Did OpenAI Just Hand Oracle $30 Billion to Rewire the U.S. AI Market?

Inside the $500B Stargate Initiative, Oracle’s Cloud Comeback, and the 4.5 GW AI Arms Race

Welcome to Global Data Center Hub. Join 1500+ investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

In one of the most consequential shifts in tech infrastructure history, OpenAI has agreed to pay Oracle over $30 billion annually starting in 2028 to lease 4.5 gigawatts (GW) of AI cloud capacity across the United States.

That’s the power equivalent of several nuclear plants or enough to supply electricity to more than 3 million U.S. homes.

This isn’t a typical cloud deal.

It’s a territorial land grab for the future of AI one that fuses energy, compute, capital, and control.

The Deal: More Than Just Cloud

Annual contract value: >$30 billion

Capacity leased: 4.5 GW of U.S.-based AI compute

GPU hardware: ~$40 billion in Nvidia GB200s

First sites: Abilene, TX (expanding from 1.2 GW to 2 GW), with new builds in MI, OH, PA, GA, WY, NM, WI

Financing wrapper: Stargate – a $500 billion JV with Oracle, OpenAI, SoftBank, and UAE-backed MGX

Oracle, long a third-tier player in cloud infrastructure, has suddenly leapfrogged into the hyperscaler elite. If this deal plays out, it could triple Oracle’s cloud revenue and elevate it to a $100B+ company.

Why Did OpenAI Choose Oracle?

Because AI at scale isn’t about servers anymore. It’s about power.

OpenAI’s core problem isn’t just compute scarcity. It’s energy scarcity. Microsoft Azure couldn’t guarantee the multi-gigawatt, multi-year supply chain OpenAI needs to push beyond GPT-4o. So OpenAI hedged.

Oracle stepped in with:

Bare-metal GPU access

RDMA networking

Low data egress costs

A willingness to pre-build custom sites

It positioned itself as a vertically integrated AI supercomputer utility.

What’s 4.5 GW Really Mean?

One gigawatt powers 750,000 U.S. homes. So 4.5 GW:

Is 25% of all current U.S. data center capacity

Could power 5–10 trillion-token training runs

Will house over 2 million high-end GPUs by 2030

This is not a cloud platform. It’s an industrial-scale AI compute grid.

The Financial Engineering Behind the Deal

Oracle will front billions in capex ($25B+ starting FY26), absorbing near-term FCF pressure for long-term revenue visibility. The revenue doesn't hit until FY28, but investors are already reacting Oracle stock hit record highs, with price targets raised to $240–$250.

RPOs (Remaining Performance Obligations) are expected to exceed $160 billion once Stargate backlog is recognized.

Oracle will front billions in capex ($25B+ starting FY26), absorbing near-term FCF pressure a strategy previewed in Oracle’s $40 Billion Power Move.

Rewiring the Geography of AI

The Oracle–OpenAI expansion bypasses California and Northern Virginia in favor of Rust Belt and Southwest states:

Lower-cost power

Abundant land

Cooperative local regulators

Grid interconnection potential

This is AI infrastructure as regional development policy. States like Texas, Michigan, and Wyoming are becoming AI-era tech hubs.

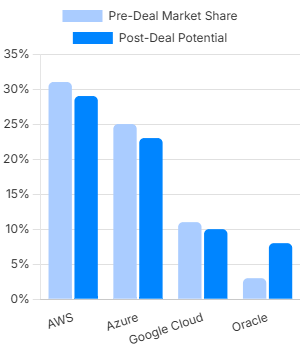

The Multi-Cloud Realignment

This deal also marks the end of hyperscaler exclusivity.

Despite being Microsoft’s strategic partner, OpenAI was constrained by Azure’s limited capacity and inflexible terms.

In January 2025, Microsoft quietly agreed to loosen exclusivity, granting OpenAI a right of first refusal. If Azure can’t deliver capacity fast enough, OpenAI can go elsewhere. The result?

Oracle for training

Azure for APIs

CoreWeave and Google Cloud for redundancy

We’re now in a multi-cloud-by-design era, with OpenAI leading the model.

We’re now in a multi-cloud-by-design era, with OpenAI leading the model evident in its $4B expansion with CoreWeave, which redefined what flexible, scalable AI infrastructure looks like.

Strategic Takeaways

Oracle is no longer a laggard it’s building the grid beneath AI.

Energy is the new bottleneck, not GPUs or code.

AI infrastructure is national infrastructure, and U.S. regulators are paying attention.

Long-term anchor deals are the new norm. Expect more $10B+ GPU+Power leases.

General-purpose clouds are being unbundled, and hyperscale AI is going vertical.

Bottom Line:

OpenAI didn’t just hand Oracle a $30 billion contract.

It handed them the blueprint to the future of AI infrastructure and forced every other cloud provider to rethink their business model.

This is compute meets capital meets capacity.

And it’s only just begun.