Cost Shock: Why Data Center Models Are Breaking and Who Will Win Because of It

Development costs have surged $2.3M per megawatt since 2022 reshaping what gets built, funded, and delivered in the data center sector globally.

Welcome to Global Data Center Hub. Join 1000+ investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

What You’ll Learn

How a $2.3M/MW cost increase is reshaping data center project viability worldwide

Why inflation now cascades across inputs, timelines, financing, and competition

How top operators are using scale, phasing, and sourcing to control volatility

Where capital is shifting toward Tier 2 markets with cost and delivery advantages

What financing structures are helping mitigate inflation and execution risk

When macro shifts in rates, tariffs, and trade will impact project timing and returns

The global data center sector needs $6.7 trillion in capital by 2030.

But while investors obsess over AI demand curves and sovereign workloads, a more immediate threat is exploding behind the scenes:

Cost inflation.

Across top markets, costs per megawatt have risen $2.3 million since 2022. That’s a 46% gap between modeled and actual capital requirements.

For a standard 36MW hyperscale campus, that's an $82.8 million shortfall, uncaptured in most investment theses.

This isn’t just a budgeting issue. It’s redrawing the investor landscape:

Projects once deemed “shovel-ready” are now stalled or abandoned.

Operators with scale and supply chain control are leapfrogging mid-market peers.

Capital is moving away from Tier 1 markets, not because demand has faded, but because costs can no longer be absorbed.

The Four-Layer Breakdown: Where Projects Start to Crack

What makes today’s cost crisis dangerous isn’t just the numbers, it’s the sequence.

The escalation doesn’t happen in isolation. It cascades.

1. Input Shock

Steel and aluminum premiums are up 30%

Tariffs on mission-critical electrical and cooling components now reach 30–42%

Lead times are stretching into quarters, not weeks

Every dollar of cost inflation here becomes a force multiplier downstream.

2. Timeline Drift

Equipment delivery windows have ballooned

Build schedules are extending 4–8 months on average

Carrying costs and interest accrual are eating into returns before lease-up begins

Every delay adds pressure to the capital stack and compresses exit flexibility.

3. Capital Cost Amplification

Higher interest rates are magnifying budget drift

Lenders are demanding fatter contingencies and more equity

Some previously bankable sponsors can no longer clear debt thresholds

In this environment, project viability is being determined less by tenant demand and more by financing risk tolerance.

4. Competitive Reordering

The result? A sharp divide:

Top players can hedge, procure, and absorb shocks

Mid-tier developers are delaying or scaling back

Subscale sponsors are becoming acquisition targets—or walking away

This is the most significant value migration in digital infrastructure since the cloud buildout began.

What Smart Capital Is Doing Differently

While many sponsors are reacting late, top-tier developers and institutional investors are applying playbook-level precision to ride the cost wave instead of being crushed by it.

Here’s how:

1. Scale Recalibration

Average land transactions have grown 144% since 2022

Multi-building campuses now dominate due to shared procurement, labor, and energy costs

Developers are baking in flexibility across phasing, shell builds, and IT load composition

Scale is no longer just a growth strategy, it’s an inflation shield.

2. Strategic Geography Rotation

The old hierarchy—Ashburn, Singapore, Frankfurt—now comes with premium pain.

Instead:

Markets like Querétaro, Chennai, and Phoenix offer lower land and labor costs

Power-first site selection is replacing cloud-first location theory

Inflation sensitivity is now part of the site selection model

The question is no longer “Where’s the demand?” It’s “Where can we deliver economically viable capacity?”

3. Supply Chain Architecture

Leaders aren’t just buying smarter. They’re designing procurement as a strategic function:

Dual-sourcing essential components across geographies

Forward-buying and inventory warehousing for switchgear and generators

Vendor partnerships that optimize for price stability, not just lowest bid

In today’s market, procurement speed and certainty equal execution edge.

4. Capital Stack Engineering

The new capital rulebook looks like this:

Development agreements tied to inflation-indexed contracts

Capital release schedules that adjust to milestones, not calendar months

Risk-sharing clauses with contractors and OEMs to protect IRRs

The sponsors still standing in 2026 will be those who started structuring for volatility in 2024.

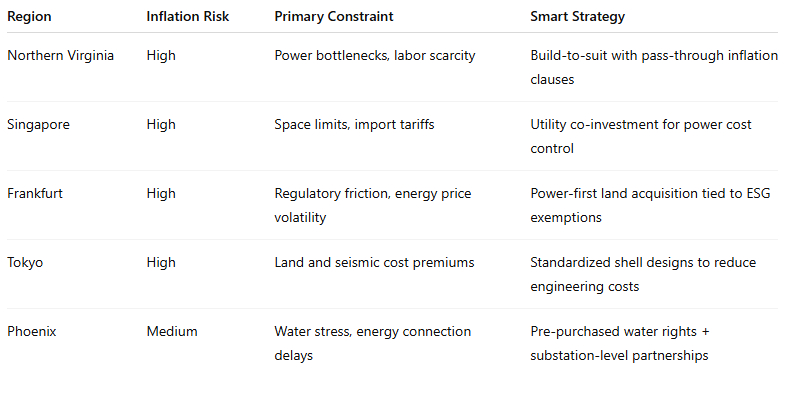

Risk Maps Are the New Market Maps

Here’s how the inflation pressure landscape is reshaping investor strategies:

Why This Can’t Wait

Three macro signals make this a now-or-never window:

Tariffs and trade restrictions are accelerating, not easing

Interest rate normalization is unlikely before late 2025 or 2026

First-mover developers are locking up land, power, and PPA pathways in the best inflation-adjusted corridors

This isn’t a wait-and-see cycle.

If you're not adapting, you're already exposed.

Strategic Implications for Investors

This cascade of costs creates a decision point for every fund, operator, and allocator:

1. Re-Underwrite Everything

Recalculate CapEx and timelines on every unbuilt MW.

Projects that made sense in 2022 may be underwater today.

2. Prioritize Execution over Access

Demand is not the issue.

Delivery is.

Focus on teams and geographies that show repeatable build discipline, cost containment, and supplier reliability.

3. Spot the Dislocation

Stranded projects in Tier 1 markets may be bought at a discount

Secondary markets are mispriced relative to their inflation protection

Mid-tier operators with strong pipelines but poor procurement may be ideal JV candidates

The winners won’t just build faster.

They’ll build smarter—while everyone else recalculates budgets and misses the wave.