Did CoreWeave Just Spend $9B to Beat Microsoft in the U.S. AI Power Race?

CoreWeave’s $9B Acquisition of Core Scientific Signals New Era of AI Data Center Power Control

Welcome to Global Data Center Hub. Join 1500+ investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

A year ago, CoreWeave was paying Core Scientific billions to lease power-rich data center space.

Now it’s the landlord.

This month, CoreWeave announced a $9 billion all-stock acquisition of Core Scientific once the largest Bitcoin miner in North America.

It’s the most aggressive move yet in the AI infrastructure arms race.

And it’s not about GPUs.

It’s about power.

Why CoreWeave Did the Deal

This wasn’t a classic cloud M&A deal.

It was vertical integration pure and simple.

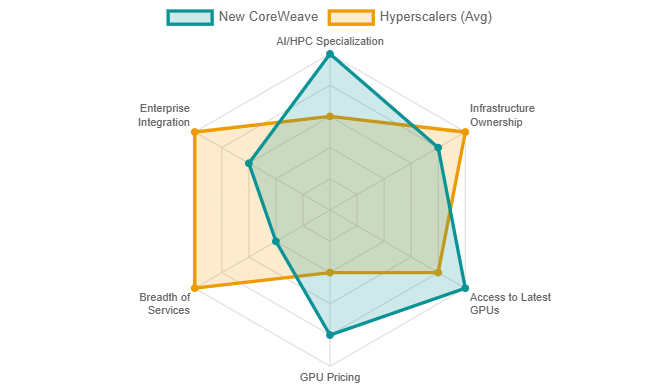

CoreWeave’s strategy has always been clear: provide bare-metal access to the latest GPUs, backed by speed, flexibility, and scale.

But speed is useless without power.

Rather than wait for utilities or lease up capacity, CoreWeave is taking control of the stack.

The Core Scientific deal gives them:

1.3 GW of operational power across U.S. data center sites

Another 1 GW+ of expansion potential

Control of land, energy contracts, and development timelines

More importantly, it eliminates $10 billion in future lease obligations, transforming a cost center into an owned asset.

From Bitcoin Mining to AI Infrastructure

Core Scientific didn’t always look like an obvious fit.

The company filed for Chapter 11 bankruptcy in 2022 during the crypto crash.

But it emerged leaner in 2024 and began converting its mining infrastructure to support high-density HPC and AI workloads.

By early 2025, it was providing CoreWeave with hundreds of megawatts of hosting capacity through long-term contracts worth over $10 billion.

The acquisition makes those contracts permanent and gives CoreWeave the operational leverage to scale on its own terms.

This is what it looks like to repurpose stranded crypto assets into AI infrastructure.

Crusoe’s strategy mirrors this playbook. In Crusoe’s $11.6B Bet on OpenAI’s Texas Campus, the company is converting former Bitcoin infrastructure into AI supercomputing campuses blurring the line between crypto legacy and compute future.

Why the Market Reacted With Skepticism

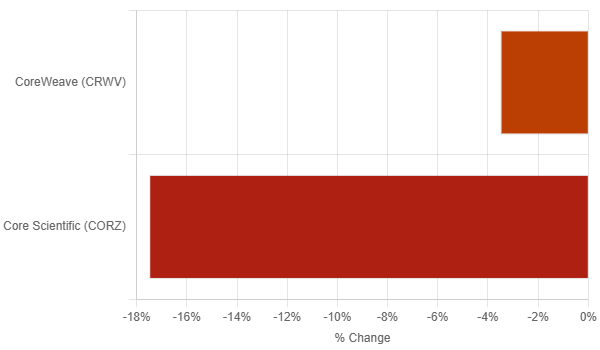

Shares of both companies fell on the news CoreWeave by ~4%, Core Scientific by nearly 20%.

Why?

The deal is all stock

The integration is complex

Core Scientific is fresh out of bankruptcy

But the market may be missing the bigger picture.

This isn’t just about adding capacity. It’s about owning control.

In an AI economy bottlenecked by power, control isn’t risky it’s strategic.

The Bigger Shift: From Leasing to Owning the Stack

This marks a turning point for AI-native cloud providers.

Vertical integration was once the realm of hyperscalers AWS, Azure, Google.

Now, challengers like CoreWeave are doing the same.

Not by choice. By necessity.

Because the real constraint isn’t chips it’s power.

And the companies that own land, grid access, and infrastructure will dictate:

Pricing

Capacity

Delivery timelines

In this new era, electricity isn’t just an input.

It’s the entire playbook.

That shift is happening across the board. Gridlock: The Energy Crisis That’s Rewriting Data Center Investment Strategy breaks down how energy bottlenecks are now the primary constraint shaping infrastructure decisions.

What Comes Next

Expect more deals like this.

Expect more Bitcoin mines to be acquired, repurposed, or outbid.

Expect more infrastructure operators to reprice their assets not by rent or PUE but by the value of the power they control.

And expect capital to follow.

Because investors are realizing something crucial:

In the race for AI dominance, compute runs on electricity.

And whoever controls the grid… controls the game.