraws the Map

Digital Edge’s $4.5B Indonesia campus changes the global hyperscale map, but not by creating a new Tier-1 hub.

It confirms a deeper transition. Hyperscale geography is no longer shaped by where demand is loudest or capital is most comfortable, but by where power can be delivered on time, at scale, and financed with confidence.

The hyperscale map is no longer static. It is being redrawn corridor by corridor, substation by substation, by operators that can turn power availability into bankable infrastructure before others catch up.